U.S. Credit Card Debt on the Rise Again, up for 4th Straight Month

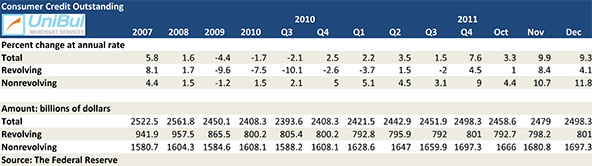

I think that we can announce with some confidence that the post-Lehman trend of sharply declining credit card debt in the U.S. has reversed itself and is now climbing upwards quite rapidly. Following the huge gain in November, consumer credit card debt rose again in December, although at a much more modest rate, we learn from the latest Federal Reserve report, released on Tuesday. It was the fourth consecutive monthly increase — the first time that has happened since the financial crisis struck in September 2008.

While the December rate of increase in credit card borrowing was more than twice as low as November’s, the opposite was true for non-revolving consumer credit, whose rate of growth accelerated and was in double-digits for a second consecutive month. As a result, the aggregate U.S. consumer borrowing grew at a close to double-digit rate and is fast approaching pre-recession levels.

An increase in consumer debt was largely expected, as we already knew that retailers enjoyed solid holiday sales, however the growth rate exceeded the expectations of most of us. And, if anything, the increasingly good unemployment numbers should prepare us for more such surprises in the months to come.

Credit Card Debt up 4.1% in December

The total amount of outstanding consumer revolving credit, made up almost entirely of unpaid credit card balances, rose in December by 4.1 percent, or $2.8 billion, lifting the aggregate number up to $801 billion. That amount was 1.42 percent above the post-Lehman low of $789.6 billion reached in April of last year, which also happens to be the lowest level in more than seven years.

The total amount of outstanding consumer revolving credit, made up almost entirely of unpaid credit card balances, rose in December by 4.1 percent, or $2.8 billion, lifting the aggregate number up to $801 billion. That amount was 1.42 percent above the post-Lehman low of $789.6 billion reached in April of last year, which also happens to be the lowest level in more than seven years.

Following the financial meltdown of 2008, revolving credit in the U.S. had been falling uninterruptedly until December 2010. For 2011, however, half of the Federal Reserve monthly releases, and each one of the last four reports, showed increases in this total.

Yet, even with the latest spike in revolving credit, the total remains far below the level recorded in August 2008, the month before the collapse of Lehman Brothers. December’s $801 billion figure is lower by 17.73 percent, or $172.6 billion, than the $973.6 pre-crisis high.

Overall Consumer Credit Up 9.3%

The non-revolving portion of the consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, rose in December at a double-digit rate for a second month in a row. The Fed reported an 11.8 percent spike, bringing the total up to $1,697.3 billion, an increase of $16.5 billion from November. The non-revolving debt total didn’t fall as much as the revolving one in the wake of the Lehman disaster and resumed its upward trajectory much sooner. It has now been rising almost uninterruptedly since July 2010, with August 2011’s 6.4 percent decline marking the sole exception. The current total is higher by 4.9 percent, or $79.9 billion, than the pre-Lehman high of 1,617.4 billion, measured in July 2008.

The aggregate amount of outstanding consumer credit in the U.S. — the sum of revolving and non-revolving debt — rose by 9.3 percent, or $19.3 billion, to $2,498.3 billion in December. It was the fourth consecutive monthly increase. The new total is still lower by $89.8 billion, or 3.5 percent, than the all-time high of $2,588.1 billion, reached in September 2008, the month when Lehman tumbled.

The Credit Card Takeaway

We know what’s causing consumer credit to rise. We’ve now had seven straight months in which the economy has added 100,000 jobs or more and the last two months have seen the biggest gains of the series. The December number was 200,000 and the one for January — 243,000. The unemployment rate is now 8.3 percent, 0.8 percent below the August 2011 level and the lowest one in three years. The improving employment picture is yet to lead to any meaningful rise in paychecks (hourly wages were only up by 1.9 percent in January on a year-over-year basis), but Americans clearly feel upbeat about the future and are beginning to take up more credit once again.

Yet, even as credit card debt is on the rise, the credit card delinquency and charge-off rates are falling. The late payment rate in December — 2.91 percent — set another all-time-low record, according to data from Moody’s, a credit ratings agency. The default rate for the month was reported at 5.04 percent — 37.24 percent below the level at the end of 2010 — and Moody’s expects it to fall to under four percent by the end of the year.

Moreover, the December monthly payment rate (MPR) — the portion of their outstanding credit card debt Americans repay at the end of each month — was 21.58 percent, more than a percentage point higher than the November level and very close to the all-time high of 21.91 percent measured in August. For perspective, the historical average has hovered in the mid-teens. So, even as they are starting to feel comfortable with debt once again, Americans seem to be doing so, on the whole, within their means and are keeping a close eye on the “payment due” date. Let’s hope that this trend will survive the recovery.

I have read your blog can you please gime me more details How to Consolidate Your Credit Card Debt.