People Have Really Had It With Debt Collectors. Yet Life Would Be Worse Without Them. Yes, Really.

That is the question tackled by three researchers in a new paper for the Federal Reserve Bank of Philadelphia. On the face of it, third-party debt collection should have no place in our financial system. “Informational, legal, and other factors”, the researchers note, “suggest that original creditors should have an advantage in collecting debts owed to them”. Not to mention that, when doing the job themselves, the original creditors keep all they can recover, whereas when relying on others, they only get back about 80 percent of the collected debt, on average. Yet, third-party debt collectors not only exist, but they thrive, employing more than 140,000 Americans and recovering more than $50 billion each year. How can that be?

Well, the researchers identify one major factor, which they believe is giving third parties a sizable advantage and is the reason why original creditors are hiring them. It all comes down to the collection methods employed by the two parties. The original creditors, the paper argues, convincingly, tend to use softer debt collection methods, because they care about their reputation. Lenders don’t want to antagonize debtors who may, in due time, become profitable customers once again, nor do they want to create a bad name for themselves and scare away potential new customers. Oh, and they certainly don’t want to attract regulatory attention.

Third-party collectors, for their part, exist solely for the purpose of recovering debt, which means that they don’t have to worry about maintaining customer relationships. After all, debt collectors’ customers don’t choose to do business with them — they simply fall into their laps. The customer whose happiness a debt collector really cares about is the lender who hired her. All that being the case, we can understand why a third-party agency would be less lenient with debtors than the original creditor could afford to be.

But the paper’s main point is that third parties do bring efficiency to the debt recovery process, which is why lenders rely so heavily on them and is also why we have developed a specialized payment processing solution for them. The paper also lends support to another recent Philadelphia Fed paper, which found a direct negative correlation between the level of strictness of debt collection regulation and the availability of consumer credit. But let’s take a look at the new paper.

Third-Party Debt Collection — an Overview

Debt collection is the primary mechanism of contract enforcement in consumer credit markets and affects millions of Americans, the paper reminds us. Creditors can try to collect debt on their own or they may outsource collections to third-parties and they utilize both approaches.

The third-party debt collection industry is large and represents most of the debt collection activity in the U.S., the authors remind us and proceed to give us some statistics. In 2011, about 14 percent (or 30 million) of American consumers had credit accounts that were placed with third-party collectors. The industry recovered about $55 billion from debtors in 2010 and returned approximately 80 percent of this amount to the creditors which hired them. Third-party collectors employ more than 140,000 people who make more than 1 billion consumer contacts every year.

And third parties are more successful than the original creditors, even though “there are a number of reasons to think that creditors enjoy a substantial absolute advantage over third-party collectors”. For example:

- Original creditors typically have available more information about their borrowers than do collection firms.

- Creditors are generally less constrained by regulation than are third-party collectors in the U.S. This is because federal and many state debt collection laws explicitly exclude from their jurisdiction the activities of original creditors collecting on their own loans.

- The debt collection industry is much less concentrated and more geographically segmented than the credit card market, which is both concentrated and national in scope. The majority of third-party collections firms employ fewer than 10 people. Therefore, outsourcing debt collection to third-party agencies may not provide additional benefits from economies of scale compared with what creditors can achieve by keeping debt collection in-house.

And yet, third-parties are thriving. Why? Well, here it is.

Why We Need Debt Collectors

Debt collectors can create value for creditors, the authors assert, despite all the benefits of collecting in-house. The biggest advantage of outsourcing debt collection is that it “enables creditors to protect their relative reputations in a competitive credit market with rational borrowers”. When doing it on their own, creditors tend to use softer collection practices for fear of damaging their reputations, which would, in turn, reduce demand for their services.

A third-party agency collecting on behalf of several creditors, for its part, is free to use “harsher” debt collection methods than the creditors would. Crucially, the authors posit, those practices will be associated with all creditors, for which this agency works, so “borrowers cannot discriminate against individual creditors”. The upshot is that “all creditors that hire third-party debt collectors may have bad reputations, but no individual lender may be seen as any worse than any other individual lender”. So, creditors may all be bad, but they are equally bad. And then the researchers proceed to test their assumptions.

The Third-Party Advantage

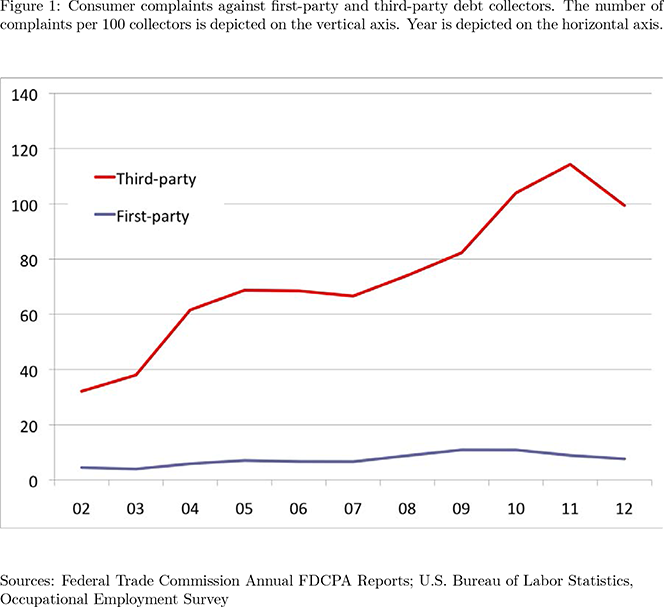

To test their assertion that debt collectors use harsher debt collection practices than original creditors, the researchers examine the consumer complaints filed with the Federal Trade Commission (FTC). And what they find is striking: there are about 10 times as many complaints (on a per-collector basis) in the third-party collections industry, as there are in the industry as a whole. Here is the graph:

So that seems to be definitive. Then the researchers proceed to test the one-creditor-many-collection-agencies paradigm, which they suggest makes the use of third parties to do the dirty work particularly appealing. Well, here are the data:

The average collection firm serves 422 clients. Creditors, in turn, tend to allocate their accounts across multiple collection agencies. The U.S. Department of Education, for example, uses 22 debt collection agencies (Department of the Treasury 2011). In addition, creditors often move accounts that have not been liquidated from one collection firm to another. In a recent survey, 75 percent of the value of charged-off debts were placed with a first collector and 25 percent with a second or third collector (ACA International 2011). Even though we do not explicitly model reallocation of accounts here, such reallocation suggests that creditors typically use multiple collection firms at the same time.

So yes, creditors do indeed use multiple collection agencies. And although it is really difficult to prove that they do so in order to protect themselves more successfully against charges of bad treatment, this remains a highly plausible possibility.

The Takeaway

Here is the gist of the paper’s findings:

We study the economics of contract enforcement in consumer credit markets and show that outsourcing debt collection to third-party agencies can create value for creditors, despite the costs associated with transferring accounts for collection from original creditors to debt collectors.

…

We show that third-party agencies use harsher collection practices than original creditors, consistent with the behavior we observe in the data. When multiple creditors hire multiple third-party agencies, each creditor must hire a sufficient number of debt collection agencies, which explains the usual practice of having multiple agencies collect on behalf of the same creditor.

Finally, the paper shows that “more effective debt collection increases the supply of unsecured consumer credit”. This result dovetails nicely with the findings of another recent Philadelphia Fed paper, which told us that even marginally stricter regulation of the debt collection industry leads to a substantial reduction of available revolving lines of credit — credit card limits. So, despite the bad rap they get, collection agencies are a force for good in the economy.

Image credit: Flickr / msaari.