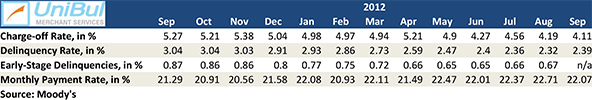

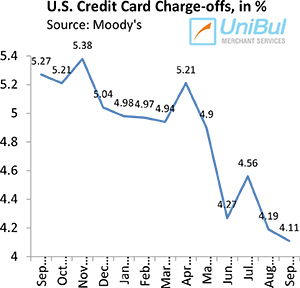

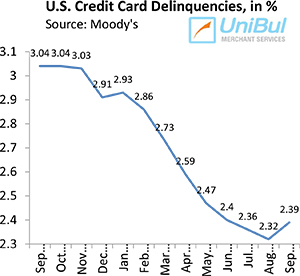

U.S. Credit Card Defaults Keep Falling

The rate at which Americans default on their credit card payments continued to decline in September, in line with expectations, according to the latest data released by Moody’s, a credit ratings agency. Among the six biggest U.S. card issuers, all but one (Capital One) reported lower charge-off rates for the month and the ratings agency expects that rate will keep falling through the rest of the year.

On the other hand, the headline delinquency rate rose in September, breaking a run of six consecutive monthly declines, but still remains very near its all-time record-low, reached in August. All big U.S. issuers posted higher delinquency rates for the month, in a marked contrast to their default results.

The monthly payment rate (MPR) receded from the all-time high mark reached in August, but is still above the 22-percent threshold, where it has remained for the past five months. We have never seen anything close to such high debt repayment levels since Moody’s first began keeping track of them more than 20 years ago and there are no indications that Americans will relapse into their pre-crisis repayment pattern anytime soon. Let’s take a closer look at the latest data.

Credit Card Charge-offs down to 4.11%

Credit card charge-offs fell in September, by 8 basis points, according to Moody’s, even though Capital One’s default rate spiked from 2.58 percent to 3.93 percent. All other big issuers posted lower or flat charge-offs and evidently that was enough to push the overall index down. The current level — 4.11 percent — is lower by 1.16 percent than the September 2011 rate of 5.27 percent, a decline of 22 percent for the year.

Credit card charge-offs fell in September, by 8 basis points, according to Moody’s, even though Capital One’s default rate spiked from 2.58 percent to 3.93 percent. All other big issuers posted lower or flat charge-offs and evidently that was enough to push the overall index down. The current level — 4.11 percent — is lower by 1.16 percent than the September 2011 rate of 5.27 percent, a decline of 22 percent for the year.

The charge-off rate is calculated as a ratio of all individual credit card accounts with overdue balances that a lender no longer expect to be repaid by its cardholders, in relation to the aggregate number of active accounts in that lender’s portfolio. Charged-off accounts are written off of the lender’s books as losses, usually at 180 days after the last payment on the account has been posted.

Credit Card Delinquencies up to 2.39%

The credit card delinquency rate rose by seven basis points in September to 2.39 percent, which is still good for the third-lowest level ever measured by Moody’s, behind the two previous months’ marks. It is only the second time since October 2009 that the delinquencies have increased, we are told, but it is also the tenth consecutive month in which the late payment rate has remained below the three-percent level, which had never been reached before.

The credit card delinquency rate rose by seven basis points in September to 2.39 percent, which is still good for the third-lowest level ever measured by Moody’s, behind the two previous months’ marks. It is only the second time since October 2009 that the delinquencies have increased, we are told, but it is also the tenth consecutive month in which the late payment rate has remained below the three-percent level, which had never been reached before.

Moody’s headline delinquency rate is calculated as a ratio of the credit card accounts on which payments are past due by 30 days or more, in relation to the total number of open accounts. The ratings agency also keeps track of the “early-stage delinquency rate” for payments that are overdue by 30 – 59 days, however this rate was not reported in Moody’s latest release.

Every month I wonder if there is still room left for the delinquency rate to fall and this month is no different. Moody’s tells us that “September typically features seasonally elevated delinquencies”, so it would not be unreasonable to expect that we would see a further decline in the coming months, even as the early-stage delinquency rate already seems to be right at the real-world absolute low.

The Takeaway

My favorite early guide to the future trajectory of both the credit card delinquency and charge-off rates remains the monthly payment rate. The MPR is calculated as a ratio of the aggregate amount of credit card debt which American cardholders are repaying at the end of each month, in relation to the total outstanding principal balance. In September, the MPR fell by 0.64 percent from August’s record-high level, to 22.07 percent, but is still 78 basis points above the September 2011 level. Moreover, when you consider that historically the MPR has hovered in the mid-teens, you get an idea of just how much higher credit card debt repayment now is on Americans’ financial priority list.

Moody’s latest data also illustrate just how much stronger the U.S. card issuers’ portfolios have become today, as a direct result of the huge charge offs of bad debt during the recession and the much stricter underwriting standards they have adopted since the financial crisis. As Jeffrey Hibbs, a Moody’s assistant vice president, says:

The result… is credit card securitizations that almost exclusively comprise receivables of well-seasoned, high-quality cardholder accounts that have performed well despite persistently high unemployment.

What remains to be seen is whether the debt repayment discipline will be maintained, and the quality of the issuers’ portfolios kept high, as the economy improves and unemployment falls.