Citi Goes to China, Will Issue Credit Cards

Citigroup is now allowed to issue credit cards in China, we learn from Bloomberg. The move is seen as a sign that the Chinese government is caving in to U.S. pressure to ease its restrictions on the ability of foreign banks to operate on its territory. The announcement came as the World Trade Organization (WTO), acting on a U.S. complaint, is investigating the legality of the Chinese prohibition of foreign banks to issue credit cards and to process card transactions denominated in the local currency on its territory, Bloomberg tells us.

Citi is only the second foreign bank to be allowed to enter the Chinese credit card space on its own, but the other one is actually based in Hong Kong, which, although a special administrative region, is still part of China. So the move is truly significant and deserves a closer look.

Chinese Credit Cards by the Numbers

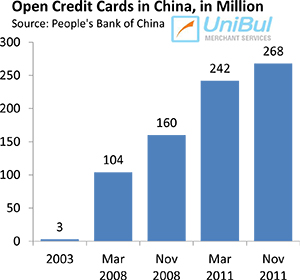

Official Chinese credit card data, as any other type of statistics in the country, is difficult to verify, but we know that credit card use there is growing extremely fast. According to official People’s?áBank?áof?áChina numbers, in 2003 there were only 3 million active credit cards. By March of 2008 that number had grown to 104 million and by November of 2008 it had risen to 160 million. By the end of March of 2011 there were 242?ámillion?áactive credit?ácards in China and the latest figure, as of November 2011, is 268 million.

Historically, the Chinese credit card delinquency and charge-off rates have been among the lowest in the world, not least because defaulting on a credit card could land you in jail, but that may now be changing. Again according to People’s?áBank?áof?áChina data, at the end of Q1 2011, credit card overdrafts in the country totaled 473.78 billion yuan ($75.18 billion), surging 90.6 percent on a year-over-year basis.

Historically, the Chinese credit card delinquency and charge-off rates have been among the lowest in the world, not least because defaulting on a credit card could land you in jail, but that may now be changing. Again according to People’s?áBank?áof?áChina data, at the end of Q1 2011, credit card overdrafts in the country totaled 473.78 billion yuan ($75.18 billion), surging 90.6 percent on a year-over-year basis.

What the Future Holds

Now that China has begun to loose its restrictions on foreign issuers, a natural next step seems to be for the government to do the same with the payment processors. At present, all foreign issuers must have their credit card transactions processed by China UnionPay, which, as Bloomberg reminds us, contradicts a pledge the country made when it joined the WTO. Back then China promised to allow foreign processors to operate in the country by 2006 and now the U.S. is demanding that this promise is belatedly fulfilled.

Nothing can be taken for granted in China, but at this point it seems unlikely that the government will go back on its decision. Leaving the U.S. WTO complaint aside, liberalizing the country’s greatly underdeveloped banking sector will go a long way toward bringing it into the 21st century. Of course, there will remain many conditions with which foreign banks will have to comply, but even so, it is all but certain that Citi will soon be joined in China by its Western rivals.

The increased competition will of course greatly benefit the Chinese consumers, but perhaps the country’s retailers will be even happier to see UnionPay lose its monopoly status as the sole credit card processing company in China. We don’t know what rates UnionPay charges merchants for the processing of their transactions, but letting in a competitor or two can’t hurt.

The Takeaway

The decision to let Citi issue credit cards under its own name presents a huge opportunity for the bank and its Western rivals, but there is a lot of work that they need to do, before they can take advantage of it. As Bloomberg tells us, at the end of December 2010, Citi only had 13 bank branches and 46 consumer outlets in China. The total number of outlets for foreign banks as a whole was 360. That is as close to nothing as you can get in the world’s most populous country. And expansion in China is not exactly a walk in the park, even for a domestic company. So, while this is a big decision for foreign banks, by itself it is not a sufficient cause for celebration.

Image credit: Wikimedia Commons.

One Comment