How Many Credit Cards Do You Use?

In a newly-released paper, Oz Shy from the Federal Reserve Bank of Boston looks into how Americans allocate their spending among the three types of payment cards — debit, credit and prepaid — and attempts to explain what drives their decisions. He finds that consumers tend to concentrate the majority of their transactions and a large value of their card spending on a single type of card, a type of behavior known as “single-homing on a card type”.

The researcher also investigates whether consumers focus their spending on one of the card networks — Visa, MasterCard, American Express and Discover — a behavior known as “single-homing on a card network”. Once again, he finds that the majority of consumers’ transactions and spending are concentrated on a single network.

Why does “homing” matters? Well, as Shy says, his investigation gives us interesting insights into the consumers’ payment decision process. The decision to “home” on a single card type may be related to consumers’ preferences regarding particular attributes, associated with the different card types.

Debit cards, for example, offer a fast settlement of transactions, with funds immediately debited from the cardholder’s bank account, thus preventing overspending. Credit cards, in contrast, offer spending flexibility, in the sense that the cardholder may spend money she doesn’t have available today and settle the transaction at the end of the monthly cycle or even later. Prepaid cards differ from the other two types in that they are pre-funded, which, similarly to debit cards, precludes the possibility that the cardholder would spend money she hasn’t uploaded onto her card (money she doesn’t have).

And, as the author notes, while the aggregate data show that the three types of cards are substitutes, his research shows that the degree of substitution at the individual level is low, because an individual consumer tends to “single-home” on one particular card type — the one whose attributes she prefers. Let’s take a look at the paper.

Homing on a Card Type

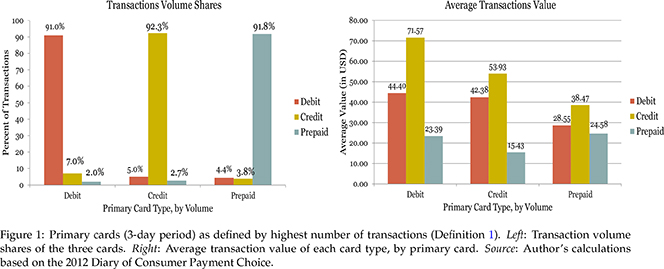

Shy begins by looking into consumer spending preferences among card types when the primary card is defined by transaction volume. For example, a debit card would be a consumer’s primary card is by transaction volume if the number of transactions she makes with this card is greater than or equal to the number of transactions she makes with either of the other two types of card (credit or prepaid). The author finds that, on average:

- Consumers concentrate 91 to 92.3 percent of their transactions on their primary card type.

- Consumers whose primary card type is either debit or credit place the smallest share of transactions on prepaid cards (2 to 2.7 percent).

- Consumers whose primary card type is prepaid place a slightly higher share of transactions on debit cards than on credit cards (4.4 percent versus 3.8 percent).

The right panel of the above figure shows the average transaction values for the respondents’ primary cards, which, the author suggests, may explain why some card users choose to allocate some of their spending to their non-primary cards. We learn that, on average:

- Primary debit card users place higher-valued transactions on credit cards ($71.57 on credit versus $44.40 on debit).

- Primary credit card users place slightly lower-valued transactions on debit cards ($42.38 on debit versus $53.93 on credit).

- Primary prepaid card users place higher-valued transactions on debit and credit cards ($28.55 on debit and $38.47 on credit versus $24.58 on prepaid).

So, regardless of a consumer’s primary card type, all consumer groups, on average, use credit for their highest-value transactions, debit for their their mid-value transactions and prepaid for their lowest-value transactions. The author suggests that this may be because consumers prefer not to be charged immediately for high-valued transactions, but prefer to be charged immediately for small transactions.

Then the author looks into the share of transactions his respondents concentrated on their primary card type. He finds that:

- 76.6 percent of respondents whose primary card is debit concentrated all their transactions on debit cards (and none on any other card).

- 81.5 percent of respondents whose primary card is credit concentrated all their transactions on credit cards.

- 86.3-percent of respondents whose primary card is prepaid concentrated all their transactions on prepaid cards.

So the majority (around 80 percent) of card users concentrated all of their transactions on their primary card.

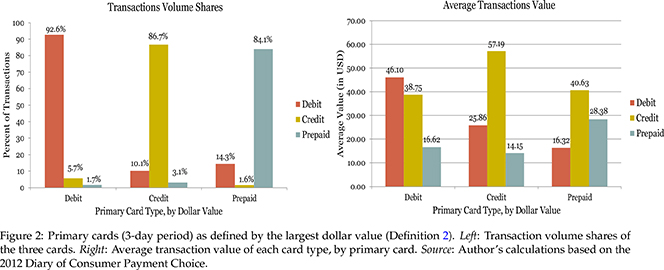

But what happens when the primary card is defined by transaction value? A credit card would be a consumer’s primary card by value if she spends a higher dollar value using credit cards than using debit and a greater or equal amount than prepaid. The researcher finds that, on average:

- Consumers concentrate 84.1 to 92.6 percent of their transactions on their primary card type.

- Consumers whose primary card type is either debit or credit place the smallest share of transactions on prepaid cards (1.6 to 3.1 percent).

- Consumers whose primary card type is prepaid place a higher share of transactions on debit cards than on credit cards (14.3 percent versus 1.6 percent).

So consumers tend to concentrate their spending on their primary card, regardless of whether the primary card is determined by volume or by value.

The right panel of the above figure shows that the average credit transaction value of consumers whose primary card by value is credit is $57.19 — more than twice the $25.86 average transaction value they place on their debit card. This shows that heavy credit card users use debit for low-value transactions. In contrast, consumers whose primary card is debit, place on average $46.10 on debit — only 18 percent higher than the average value they place on their non-primary credit cards ($38.75).

Homing on a Card Network

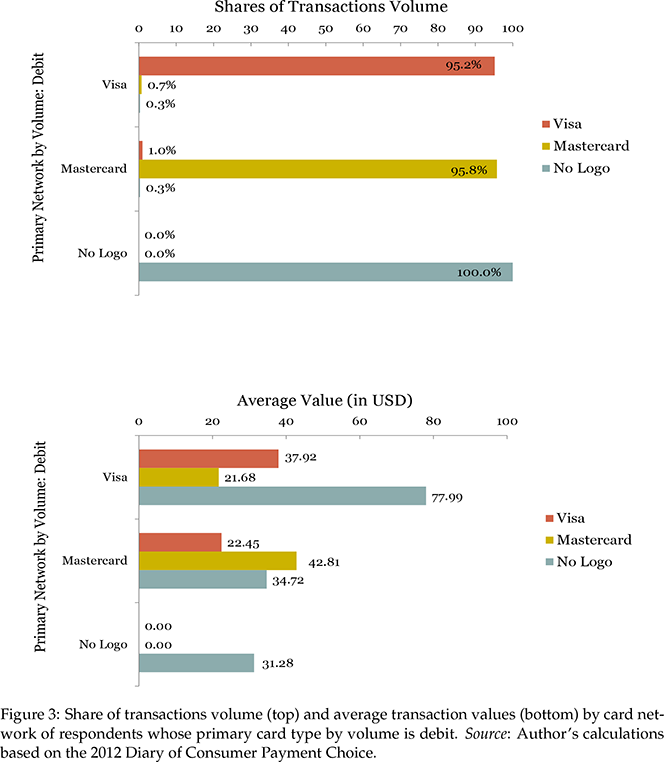

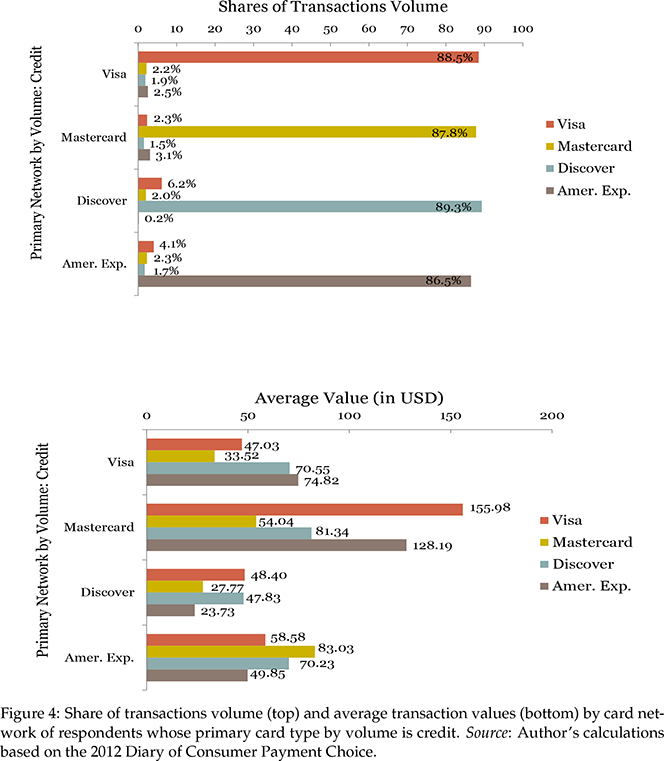

Visa is the dominant card network, both by volume and value (with about 70 percent), followed by MasterCard (with about 20 percent). However, the researcher shows that network concentration is not correlated with consumers’ tendency to concentrate their spending on a single card from a particular network.

As seen in the figure below, consumers whose primary debit network is Visa concentrate 95.2 percent of their transactions on Visa cards, on average. The corresponding average for MasterCard is practically the same — 95.8 percent. Respondents who reported that their primary debit card is “no logo” concentrated 100 percent of their transaction on no logo cards.

As seen in the figure below, consumers whose primary credit network is Visa place 88.5 percent of their transactions on Visa cards. on average. The corresponding average for MasterCard is, once again, practically the same — 87.8 percent. This time we also have averages for Discover — 89.3 percent and American Express — 86.5, which also are very close to the bigger networks’ averages.

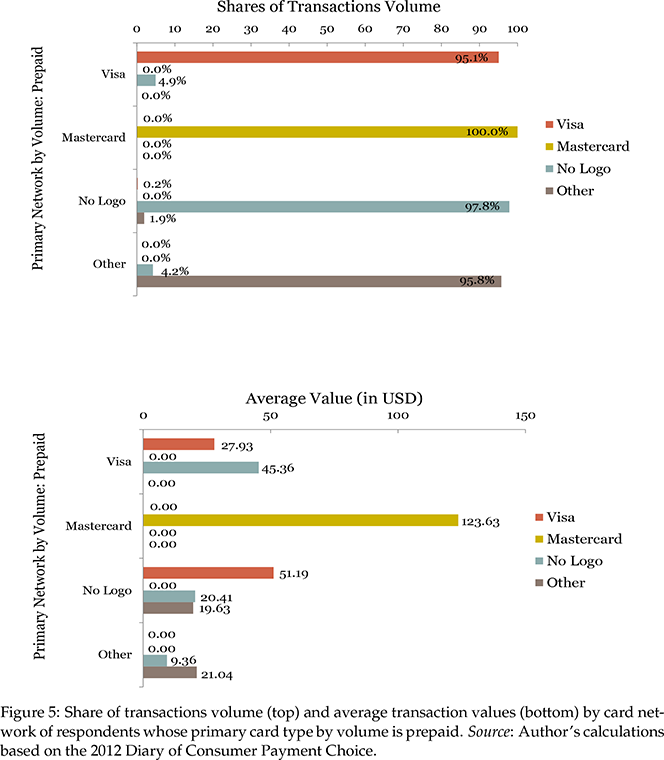

Finally, as the figure below shows, primary prepaid card users concentrate 95 to 100 percent of their transactions on their primary network, on average.

Overall, 92 to 100 percent of debit and prepaid users single-homed on a particular card network. However, single-homing is slightly lower for credit card users, where 78 to 92 percent of the respondents single-homed on one network.

The Takeaway

So the paper provides confirmation that most consumers concentrate their card payments on a single card type. Here is how the author interprets his findings:

One might conjecture that this is because the type they use most or exclusively has a consumers’ most preferred set of attributes. It is also possible that the choice is arbitrary with respect to attributes but made because consumers find it more convenient to use a single card or card type or network. In contrast, consumers who multi-home with respect to card types are probably those who gain from being able to choose from a variety of attributes (preference for variety). Multi-homing behavior may imply that consumers do not view the three card types as perfect substitutes because of the different functions and attributes that are unique to a card type.

For my part, I am not at all surprised that consumers do not see the three card types as perfect substitutes. After all, these are three very different payment instruments; otherwise, why bother having them all in the first place? But this point goes deeper than that. For example, we keep being told that credit cards are about to go extinct any day now, to be replaced by some “new-age” service or other. Let’s leave aside the fact that, way too often, these new payment platforms have credit cards as a funding method at their core. The point is that, even if you introduced some completely new and infinitely convenient payment method, it would still have a hard time outcompeting the traditional payment types, simply because each of them meets a particular consumer need.

Image credit: Flickr / mangpages (changes have been made to the original image).