The Month in Numbers – February 2012

China is going through an explosion in the numbers of active credit cards in the country; Facebook has become a payments platform; the history of credit cards (revised from the previous month’s version) is traced back to 1887. These and many other interesting or just curious statistics are shown in various graphic forms in the third edition of our new rubric — The Month in Numbers.

When we started this new column, we mostly did it for fun and it is hugely amusing to be sure. But there is also much to be learned from all these infographics, slideshows and just plain graphics below. Their authors have put in quite some work first to gather the data and then to find the best way to represent it visually. And the results are spectacular.

So here are our picks for February 2012.

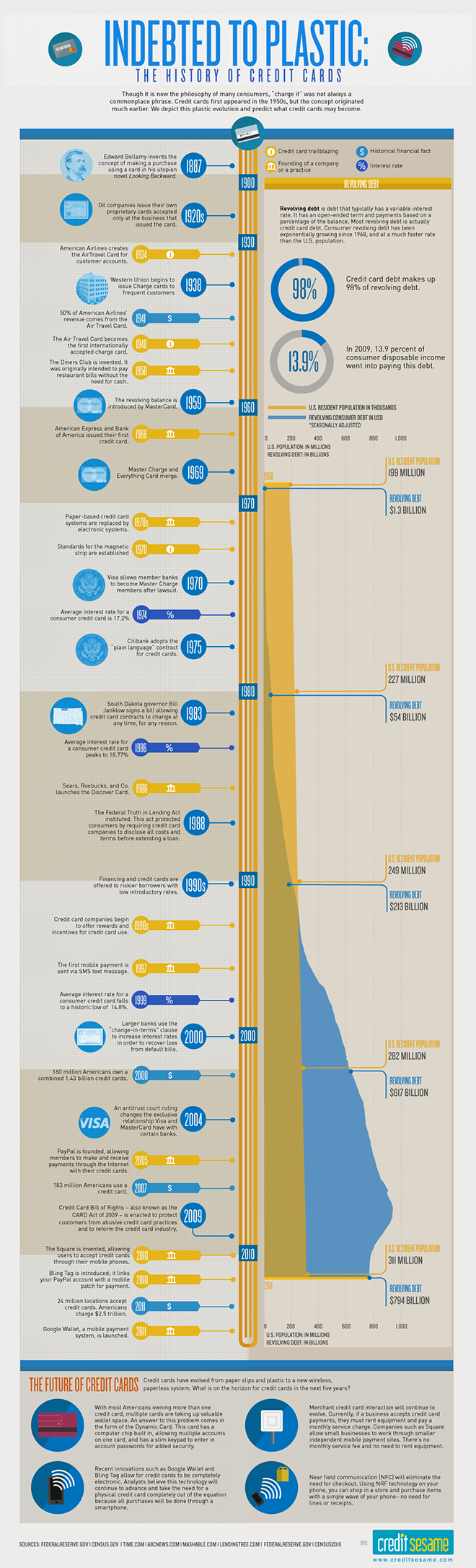

1. The History of Credit Cards

Last month we had an infographic that traced the history of credit cards all the way back to 3,000 BC. This month’s version, courtesy of Credit Sesame, is a more comprehensive one, even though it only goes back to 1887 AD.

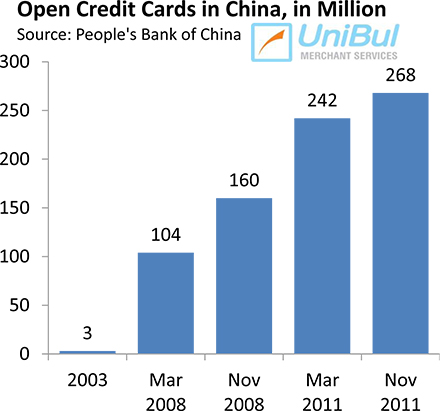

2. Credit Card Use in China Skyrockets

People’s Bank of China data, difficult as they are to verify, tell us that the number of active credit card accounts in the country is skyrocketing. In 2003 there were only 3 million open credit cards in China. By November of 2008 that number had already grown to 160 million and by November of 2011, it had risen to 268 million.

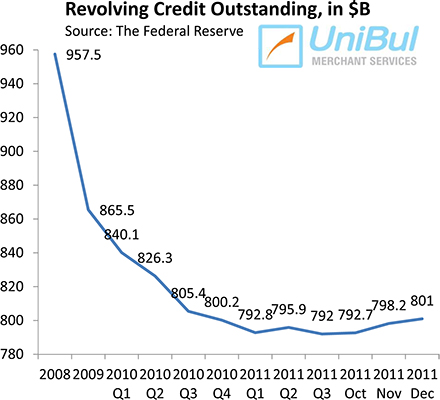

3. U.S. Credit Card Debt Keeps Climbing

U.S. consumer credit card debt rose in January for a fourth consecutive month, the first time that has happened since Lehman Brothers collapsed in September 2008.

4. How to Crack Google Wallet in Seconds

Developers from Zvelo evaluated Google Wallet’s security credentials and have found them wanting. They built an app to show just how easy it is to crack a Google Wallet’s PIN and have posted it on YouTube. Later in the month we learned that Google had fixed the issue.

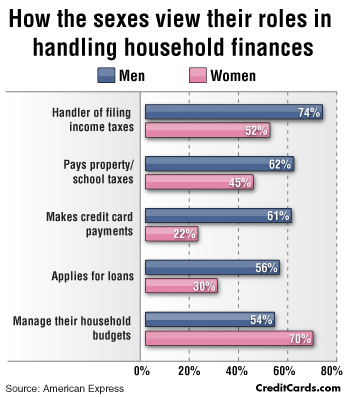

5. Men File the Taxes, Women Manage the Household Budget

That is one of the findings of an American Express survey commissioned for Valentine’s Day. We also discover, among many other things, that more men subscribe to online dating services than women. You can view the whole slideshow here and below is a CreditCards.com representation of the household financial responsibility data.

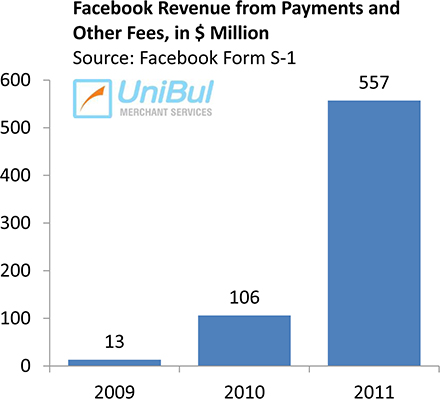

6. Facebook Has Become a Payments Platform

In 2011 the social network generated $557 million in revenue from “payments and other fees,” achieving something its rival Google has yet to achieve: find a second major revenue source to complement, and possibly surpass in the not-too-distant future — its advertising revenue. That total is up by 425 percent from the 2010 number, which itself was up by 715 percent from the 2009 total.

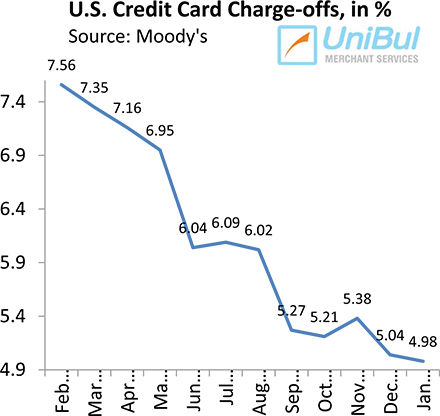

7. U.S. Credit Card Charge-offs Fall to Lowest Level in 4 Years

The U.S. credit card charge-off rate fell to 4.98 percent in January, according to data from credit ratings agency Moody’s, which is the lowest one since November 2007, the last month before the Great Recession officially began and it also is lower by 2.47 percent than the rate measured in January 2011.

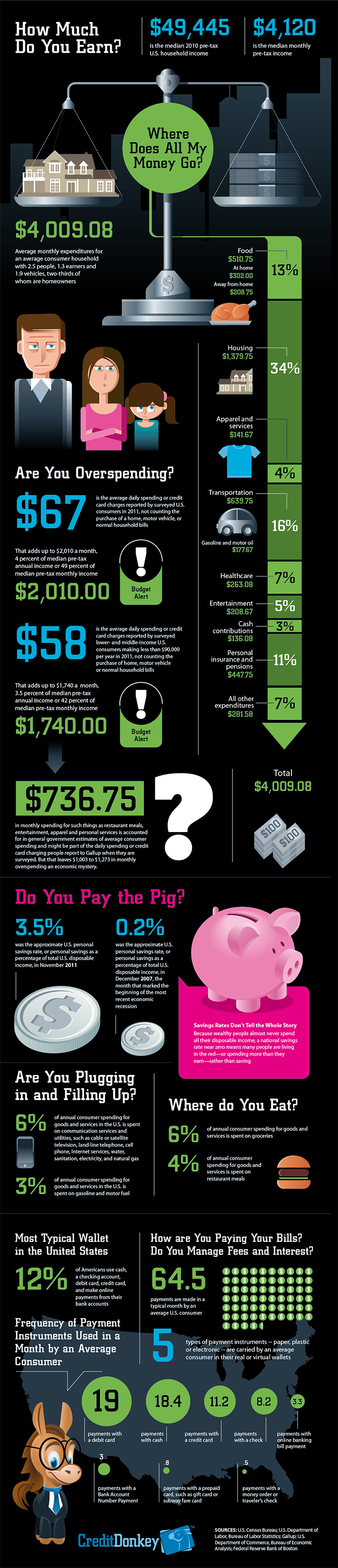

8. Americans Make 64.5 Payments a Month

That is one of the statistics the good people at Credit Donkey have plugged into yet another awesome infographic. We also learn that the average American consumer carries five payment instruments in his or her wallet.

Image credit: Flickr / 401(K) 2013.