How Many Cards Does Google Wallet Need to Process a Single Payment?

To tell the truth, I’m still trying to figure this out myself. This past Friday I wrote about the latest twist in the Google Wallet saga, which, I concluded, turned the service into a “mobile PayPal“. The search giant’s digital wallet would now support all major payment cards, we were told, so that users would be able to “use Google Wallet in conjunction with your selected credit or debit card for purchases”. Then this morning we learn that American Express, for one, gave Google no approval for its cards to be included in its wallet. So it’s a bit of a mess.

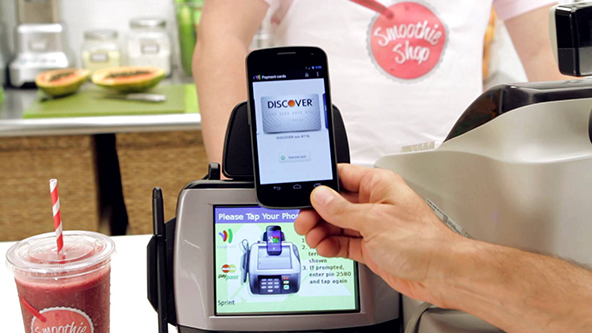

But there is another issue, and a much more interesting one than the AmEx confusion, that I did not touch upon on Friday, partly because my main focus was the Google – PayPal parallel, but also because I just wasn’t sure what to make of it. Well, I’m still perplexed, but I’ll lay out the facts as I know them and leave everyone to make his or her own conclusions. I’m talking about the way Google Wallet will process card-funded payments. Let’s take a look.

So How Many Cards Does Google Wallet Need to Process a Single Payment?

Google tells you that “you can use any card when you shop in-store or online with Google Wallet.” Similarly to PayPal, you would store your bank cards into your account and, whenever you need to make a payment, you would select one of them and Google would charge it with the transaction amount. But there is a twist: in most transactions there will be an intermediary stage in Google Wallet’s payment process that is missing from PayPal’s. It turns out that payments will actually be processed on another card, before the one of your choice gets involved. Here is how Google describes it:

When you add credit or debit cards to the Google Wallet mobile app, you will be issued a virtual MasterCard card by The Bancorp Bank, Google Wallet’s partnering bank. This virtual MasterCard is referred to as the “Google Wallet Virtual Card” in the Terms of Service. When you activate your credit or debit cards in Google Wallet, they are linked to the virtual MasterCard card. When you make an in-store purchase, Google Wallet facilitates payment to the merchant for your in-store purchase using the virtual MasterCard, then charges the amount of the original purchase to your selected debit or credit card.

It isn’t explicitly stated, but to all appearances the virtual MasterCard in question is a prepaid card. This process will be applied to all transactions, with the exception of the ones involving what Google calls “directly enabled” cards, “such as the Google Prepaid Card and most Citibank MasterCard cards”, where the sales amount will be charged directly to the user’s card of choice.

Why does Google need to insert this virtual card into the process? I have no idea. Speculations abound in the blogosphere, but there are more questions than answers. If I had to venture a guess, I would suggest that it’s probably a bank integration issue of some sort. After all, the only issuer whose cards are “directly enabled”, and hence circumvent the “virtual card” stage, is Citi — Google Wallet’s original partner. But that’s a pure speculation on my part and if anyone knows what’s going on, please let the rest of us know.

What about the Interchange?

This is the other interesting question that arises from the insertion of the virtual card into Google Wallet’s payment process. Every time a card is used for payment, its issuer collects a fee — the interchange. However, whenever a Google Wallet user completes a payment that does not involve a “directly enabled” card, not one, but two transactions will in fact be taking place.

From the merchant’s stand point, the transaction is completed using the virtual card. After all, that is the only card the merchant sees. So the interchange will be paid by the merchant, through its acquirer, and collected by the virtual card’s issuer — The Bancorp Bank, Google Wallet’s partnering bank. However, right after this transaction is completed, Google will transfer the sales amount from the card that was actually selected by the user to the virtual card. And now the issuer of the ultimate payment source will also have to collect its interchange fee. This time Google will have to pay for it and it doesn’t seem like the search giant can offload the interchange to anyone else. I mean, the merchant can’t really be charged twice for the same transaction and asking the user to foot the bill just doesn’t seem like a winning proposition. Some have suggested that Google may still pass the fees on to its users by having them pay for “loading” funds on the Google prepaid card that comes with the wallet, but that’s too consumer-unfriendly for Google to adopt, I think. And anyway, what about all other transactions that will be funded through credit and debit cards?

The Takeaway

I think that it’s fair to describe the current state of the Google Wallet project as a mess. Even leaving the AmEx issue aside (by the way, as of the time of writing, on its websites Google still says that American Express cards can be added to its digital wallet), the service’s current set-up is just untenable. For it to be viable in the long run, this “virtual card” transaction stage needs to go. It makes the process unnecessarily complex and much more expensive than it needs to be.

Image credit: YouTube / Google.

With this 2 transaction model, is there any settlement risk?

This is a really interesting article. Any updates on new findings? I did some digging myself and couldn’t find any new information.