What Everybody Needs to Know About Credit Card Processing

The processing of a credit card transaction is the end result of a series of interactions involving several parties. Each card transaction is processed in the same way, even though the communication tools may differ, depending on how information is collected. For example, e-commerce merchants receive the payment information in a form on their websites, whereas brick-and-mortar retailers use point-of-sale (POS) terminals to “read” it from their customers’ cards.

Yet, once the payment information is collected, however this may have been done, it is then processed the very same way every time. In this post I will show you how this is done.

Participants

The following parties are involved in the transaction process.

- Cardholder. Cardholder is an authorized user of a credit or debit card.

- Processing bank. Processing banks (also known as processors, acquirers or merchant banks) are financial institutions that are members of Visa and MasterCard. They provide authorization, clearing and settlement services for merchants. Processors often use third parties to provide one or more of these services.

- Payment processor. These organizations provide payment processing services on behalf of merchant banks. They are required to be registered with Visa and MasterCard as payment processors and to display on all of their marketing materials the name of their processing bank.

- Card acceptor. Card acceptor (usually called merchant) is a business or a non-profit that has contracted with a merchant bank directly or through a payment processor to accept cards for payments.

- Card issuer. Card issuers are financial institutions, members of Visa and MasterCard, which issue credit and debit cards on behalf of the two Credit Card Associations. The issuers extend a line of credit to their cardholders under certain terms and conditions for the repayment of the used credit and any applicable fees.

- Credit Card Associations. The Credit Card Associations (or Networks) are Visa and MasterCard. They are member-owned networks of financial institutions that set the rules for the issuing of cards bearing their logos and for the processing of transactions involving their cards. Both networks have developed payment systems to facilitate the processing of transactions between their member banks.

- Service provider. These are third parties that provide services used in the transaction process, including POS terminals, payment gateways, virtual terminals, shopping carts, SSL certificates, etc.

Credit Card Processing Cycle

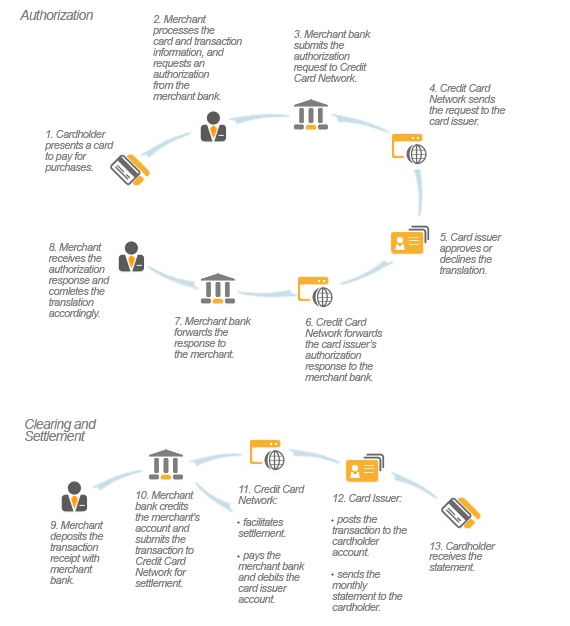

The processing of credit card transactions goes through the following stages:

- Authorization. Authorization is the process of routing the transaction information to the card issuer and then its response back to the merchant. Issuers either approve or decline the transaction.

- Authentication. Authentication is the process of verifying the validity of both the card and the cardholder. In a face-to-face setting this is done through the examination of the card, cardholder’s signature, photo ID, etc. In a card-not-present environment, it is done through the use of services like Verified by Visa and MasterCard SecureCode.

- Capture. Capture is the process of collecting and organizing credit card transaction information for submission for clearing and settlement.

- Clearing. Clearing is the process of transmitting, reconciling, and, in some cases, confirming transaction information between a processor and an issuer. Clearing and settlement occur simultaneously.

- Settlement. Settlement is the exchange of funds between a processor and an issuer to complete a cleared transaction.

The rules for processing credit card transactions are set by Visa and MasterCard. The participants have the freedom of choosing the tools, with which they communicate transaction information, as long as they are compliant with Associations standards.

Image credit: Libertyccs.com.

very nice description of the process here. Not many merchants take the time to fully understand this.

Great blog! I know this is an old post but I’m actually dealing with setting up a merchant account for my small business. I’ve gotten a few quotes through credit card processing rates Is there a way to negotiate with agents to get a better rate? Or do you know of any processors that offer lower rates? Thanks again I look forward to hearing back from you.