Should We Cut up Our MasterCard and Visa Cards and Switch to AmEx or Discover?

American Express is the highest-ranked credit card company in J.D. Power and Associates’ Credit Card Customer Satisfaction Study for a fifth year in a row, with Discover a close second. Overall credit card satisfaction has improved for a second consecutive year, following a decline in 2009.

Issuers of MasterCard and Visa cards are lagging quite a distance behind the two leaders. Why is that? Let’s take a look.

AmEx Best in Satisfying Customers, HSBC — Worst

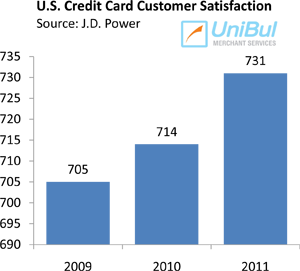

J.D. Power and Associates uses six broad factors to measure credit card satisfaction: interaction, credit card terms, billing and payment process, rewards, benefits and services and problem resolution. The average industry score for 2011 was estimated at 731 on a 1,000-point scale, up from 714 in 2010 and 705 in 2009.

American Express topped the list, slightly ahead of Discover. Barclaycard and Chase are the only other issuers with an above-average score. Bank of America ranks second to last with a score of just above 700, while HSBC is the only issuer to score below 700.

CARD Act Credited with Boosting Satisfaction Scores

The CARD Act of 2009 gets much of the credit for the marked improvement in consumer credit card satisfaction. In the words of Michael Beird, director of banking services at J.D. Power and Associates:

It appears that credit card companies are doing a better job of communicating with customers, which may be an effect of the CARD Act. This improved communication is key to ensuring that customers fully understand their credit card terms — particularly benefits and fees — which helps reduce the number of problems reported and improves the overall experience.

Not surprisingly, consumers also like the lower interest rates, which were a direct result of the wholesale switch to variable interest rates that issuers embarked on once the CARD Act was passed. Of course, once the Fed begins to raise its Funds Target Rate, the credit card variable interest rates will be raised automatically, but that is not a worry for the present.

Why Are AmEx and Discover Better?

Here is what the report has to say about the two top-ranked card issuers:

Here is what the report has to say about the two top-ranked card issuers:

American Express ranks highest in customer satisfaction for a fifth consecutive year with a score of 786 and performs particularly well in the benefits and services, credit card terms and rewards factors. Discover Card follows with a score of 779, and performs well in the interaction factor.

But why is it that the two credit card companies have been able to put such a distance between themselves and the issuers of MasterCard and Visa cards who are mostly clustered around the average satisfaction score?

I don’t think that I have a complete answer to this question, but it seems to me that it could have something to do with the fact that AmEx and Discover act as both issuers of their cards and processors of their transactions. By comparison, their rivals issue cards whose transactions can be processed by any other Visa or MasterCard member.

As a consequence, it is much easier for AmEx and Discover to address customer inquiries and resolve disputes, because they don’t need to turn to another bank for assistance. This would directly affect the interaction, billing and payment process and problem resolution categories in J.D. Power and Associates’ study. That could be enough to account for the results.

The Takeaway

So should we all cut up our Visa and MasterCard-branded cards and switch to AmEx or Discover? Well, over the years I’ve used cards bearing the logos of each of these companies and have not really noticed that big of a difference. My choice has always been based on the size and type of rewards on offer and I think I’ll keep it this way.

Update. J.D. Power’s Michael Beird has provided some additional details about his study’s results in the comments below that help explain why AmEx and Discover score better than the issuers of MasterCard and Visa cards. Be sure to read it.

Image credit: Flickr / Andres Rueda.

I liked your assessment of my study and I think many of your insights are accurate in addressing “why” American Express and Discover are #1 and #2 versus the VISA/MC issuers in our list. However, in the years I have been running this research, a few other more salient aspects emerge which sets these issuers apart from the VISA/MC crowd:

1) American Express and Discover overcommunicate: AmEx and Discover both leverage multiple communication channels (mail, email, collateral, statements, website, etc.) to inform of changes, new products/services and drive home relatively simple, focused messages on an ongoing basis.

2) Their customers have a better grasp of what they get by being a customer: AmEx customers, for example, state they get over 5 benefits from their card, versus only 3.3 benefits with other cardholders. This is key when it comes time to pay the annual fee.

3) Strong brand image: Both AmEx and Discover excel in JD Power’s assessment of brand image. Measured across 7 attributes, both companies average over .5 points higher (on a 7 point scale) than with VISA/MC. This customer view of the companies of being more customer focused, proactive, friendly AND financial stable is critical to sustaining high marks in overall satisfaction and customer commitment.

Hello Michael,

Thanks for sharing these details. There is something I’ve been wondering about for some time and perhaps your study can shed some light on the subject. Do consumers understand what the relationship between Visa and its member banks is or between MasterCard and its member banks? Do they understand the difference between the two Associations (Visa and MasterCard) and Discover and American Express? Do they realize that, say, Chase or Bank of America are different from Discover and American Express?

Having had a recent bad experience with Amex and their passive non-caring customer service ways during a vacation I am here to tell you Amex is no longer the Company it once was as I’ve used them for a long time and there’s little that they can offer me at this time that another card would not.

Great questions. When we survey customers, the majority of the questions asked are only about the card that they designate as their “primary card”, although we do have some questions regarding secondary card usage. Since we are only surveying customers about their perceptions of only their card, and how well it meets their own needs, we would not be able to draw conclusions about how well, in their minds, it compares to competitors’ cards and/or what distinguishes it from other issuers. We can only assess their own level of satisfaction with their current card issuer.

It would be great if someone actually did include these questions in their study. My own experience tells me that in general people have no idea what the difference between Visa and MasterCard on one side and Discover and AmEx on the other is. Nor do they have any better understanding of what the relationships between Visa and MasterCard and their card issuers is.

I will consider that for the future. I suspect you might be right however. Most people are just focused on the rewards, terms, benefits, etc. associated with the current card(s) but with little understanding of what else is associated with the networks and issuers.