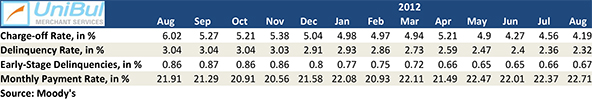

U.S. Credit Card Charge-offs, Delinquencies Keep Falling

U.S. credit card charge-offs resumed their fall in August, following an uptick the month before, according to the latest data released by Moody’s. All but one (American Express) of the six largest U.S. card issuers posted lower default rates for the month and the ratings agency expects that rate to keep falling through the rest of the year.

The headline delinquency rate continued its free fall, setting yet another record-low in the process, the sixth one in as many months, we learn. The early-stage component of the delinquency rate has been virtually unchanged for the past five months, hovering in the 0.65 percent – 0.67 percent range, the lower end of which, reached in May and June, was an all-time low.

The monthly payment rate (MPR) also set a record in August and has now remained above the 22-percent threshold for four consecutive months. What is more, it seems that the MPR has still some room to rise. Let’s take a closer look at the numbers.

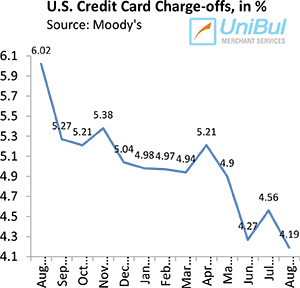

Credit Card Charge-offs down to 4.19%

Credit card charge-offs fell in August, by 37 basis points, according to Moody’s. The drop was primarily caused by a sharp 97 basis point decline in JPMorgan Chase’s charge-off rate, we learn. The current level — 4.19 percent — is lower by 1.83 percent than the August 2011 rate of 6.02 percent, a decline of 30.4 percent for the year.

Credit card charge-offs fell in August, by 37 basis points, according to Moody’s. The drop was primarily caused by a sharp 97 basis point decline in JPMorgan Chase’s charge-off rate, we learn. The current level — 4.19 percent — is lower by 1.83 percent than the August 2011 rate of 6.02 percent, a decline of 30.4 percent for the year.

The charge-off (also called write-off or default) rate is measured as a ratio of all individual credit card accounts with past due balances that an issuer no longer expect to be repaid by their cardholders, in relation to the total number of open accounts in the issuer’s portfolio. Charged-off accounts are written off of the lender’s books as losses, typically at 180 days after the last payment on the account has been received.

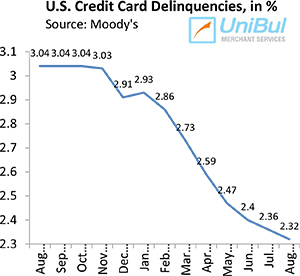

Credit Card Delinquencies down to 2.32% – an All-Time Low

The late payment rate fell by four basis points in August to 2.32 percent. This is the lowest level ever measured by Moody’s since the ratings agency began tracking the indicator more than 20 years ago. It is also the ninth month in a row in which the delinquency rate has remained below the three-percent level, which had never been reached before.

The late payment rate fell by four basis points in August to 2.32 percent. This is the lowest level ever measured by Moody’s since the ratings agency began tracking the indicator more than 20 years ago. It is also the ninth month in a row in which the delinquency rate has remained below the three-percent level, which had never been reached before.

Moody’s headline delinquency rate is measured as a ratio of the credit card accounts on which payments are overdue by 30 days or more, in relation to the total number of active accounts. The agency also keeps track of an “early-stage delinquency rate” for payments that are past due by 30 – 59 days. This rate was virtually unchanged in August, rising by a single basis point to 0.67 percent.

We don’t know with certainty whether the early-stage delinquencies have bottomed out, but we do know that they are very close to the absolute bottom and perhaps right at the real-world limit. In any event, the mid- and late-stage delinquencies and, by extension, the charge-off rate, will keep falling for some time to come, so we should break some more records in the coming months.

The Takeaway

As regular readers know, my favorite credit card indicator over the past couple of years has been the monthly payment rate (MPR), because it is a great early guide to the future trajectory of both the delinquency and charge-off rates. The MPR is measured as a ratio of the amount of credit card debt which American cardholders are repaying at the end of each month, in relation to the total outstanding principal balance. In August, the MPR rose by 0.34 percent from July’s level, to 22.71 percent, an all-time high. For a perspective, historically the MPR has hovered in the mid-teens, which tells you just how much higher credit card debt repayment has now climbed on Americans’ financial priority list. Or, looked at from a different angle, the latest data shows just how strong U.S. issuers’ portfolios are today. As Jeffrey Hibbs, a Moody’s Assistant Vice President and Analyst, puts it:

Historically low delinquencies and high payment rates underscore the exceptionally strong credit quality of securitized credit card receivables today. Issuers charged off the accounts of weaker cardholders at record levels during the recession, and originators have added few receivables from new accounts to securitizations.

Small wonder then that U.S. issuers have been able to sell $21 billion of bonds backed by credit card receivables so far this year, up from $4.8 billion last year.