Mobino Wants to Prevent M-Pesa from Robbing Kenya’s Government

FT Alphaville’s Izabella Kaminska, of whom this blogger is a huge fan, takes us slowly through a little-discussed, but greatly consequential, side effect of the huge success the money transfer service provided by M-Pesa has had in Kenya and elsewhere. So slowly, in fact, that it takes the author two posts to complete the job.

However, Kaminska’s efforts have not been prompted by M-Pesa itself, of which we are warned not to dare speak ill, but by a little-known Swiss mobile-payments start-up, called Mobino. So what has got FT Alphaville’s attention? Well, part of the answer lies in Mobino’s boss, whose sterling credentials and “good working knowledge” of money Kaminska is careful to lay out, but also—and this is really the point—by the creation by M-Pesa of a “private money system”, functioning in parallel to the official one. Kaminska explains how these alternative currencies reduce government’s revenue from seigniorage—the difference between the cost of issuing money and its value—and channels Mobino’s prescription on what governments should do about it. Incidentally, the Swiss start-up has placed itself in a position to facilitate the prescribed government response.

How M-Pesa Robs the Government

To understand how M-Pesa affects the amount of revenue the government collects from seigniorage, you need to know exactly how its service works. So, when an M-Pesa user wants to transfer a certain amount of money to someone else, she would go to an M-Pesa agent and pay them cash in exchange for virtual credit, known as e-float, which is loaded onto her phone. This e-float can then be swapped and transferred between mobile users with a text message and a system of codes. The recipient of the e-float takes her mobile phone to her nearest M-Pesa agent when she wants to cash in, and swaps her text message code back for physical money.

So what does that have to do with seigniorage revenue? Well, the thing is that at any given point in time there is a certain amount of M-Pesa’s e-float in circulation and, as M-Pesa’s popularity grows, so does the amount of its currency in circulation. And, as Kaminska notes, “[the] more currency circulates and is transformed into M-pesa, the less physical banknote cash goes round in its place”. The need for fewer banknotes leads to a more sporadic use of the government’s printing press and that, Kaminska warns, “undermines an important source of revenue for the state”. That source is, of course, seigniorage.

But why is that a problem? Well, the thing is that governments don’t like having their revenues shrink and, if they can, will always try to offset their losses. However, such efforts often lead to undesirable consequences. In M-Pesa’s case, Kenya’s government could ban the service or otherwise force it out of business, but at this stage that would certainly prove prohibitively unpopular. So instead, as Kaminska notes, they have decided to levy a tax—a still unpopular decision, but one with altogether more bearable consequences. Yet, surely governments can do better than that, can’t they? Well, that is what Jean-Fran?ºois Groff, the aforementioned Mobino boss, believes.

The Mobino Solution

Here is how Groff sums up the issue:

I’m warning countries to beware and not go the route of Kenya. The state is losing seigniorage revenue on cash but the special tax on mobile money transactions makes them look like the villains.

So what is Groff’s solution? Well, if I understand it correctly, he proposes to help governments keep all of their currency in circulation by avoiding M-Pesa-like e-float leakages into a parallel financial universe. As the above warning indicates, it is too late for such a strategy to be implemented in Kenya, but other governments can still save themselves. To achieve this objective, the governments at issue would need to create in effect their own M-Pesas.

And that is precisely where Mobino comes in. In its “Mobino for central banks” section, the start-up’s website offers “an infrastructure to manage the circulation of e-money” to help governments to “[p]rovide a national mobile money infrastructure for all your citizens”. Noting that Mobino’s “closest equivalent is dwolla in the US”, Kaminska fills in the details:

Mobino’s system aims to cut out as many intermediaries from the debit process as possible by getting you, the customer, to strike up a single direct debit agreement with itself. The company then charges the customer for transactions conducted with partner vendors, whilst the customer deals only with Mobino rather than a multitude of online or retail vendors.

By the way, Mobino’s fee is “as little as 1%” of the transaction amount, charged to the merchant. But how does Mobino solve the currency leakage problem? Well, Kaminska tells us the following:

But the transaction itself?áis?áautomatic, and most importantly, does not require you to hold a pre-existing float on your account (though you can choose to keep a small one if you so desire).

For as long as the transaction takes to settle, the “money” in question exists in the ether as monetary base.

Yet, it seems to me that, for as long as users can keep money in their Mobino accounts, there is a blurring of the differences between Mobino’s operation and what M-Pesa is doing. Mobino may not call the money kept into its system e-float, as M-Pesa does, or anything else, for that matter, but otherwise it is the same thing—currency that remains trapped in Mobino’s system. If that option were eliminated, however, the leakage would be avoided.

The Takeaway

Isn’t it amazing that only a few years after it was started, M-Pesa now influences macroeconomic decisions in Kenya? I think it is. I also believe that mobile payments services of the type provided by M-Pesa should remain the domain of private enterprises and that the government should stay out of them. If there are legitimate concerns about issues like seigniorage revenue, governments could assess transaction fees to offset their losses. No one would enjoy such fees, but they are preferable to the alternative.

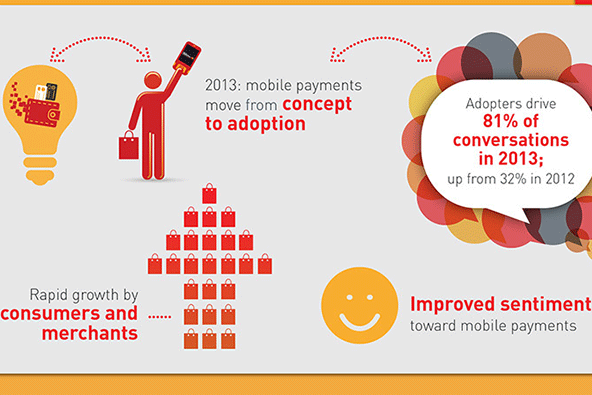

Image credit: Mobino.com.

Mobino just wants its 1% cut. And, this defeats a major plus of the M-PESA system of serving those who are unbanked or underbanked. If one doesn’t have a traditional banking account which can be used in an auto-debit agreement with Mobino, what then?

The advent of Digital Coins like Bitcoin and others on the way will make all controls and solutions by sovereign governments and even centralized companies like M-Peza obsolete in the coming 10 years. So forget about solving a problem that itself is the problem…. Sovereign Goverments Printing Money!

Hello, this is the problem, they can tax but should not print the currency!

It’s over, Digital Coins are here to stay, and for that matter so is M-Pesa and their attempts to be in the middle between people and their money.