How Many Credit Cards Do You Need to Make a Single Payment?

No, this is not a rhetorical question. According to a leaked report published by Android Police, Google is now issuing physical prepaid cards to select users of its digital wallet. For all practical purposes, such a card is a copy of the primary payment card stored in the user’s account and can be used in its place. The rationale behind it is that, if you cannot use Google Wallet’s primary contactless payment method, you could simply swipe the Google Wallet card instead.

Well, this doesn’t make any sense to me. My immediate question having read this report was why would I not simply swipe the card I already have? Why do I need yet another piece of plastic to do precisely the same thing and one, moreover, issued by a payment service provider whose stated objective is to make using plastic a thing of the past? It just boggles my mind. But the most amazing thing to me was that the Android Police guys’ minds were not nearly as boggled as mine. On the contrary, they love the idea. It may not be “the magical future of using your phone to pay everywhere with a painless tap”, they concede, but it is “awesome nonetheless”. But once you take a closer look at this card, its awesomeness begins to disappear. Let me explain.

Google Wallet Virtual Card

As we’ve discussed before, Google Wallet processes transactions in a circuitous, Rube Goldberg-type of way. When you make a payment using your Google Wallet account, Google first charges the transaction amount to a virtual MasterCard — a prepaid card — and then charges that same amount to your selected debit or credit card. Now, why Google would want to complicate the payment process by inserting a prepaid card in the middle of it we don’t know, but I’ve speculated on the subject in the post referenced above, so you can go read, if you are interested.

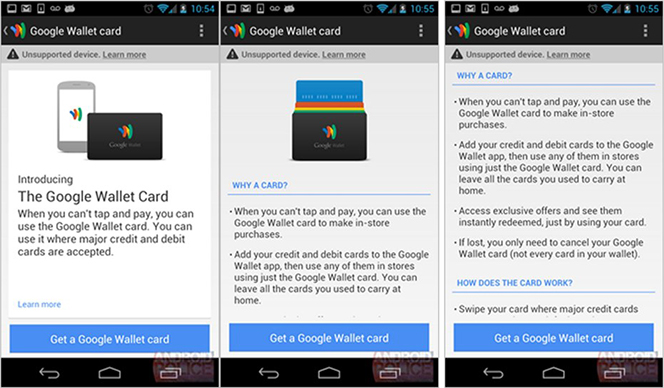

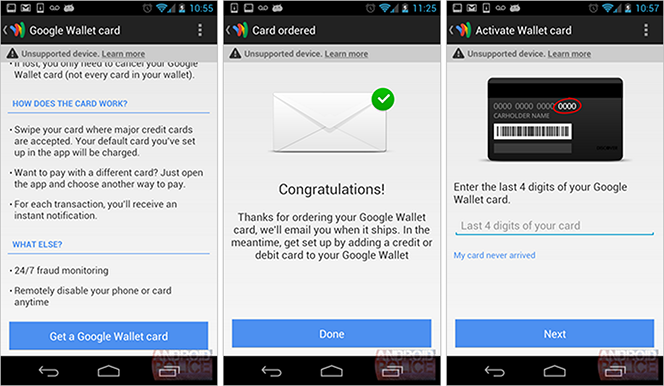

In any case, this virtual MasterCard prepaid card, Android Police is telling us, is now being issued in a plastic form. In its communications with the Android policemen’s anonymous source, Google has been uncharacteristically explicit about the nature and functions of its card. Here is how the search giant explains what it is and why it is needed:

Then Google goes on to explain how the card works:

However, no reference to the physical wallet card is yet to be found anywhere on the publicly available Google Wallet pages, or at least I wasn’t able to find one.

Do We Need a Google Card?

Now, even though the insertion of Google’s virtual card into its wallet’s payment process seems to be quite superfluous, there just might be a valid case that the search giant could make to justify its decision (again, you can read my musings on the subject here). However, there is no such case to be made for the card’s plastic iteration. Yes, the Android policemen are wistfully rolling their eyes when imagining a future in which you could be “leaving all your credit cards at home… and just carrying one, and your phone”, but I won’t even comment on the wonders such a world promises.

The Google card has some limitations, which prevent it from being a perfect clone of the card it substitutes. Google spells them out in its Terms of Use section and here are the most important ones:

- Spending limit. Your Google Wallet card comes with a daily spending limit of $1,000.00, unless your card on file itself has a lower limit.

- Usage restriction. The ToU state that “[y]ou may use the Google Wallet Virtual Card to initiate Payment Transactions for the purchase or lease goods or services wherever contactless payments are accepted”. While it is not explicitly stated, Google is telling us that we cannot use its card wherever contactless payments are not accepted, i.e. at the vast majority of merchant locations around us. In other words, you would still need to carry your credit card to make payments at these outlets.

- No recurring transactions. The ToU state that you “may not make preauthorized regular payments or other recurring Payment Transactions”.

There are some other restrictions, but the point, once again, is that the Google card, in either of its incarnations, is not a perfect clone of the one it aims to replace.

The Takeaway

I don’t think that there can be any doubt about how Google itself views its digital wallet. Its primary function, as far as the search giant is concerned, is data collection. After all, information management is what Google does. This information can then be made available — at a price — to participating merchants to be used in targeted ad campaigns. Of course Google itself would too be using the data for its own purposes. This is why Google decided very early on in its wallet’s development that it didn’t want any share of the payment processing fees. Of course, the search giant would probably not have received any portion of these fees even if it had asked very nicely for it, but the point is that it decided to focus instead on the data piece of the equation, rather than fight the banks over the interchange and processing fees. And it is a sound strategy.

Image credit: SDPnoticias.com.