MasterCard’s Global Clearing Management System

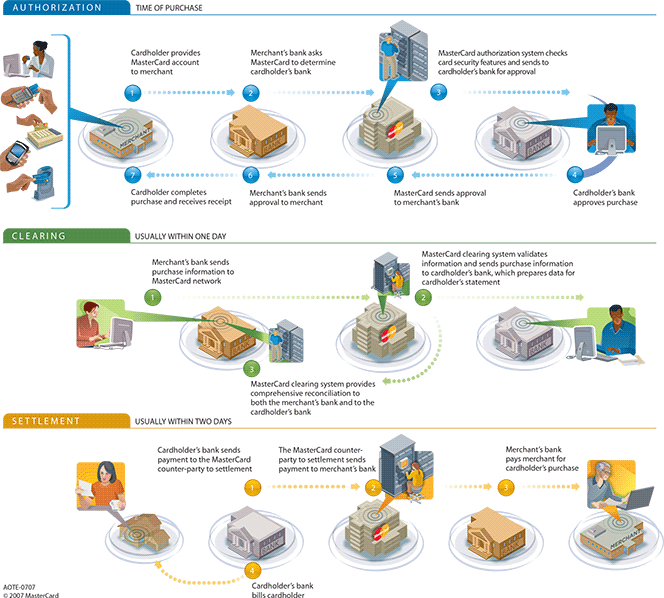

MasterCard’s transactions are processed through the MasterCard Worldwide Network using the Authorization Platform, Global Clearing Management System (GCMS) and the MasterCard Settlement Account Management (S.A.M.) system. The Authorization Platform approves (or declines) card transactions on behalf of MasterCard’s issuers.

GCMS, which is a centralized clearing facility that is owned and operated by MasterCard, performs daily processing and routing of card transactions between MasterCard and its acquirers and issuers. Clearing is the process through which a card issuing bank exchanges transaction information with an acquiring bank and occurs simultaneously with the settlement, which is the actual exchange of funds between an issuer and an acquirer.

Finally, MasterCard’s Settlement Account Management (S.A.M.) system facilitates the transfer of funds for the purpose of the financial settlement of cleared transactions, MasterCard fees and other transfer of funds between MasterCard and its acquirers and issuers.

In this post I will review the authorization, clearing and settlement processing of MasterCard transactions and will go in some detail over the way MasterCard’s Global Clearing Management System works. Let’s get started.

Authorization, Clearing and Settlement of MasterCard Transactions

1. Authorization. Every MasterCard authorization request receives an authorization response that serves to advise both the acquirer and its merchant on how to proceed with the transaction. The response is typically a code which identifies the action that the merchant should take. The specific format of the authorization response depends on the acquirer’s access method.

If the acquirer is online, the authorization response message will include a two-digit response code. This code directs the acquirer and its merchant on the action that should be taken (approve, decline, refer to card issuer, capture card or valid — see below for details). Regardless of the specific format in which an authorization response is received, it always prompts the merchant to take one of the following actions:

| Response | Action |

| Approve | The transaction is authorized as reported and the issuer provides a six-digit authorization code to the acquirer who sends it on to its merchant.

|

| Decline | The merchant should not complete the transaction, but should return the card and ask for a different payment method. |

| Refer to card issuer | The merchant must contact the issuer for further instructions (make a Code 10 call). |

| Capture card | The merchant must use its best efforts to retain the card, but only by reasonable and peaceful means. |

| Valid | Not declined — this is used only for inquiry transaction types. Issuers provide a valid response for example when processing balance inquiries, address verification requests or other non-financial types of requests. Merchants use the information returned in the response message to provide information to the cardholder or to determine if further authorization decisioning is required. |

When you use your MasterCard card to buy goods or services from a merchant, the acquirer reimburses the merchant for the transaction and then settles those funds with the issuer by presenting the transaction into “interchange” — MasterCard provides this functionality.

Partial approvals. The partial approval is a special authorization response, which enables merchants and cardholders to complete a higher percentage of debit card (including prepaid) transactions and reduce checkout time when the cardholder uses a debit (or prepaid) card with an available balance that is less than the transaction amount.

The partial approval response enables an issuer to approve only a portion of the transaction amount shown in the authorization request when that amount exceeds the amount of funds available on the debit or prepaid card and the merchant’s POS terminal supports partial approvals. At gas stations, an issuer may respond with a partial approval amount that is greater than the amount provided in the authorization request.

When the issuer responds with a partial approval amount and partial approval response code, the cardholder can then choose to use another payment method to pay the balance and complete the purchase. This is known as a “split tender” transaction.

All U.S.-based MasterCard issuers and acquirers are required to support partial approvals for all debit MasterCard accounts, including prepaid. Upon receipt of a partial approval, acquirers usually send a balance due message to the merchant. This message indicates the difference between the original purchase amount and the partial amount approved by the issuer. By displaying the remaining balance due amount, the merchant can quickly and accurately prompt the customer to complete the split-tender purchase.

2. Clearing. Acquirers and issuers perform clearing to exchange transaction data. From the data exchanged in clearing, the MasterCard Global Clearing Management System (GCMS) derives the amounts for settlement. All MasterCard issuers and acquirers (which are enabling merchants to accept cards), must perform clearing to exchange transaction data.

Clearing is the process of exchanging clearing data. For instance, clearing includes sending transactions from the acquirer to the issuer for posting to the cardholder account (also called “presentment”). GCMS accepts the information, edits it, assesses the appropriate fees and routes it to the appropriate receiver. The clearing messages contain data but do not actually exchange or transfer funds — that is the function of the settlement process.

GCMS manages the clearing processing of credit and debit transactions (in offline mode). GCMS is a centralized clearing facility that is owned and operated by MasterCard for the daily processing and routing of worldwide financial transactions between MasterCard and its members (issuers and acquirers).

3. Settlement. Settlement is the process by which the actual funds are exchanged. The funds are the monetary value of the cleared transactions and are exchanged each day between MasterCard’s acquirers and issuers.

MasterCard calculates the net position of each acquirer and issuer involved in the clearing process and performs the following two settlement functions:

- Sending advisements.

- Transferring funds (when applicable).

Here is a visual representation of the whole cycle (click on the image for a larger view):

MasterCard’s Global Clearing Management System

Now let’s dive into some technical details. MasterCard’s Global Clearing Management System (GCMS) replaced the INET system more than a decade ago and uses messages in the Integrated Product Messages (IPM) format. This format is an International Organization of Standardization (ISO)-based flexible format, consisting of bitmapped messages that don’t require fixed-fields where data are placed.

IPM message structure. All IPM messages contain four main components:

- Message Type Identifier (MTI). MTI is the first element of every IPM message.

The MTI is always located in positions 1-4 of the message. The MTI describes the message class. For example, MTI 1442 indicates a chargeback message. - Bitmaps. Bitmaps are the second and third elements of every IPM message. The bitmaps indicate the presence or absence of ISO data elements (DE 1 through DE 128) in each message. There are two bitmaps in every message:

- Primary — Positions 5-12; indicates the presence of data elements 1-64.

- Secondary — Positions 13-20; indicates the presence of data elements 65-128. Each bit contains a value of zero if the corresponding data element is not present in the message or a value of one if it is present.

- Data elements. Data elements represent different, pre-identified pieces of information and follow the bitmaps in order by number (known as data element number). For example, function codes are stored in DE 24 (Function Code) and indicate the specific purpose of a message in a message class. Examples of function codes are 450 (first chargeback — full amount) and 453 (first chargeback — partial amount).

- Message reason codes. Message reason codes for first chargebacks, second presentments, and arbitration chargebacks are stored in DE 25 (Message Reason Code).

For example, a first chargeback for a full amount for message reason code 4837 — No Cardholder Authorization would have the following values.

| MTI | 1442 | Indicates that the message is a chargeback. |

| DE 24 (Function Code) | 450 | Indicates that the message is a first chargeback for the full amount. |

| DE 25 (Message Reason Code) | 4837 | Indicates the reason for the chargeback. |

Chargeback processing cycles. The following table summarizes the IPM messages used in each chargeback processing cycle.

| MTI | Description | Function Code | Description | Initiated by |

| 1240 | First Presentment | 200 | First presentment | Acquirer |

| 1442 | First Chargeback | 450 | Full amount | Issuer |

| 453 | Partial amount | Issuer | ||

| 1240 | Second Presentment | 205 | Full amount | Acquirer |

| 282 | Partial amount | Acquirer | ||

| 1442 | Arbitration Chargeback | 451 | Full amount | Issuer |

| 454 | Partial amount | Issuer |

The following MTI and Function Code combinations may also be used in chargeback processing:

- Retrieval Request / 1644-603.

- Fee Collection (Member bank-generated) / 1740-700, -780, -781, or -782.

- Fee Collection (Clearing System-generated) / 1740-783

Additionally, IPM Second Presentment / 1240 and Arbitration Chargeback / 1442 messages indicate the reason for the second presentment or arbitration chargeback.

Image credit: Wikimedia Commons.

Hi,

I work in the finance industry and it is indeed a great material to give an overview of the ISP message format. Though it is informative, I am looking for detailed info about how to decode the message and meaning of every possible function code and all!

Can you direct me the the place where I can get this information? Also, I would be happy to know about the Visa/ Amex

great summary