NFC-Based Mobile Payments Service Debuts in U.K.

Finally, after much hype and speculation, an NFC-based mobile payments service is making an appearance in the U.K. Collaboration between Orange, a wireless carrier, and Barclays, a bank, the “Quick Tap” payment system was launched on Friday and can be used with the Samsung Tocco Lite smart phone.

How Quick Tap Works

The new mobile payments service will enable Orange customers who also own a Barclaycard, Barclays debit card or Orange credit card (all MasterCard products) to make payments by waving their phones by specially equipped point-of-sale (POS) readers at participating stores.

The exchange of payment information between the phone and the (POS) terminal is facilitated by the application of near-field communication (NFC) technology, which allows for the enabled devices to communicate with each other within a distance of 8 inches or less.

Quick Tap will not link the user’s phone directly to his or her payment card. In other words, the sale’s amount will not be directly debited to the card account. Instead, users will have to first fund their Quick Tal account, which will then be used for payments.

Customers will have a ?ú100 ($162) limit on the amount they can transfer into their Quick Tap account in a single installment. There is another limit — of ?ú15 ($24) — on the amount of a single Quick Tap purchase.

So far Orange and Barclays have equipped 500,000 U.K. stores with NFC readers, including fast-food chains Eat, Little Chef, MacDonald’s and Pret A Manger.

Will Users Get on Board?

As we reported last week, a study by Ingenico, a technology provider for the payment card industry, has found that 46 percent of Britons would be willing to give mobile payments a try, however a majority of the respondents (61 percent) want to be reassured that the new technology is secure, before they get on board.

Consumer skepticism is likely to quickly recede, as other NFC-based mobile payments platforms begin to appear later this year. A major data breach or security flaw would undoubtedly slow down the advance of the technology, but if such events involving more traditional payment services are anything to go by, the adverse effect is only temporary.

Moreover, young consumers are much more receptive to using their phones for payment than older ones, as a recent MasterCard study shows. About two-thirds of Americans in the age group 18 – 34 say that they would be at ease making mobile payments. Younger folks are also much less concerned with security issues.

The Takeaway

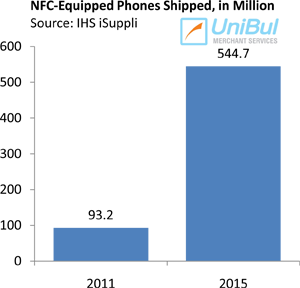

Another factor that will help speed up m-payment adoption is that all smart phone manufacturers are now behind the technology. Whether it is because no one wants to appear to be lagging behind their rivals or because they really believe in its prospects, all major phone makers are likely to launch an NFC-equipped model before the year’s end.

Another factor that will help speed up m-payment adoption is that all smart phone manufacturers are now behind the technology. Whether it is because no one wants to appear to be lagging behind their rivals or because they really believe in its prospects, all major phone makers are likely to launch an NFC-equipped model before the year’s end.

Even more enthusiastic about the NFC potential than the phone makers is Google whose latest mobile OS was the first one to support NFC and it powers the only NFC-equipped handset (the Nexus S), currently available in the U.S. Of course the search giant seems to be more interested in the potential advertising applications of the technology, but it will help promote its payment capabilities all the same.

The credit card companies are also heavily involved. Visa and MasterCard are running multiple NFC-based as well as other types of mobile payments trials. After all, mobile payments represent a new, and potentially huge, source of revenue.

So yes, mobile payments are coming fast. Orange and Barclays will soon be joined by their rivals and the service offerings will quickly improve. If everything goes smoothly, there is really no reason to impose limits on transaction size or overall spending. Eventually, your mobile phone will become a full-fledged substitute to your wallet.

Image credit: Barclaycard.com.