How LinkedIn Profiles and Typing Styles Influence Creditworthiness

The Economist has an article on a topic, which until now I hadn’t seen seriously discussed in a major newspaper, although it has a considerable headline-grabbing potential. The topic in question is the use of data gleaned from social media and other non-traditional sources by banks and other lenders to help establish the creditworthiness of loan applicants and other types of potential borrowers. It is a fascinating subject and The Economist tells us that at least some traditional lenders and “a range of start-ups” are already “busily exploring alternative data”.

The first time I heard about creditors being interested in mining Facebook and other social media websites for data on potential borrowers was several years ago and the concept immediately made sense to me, at least as far as the relevance of the data is concerned. Of course there is the issue of privacy, which needs to be accounted for, but, as The Economist tells us, many borrowers, especially younger ones, have no problem at all sharing the information on their Facebook accounts with a credit card company or with another prospective lender. After all, they would share it with anyone, so what difference does that make? But it turns out that there are many other data sources, which lenders across the globe are tapping into.

How to ‘Weed out Likely Deadbeats’ in Africa

Some of the most imaginative uses of alternative data for measuring borrowers’ creditworthiness are to be found in Africa. Here is, for example, how Finca International, an American microfinance firm operating in Africa, does it:

If an applicant has an indoor toilet, or household gifts from a relative working abroad, that is a good sign. Interviewing neighbours also helps, says Mike Gama-Lobo, who looks after Finca’s operations in Congo, Malawi, Tanzania, Zambia and Uganda. Such visits work so well that only 1.5% of loans default each year, but they come at a cost: Finca employs more than 1,200 travelling loan officers in these countries.

Hence Mr Gama-Lobo’s interest in using other data sources to calculate creditworthiness. Nine out of ten loan applicants use a mobile phone. With permission from potential borrowers, analysing usage patterns can help reveal those most likely to default. Frequent calls to or from a rich country are a good sign. So are weekday calls to a nearby market town: that suggests commercial activity.

Isn’t it remarkable just how creative lenders can be? Creative and adaptive to the local conditions. I can’t help but make a parallel between Finca’s process for “weed[ing] out likely deadbeats”, as The Economist puts it, and M-Pesa’s hugely successful mobile phone-based money transfer service. Both companies have developed solutions to uniquely local problems: in Finca’s case—the lack of a credit reporting system—and in M-Pesa’s case—the lack of traditional money transfer services. Neither approach could be applied in, say, the United States, but they both work perfectly well in Africa.

What Do LinkedIn and Upper-Case Typing Have in Common?

Yet, lender creativity isn’t confined to the developing world, the author reminds us. In fact, the rich world offers even more data mining opportunities and none more so than the biggest social networks. Here is how one start-up is using the biggest social network for professionals:

Professional contacts on LinkedIn are especially revealing of an applicant’s “character and capacity” to repay, says Navin Bathija, the founder of Neo, a start-up that assesses the creditworthiness of car-loan applicants. Neo’s software helps determine if applicants’ claimed jobs are real by looking, with permission, at the number and nature of LinkedIn connections to co-workers. It also estimates how quickly laid-off employees will land a new job by rating their contacts at other employers.

And here is how another start-up is using Facebook:

Facebook data already inform lending decisions at Kreditech, a Hamburg-based start-up that makes small online loans in Germany, Poland and Spain. Applicants are asked to provide access for a limited time to their account on Facebook or another social network. Much is revealed by your friends, says Alexander Graubner-M??ller, one of the firm’s founders. An applicant whose friends appear to have well-paid jobs and live in nice neighbourhoods is more likely to secure a loan. An applicant with a friend who has defaulted on a Kreditech loan is more likely to be rejected.

Both approaches make perfect sense to me, but here is the one I found most fascinating:

As statistics accumulate, algorithms get better at spotting correlations in the data. Applicants who type only in lower-case letters, or entirely in upper case, are less likely to repay loans, other factors being equal, says Douglas Merrill, founder of ZestFinance, an American online lender whose default rate is roughly 40% lower than that of a typical payday lender.

As it happens, Merrill’s data confirm an old observation of mine. Long ago I noticed that merchant account applicants whose inquiries shared certain characteristics were much less likely to be sufficiently well qualified or to follow up with me, after I responded to their information request. And yes, these characteristics include typing entirely in upper-case, but also poor grammar skills and an urgency to get a result as soon as possible. Each of these characteristics on its own is sufficient to raise a red flag and I’m pretty sure that all applicants who displayed all of them have proved unqualified.

The Takeaway

So the use of alternative data for financial purposes is already happening and it seems certain to grow exponentially in the coming years. The Economist reminds us of the potential dangers for lenders mining social media sites for data on potential borrowers and such risks are real and can easily lead to negative publicity or even class-action lawsuits. Yet, the risks are greatly minimized when the borrowers’ consent is obtained prior to conducting the research. And, as another example in the article clearly illustrates, many consumers, especially the younger ones who grew up in the digital age, don’t think twice about giving a bank access to their Facebook account. That being the case, why wouldn’t lenders take advantage of it?

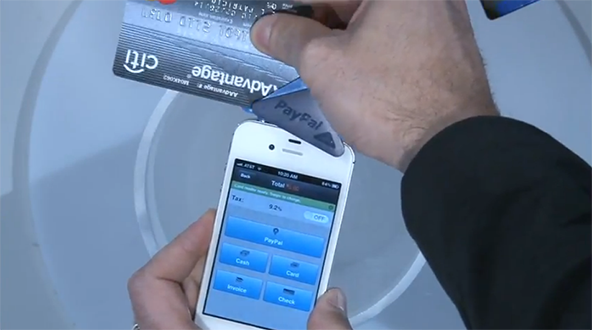

Image credit: Fuentek.com.

This falls in line with my observations too. Generally, you would want to do business with smart people; otherwise you are unlikely to be successful in the long run.