U.S. Credit Card Charge-offs, Delinquencies Fall Again

Americans continued making their credit card payments on time in May. Each one of the six biggest U.S. credit card issuers reported lower rates of late payments in their latest regulatory filings and all but one (JPMorgan Chase) also had lower rates of credit card defaults for the month, setting new records in both categories in the process.

Credit Card Charge-offs Fall to 7.42 Percent

The aggregate amount of credit card loans charged off by U.S. credit card issuers fell by 0.46 percent in May from the previous month, to 7.42 percent, according to the latest data from Fitch Ratings, a credit ratings agency. Charge-offs (defaults) are outstanding credit card balances that issuers no longer expect to be repaid and write off as losses, typically 180 days after the latest payment was made on the account.

The May default rate has decreased by 33 percent on a year-over-year basis to its lowest level since February 2009 and is 36 percent below the peak reached in September 2009.

Credit Card Delinquencies Fall for 16th Month in a Row

The ratio of credit card payments late by 60 days or more — the late-stage delinquency rate — fell in May for the 16th month in a row, to 2.75 percent from 2.93 percent in April, according to Fitch.

Payments late by 30 – 59 days — the early-stage delinquency rate — also fell in May, to 3.54 percent, down 0.27 percent from April.

Issuers Report Lower Charge-offs, Delinquencies

Each of the six biggest credit card issuers reported lower delinquency rates in May and five of them also had lower default rates:

Each of the six biggest credit card issuers reported lower delinquency rates in May and five of them also had lower default rates:

- JPMorgan Chase’s delinquency rate – payments late by 30 days or more – fell to 2.66 percent in May from 2.86 percent in April, reaching its lowest level since June 2007. The bank’s charge-off rate rose 0.07 percent for the period to 5.67 percent, after falling by 0.42 percent the previous month, which marked Chase’s lowest default rate since December 2008, but May’s level is still well below the peak of 10.91 percent reached in January of 2010.

- Bank of America reported a delinquency rate of 4.28 percent in May, down from 4.52 percent in April. This is BofA’s lowest delinquency rate since August 2006 (4.24 percent). The Charlotte, N.C.-based bank’s charge-off rate fell by 0.22 percent to 8.03 percent for the period, after rising by 0.07 percent the previous month. BofA’s default rate is the highest among the six biggest U.S. issuers, but is now well below its peak of 14.53 percent, reached in August 2009.

- Citibank said its delinquency rate in May was down 0.21 percent to 3.66 percent, the 10th consecutive month of decline. The New York-based bank charged off 7.81 percent of its cardholders’ credit card balances, down 0.04 percent from the April level. This is still above the January rate of 7.49 percent, but well below Citi’s default peak of 12.14 percent, reached in August 2009.

- Capital One’s 30-day delinquency rate dropped to 3.32 percent in May, down 0.09 percent from 3.41 percent in April and 2.48 percent below the January 2010 peak of 5.8 percent. The bank’s charge-off rate dropped by 0.13 percent to 4.84 percent for the month, the lowest level since late 2007. Capital One’s default rate was at its highest in April of 2010 (10.87 percent).

- Discover reported a 30-day delinquency rate of 2.88 percent, down from 3.15 percent in April, the lowest level since April 2006. Its charge-off rate for May was 4.82 percent, down from 5.02 percent in April. It is the Riverwoods, IL bank’s lowest default rate since February 2008 (4.81 percent) and well below the February 2010 peak of 9.11 percent.

- American Express continued to lead the field of six biggest U.S. issuers in both the charge-off and delinquency categories. The New York-based company reported a delinquency rate of 1.60 percent in May, down 0.10 percent from April. American Express’s charge-off rate dropped 0.30 percent to 3.20 percent. AmEx’s highest charge-off rate – 10.4 percent – was recorded in April 2009.

Credit Card Takeaway

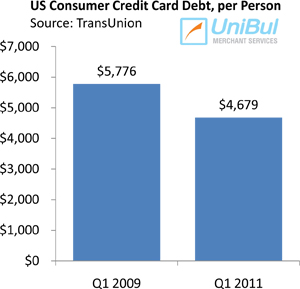

Americans are now repaying their credit card balances on time at a higher rate than at any time since 1996, according to data from TransUnion, one of the three national credit reporting agencies. Overall consumer credit card indebtedness is at its lowest level since the third quarter of 2000, according to the same report.

Americans are now repaying their credit card balances on time at a higher rate than at any time since 1996, according to data from TransUnion, one of the three national credit reporting agencies. Overall consumer credit card indebtedness is at its lowest level since the third quarter of 2000, according to the same report.

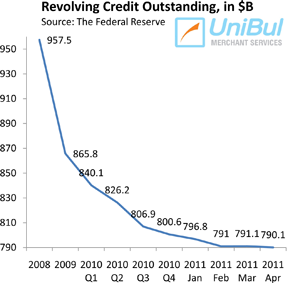

At the same time, credit card borrowing is also still falling, according to the Federal Reserve, even as credit is becoming more easily accessible. On aggregate, Americans now owe the lowest amount of credit card debt in almost seven years. The total — $790.1 billion — is 18.8 percent, or $183.5 billion, lower than the August 2008 peak of $973.6 billion.

There is not a single indication yet that the post-Lehman credit card deleveraging trend is coming to an end. Americans are still preoccupied with paying off credit card debt, even at the expense of other types of debt, most notably of the mortgage type.

Image credit: Bank-one.blogspot.com.