Americans, Brits Equally Uneasy About Mobile Payments

Two new surveys have shown a remarkable similarity between Americans and Britons in their readiness to adopt mobile payments. It turns out that, even as most technology giants and wireless carriers and all of the biggest payment processing companies, not to mention a horde of start-ups, are feverishly developing various technologies to enable users to make payments with their phones, consumers on both sides of the Atlantic say that they need to be reassured that these new services are safe, before embracing them.

Americans, Brits Want Reassurance M-Payments Are Secure

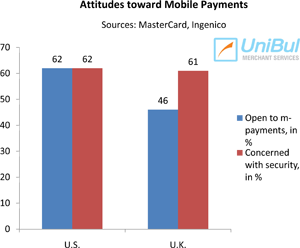

The two studies, one by credit card network MasterCard (conducted by Kelton Research) and the other by payment technology provider Ingenico, found that an almost identical share of American (62 percent) and British (61 percent) consumers want proof that mobile payments providers can guarantee the safety of their personal information, before trying them out.

The Ingenico survey does a better job than MasterCard’s of breaking down the consumer fears concerning mobile payments. The British researchers found that U.K. consumers would be put off from using their phone to make a payment, because they:

- Are worried about fraud — 56 percent.

- Are concerned about identity theft — 52 percent.

- Feel ill-informed — 47 percent.

Younger Consumers, Men More Open to M-Payments

MasterCard’s report focuses on the difference in attitude toward mobile payments among different age groups in the U.S. Unsurprisingly, younger consumers feel more comfortable with mobile payments and are less concerned with security issues than older Americans. MasterCard found that:

MasterCard’s report focuses on the difference in attitude toward mobile payments among different age groups in the U.S. Unsurprisingly, younger consumers feel more comfortable with mobile payments and are less concerned with security issues than older Americans. MasterCard found that:

- 63 percent of 18 – 34 year old Americans would be at ease making mobile payments versus only 37 percent of those in the 35-or-older age group.

- 65 percent of 18 – 34 year olds feel more naked without their phones than their wallets, while only 34 percent of the 35 or older Americans share this sentiment.

The MasterCard survey also breaks down the responses by gender and finds that men are in general more receptive to m-payments than women. The researchers found that:

- 51 percent of men would be at ease using their phones to make purchases, compared to 40 percent of women.

- 49 percent of men would be impressed by someone who used their phone to make a payment, rather than with a credit card, compared to 45 percent of women.

The Takeaway

The two studies show that, if service providers could convince consumers that mobile payments were safe, a majority of Americans (62 percent) and about half of Britons (46 percent) would be open to the new payment technologies. Moreover, these numbers are sure to rise, given the fact that younger consumers are much less concerned with security issues than older ones.

Of course, a high-profile mobile payments security breach could do a lot of damage in the short term, but, as data breaches at traditional credit card payment providers indicate, these do not have a lasting negative impact.

And in any case, mobile phones are getting smarter very quickly and are already being used for tasks that not too long ago were only performed by desktops and laptops. Using them to make payments does not really seem to be that huge of a leap. In the words of Mung Ki Woo, group executive, mobile at MasterCard Worldwide:

Consumers are already living a mobile lifestyle so using their phones to make payments on a daily basis is a natural next step.

Indeed. Mobile payments are coming and we should prepare ourselves. Inevitably there will be bumps along the way to adoption, but the process is irreversible.

Image credit: Iotags.com.