Shopifying Payments or How You Get Tricked into Getting What You Don’t Want

The eagerness with which bloggers and journalists have been accepting and propagating highly dubious or outright absurd claims made by payment processing start-ups has been one of the enduring mysteries of the past few years. Regular readers may recall, for example, a Wall Street Journal reporter marveling at Stripe’s claim that businesses which choose their payment processing service “don’t need a merchant account or gateway”. Now, even a cursory glance at the service at issue reveals that it is a garden-variety, low-risk merchant account in all but name, only more expensive than most currently available, but never mind. Others have no doubt noticed the adulation with which LevelUp’s invitation for merchants to join the “Interchange Zero revolution and stop paying processing fees forever” (you could not make this up!) has been received.

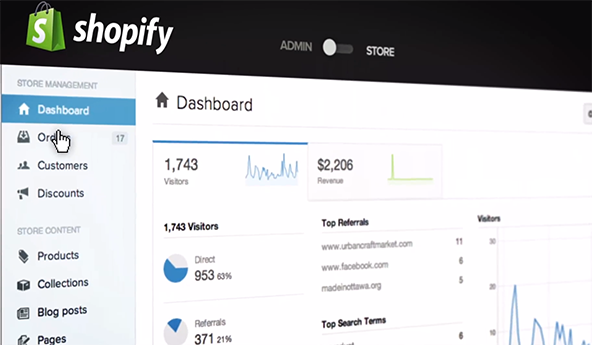

Well, earlier this week, I was pointed to a place I rarely visit. In one of its press release-like pieces (I honestly have no idea whether these guys get paid for these things or not), TechCrunch had covered the latest announcement to come out of Shopify — an Ottawa-based e-commerce platform. In it, we are told that Shopify would henceforth be doing it all for its clients: store-front management and, through a partnership with non other than Stripe, payment processing. Moreover, not only is Shopify now offering “more affordable payments processing in-house”, but it is also providing “instant approval of merchant payment accounts, so that as soon as a store goes live on Shopify the payments engine is already in place”. Now, I ask you, why on Earth would you not sign up for such a service? Well, one reason would be that neither of these claims is correct. But it’s actually even worse than that. Let me explain.

An Uninstant Merchant Account Approval

As TechCrunch tells us, the payment processing part of Shopify’s offering is “powered by Stripe”, so this is where we should look for details on the terms of service. And anyway, we don’t have much of a choice, as Shopify’s own website doesn’t have much to say on the matter. So both companies are pledging instant payment processing: Stripe is promising to enable us to “[s]tart accepting payments instantly” and Shopify — to “[a]ccept credit cards when you launch your store”.

But is setting up a merchant account an instantaneous process? The answer, of course, is “no”. And don’t take my word for it — read what Stripe (which, again, is “powering” Shopify’s payments service) has to say about it in its Terms of Service, even as it is promising all this instantaneity. Here is an excerpt of the company’s U.S. T&S, but the ones for Canada and other countries would not be much different:

To use Stripe to receive payments, you will first have to register. When you register for Stripe, we will collect basic information including your name, company name, location, email address, tax identification number and phone number. If you have not already done so, you will also be required to provide an email address and password for your Stripe account.

…

To verify your identity, we will require additional information including your business EIN or Tax ID, social security number, and date of birth. We may also ask for additional information to help verify your identity and assess your business risk including business invoices, a driver’s license or other government issued identification, or a business license. We may ask you for financial statements. We may request for your permission to do a physical inspection at your place of business and to examine books and records that pertain to your compliance with this Agreement. Your failure to comply with any of these requests within five (5) days may result in suspension or termination of your Stripe account. You authorize us to retrieve additional information about you from third parties and other identification services.

Does that sound like a process that could be completed instantaneously? Well, Stripe helpfully answers it for you:

After we have collected and verified all your information, Stripe will review your account and determine if you are eligible to use the Service. Stripe may also share your information with our payment processors (such as Wells Fargo), each of which may also make a determination regarding your eligibility. We will notify you once your account has been either approved or deemed ineligible for use of the Service.

So much for the instant access.

Oh, There Is One More Thing

But then it gets worse, much worse, for the Stripe / Shopify claim is actually not entirely made up. Our duo is exploiting a loophole, which allows a payment processor to start facilitating transactions for a client even before the final underwriting decision is made. In fact, TechCrunch is quoting Louis Kearns, Shopify’s Director of Payments, as saying:

If you haven’t sold online before, you’d open up your store and you’d want to be able to accept credit cards right away, and we’re happy to be able to solve that for them.

So there is no ambiguity here. Or is there? See, the thing is that the processor would not release its merchant’s funds before the merchant account application is approved. So you may end up using the service for, say, a week, processing sales worth thousands of dollars in the process, only to discover that your application has been denied for some reason or other. And when that happens, your processor can hold on to your money for as long as six months, before releasing it to you. How would you like that? Unfortunately, start-ups are not alone in using this ploy, as I know of several traditional merchant account providers who are doing the same thing and, doubtless, there are many more. But what’s important is that this is a dishonest practice, one which is doing no one any favors.

How do you avoid falling victim to such a scheme? Well, you have two options. The first one is that you simply avoid anyone who is offering you instantaneous payment processing, which is the course of action I would recommend — after all, how do you know that this processor is not hiding other unpleasant surprises from you? The alternative is that you hold up on using your service until your application is fully reviewed and your merchant account is approved. But again, would you trust such a service provider to be honest with you in the future?

Charging Back

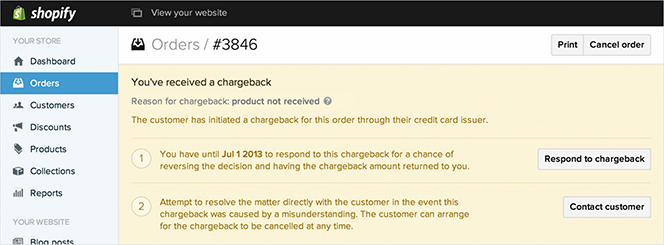

Finally, a brief note on chargebacks. TechCrunch is telling us that Shopify has devised a chargeback recovery process, which offers its merchants a better chance of winning their disputes. At its core are “full reports… about the nature and specifics of chargebacks”, generated automatically for any sale disputed by a customer. Here is how such a report looks like:

So, first of all, while nicely done, this report is no more specific than what your average merchant account provider would give you. But there is something else here that is troubling. See how the very last sentence tells you that “[t]he customer can arrange for the chargeback to be cancelled at any time”? Well, yes, a chargeback can indeed be cancelled at any time of the review process, but that doesn’t mean that it is doing no harm. In fact, this is a point that merchants have always been having difficulty understanding and Shopify is certainly not helping. Most merchants erroneously believe that winning a chargeback is all that matters. Reality, however, is more complicated. To begin with, whether or not you win the dispute, you are liable to a chargeback fee, although I guess Shopify may be absorbing it. But more importantly, all chargebacks, whether won or lost, are counted when your chargeback ratio is calculated — and an excessively high ratio can get your merchant account terminated. In other words, you may win all of your customer disputes, but if you exceed a certain chargeback threshold, you will still get in trouble. And that is what processors should be telling their merchant.

The Takeaway

The problem I have with the likes of Shopify and Stripe is that, even as they attack the traditional merchant account providers for not being straightforward with their clients and for generally offering poor value for their users’ money, these newcomers are employing some of the worst practices of the industry. And I haven’t even touched on the Stripe / Shopify pricing model here. This will be a topic for a future post.

Image credit: YouTube / Shopify.

Thanks for exposing this. Dishonest practice. Stay away

This post is very misinformed.

Shopify payments is in fact powered by stripe, however, all you need to do to activate this gateway is select it in your admin plug in your bank account/SSN details. That’s literally it. You can then accept payment immediately.

Well good luck getting support on a dispute from Shopify! Not only will They not provide the merchant ID number they use to process with a specific card company DISCOVER they also won’t give you the case number given by discover to allow you to handle the dispute. Shopify claims they do not have a merchant ID number BULLS*** we are out 10,000$ because of them!!!