Google Wallet’s PayPal Transformation Continues

Following a major upgrade three months ago, we noted that Google Wallet was beginning to look and feel very much like a payment service we’ve been using for more than a decade — PayPal. Back then the search giant announced support for all major credit and debit cards, which could be securely stored onto Google’s servers, not on the fabled NFC chip around which the service was supposed to revolve. Now, the chip was not to be discarded, we were told, but it would serve to store a wallet ID, which Google called a “virtual card number” and which would be used for authentication purposes.

Well, this week the search giant took another step in the direction of transforming its payment unit into a PayPal clone. On one of its blogs the company announced that Google Wallet had become a payment option on a couple of mobile websites and would in time be available on others. The Google Wallet payment process on these websites is precisely the same as PayPal’s. Now, many of you will remember that the Mountain View-based company had already challenged PayPal on the payment processor’s home turf in the recent past with Checkout, Google Wallet’s predecessor. The result back then was less than spectacular, but is it possible that Google might fare better in the second round against the payment processing heavyweight? I think there just may be a chance.

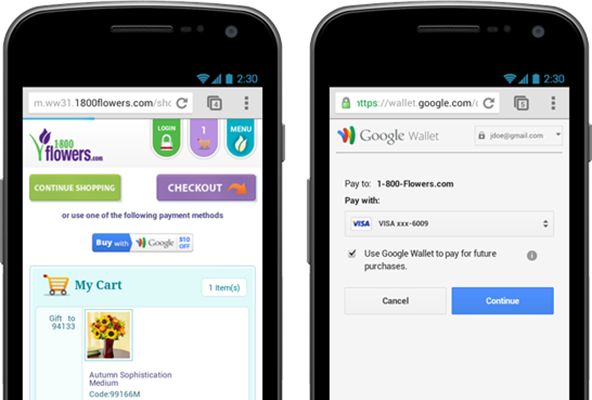

Google Wallet for Mobile Websites

Once again, there is absolutely nothing novel about Google Wallet’s mobile checkout process. The idea, as the blog post notes, is that instead of entering all of your credit card account details at the checkout — card number, expiration date, security code, address, etc. — you would “[s]imply click the Buy with Google Wallet button, log into Google Wallet and click to complete your order”. It is convenient and is also something we’ve grown quite familiar with through many years of checking out with our PayPal accounts.

Credit and debit card information, shipping and billing address and transaction history are all stored into the user’s Google Wallet account. Of course, all these data are encrypted and password-protected and, if you lose your mobile phone, you can go online and disable your Google Wallet account. All data stored in it will then be deleted. Again, we don’t see much of a difference from PayPal. So why would Google hope that its latest PayPal clone will do any better than its predecessor?

Google vs. PayPal

Back when Google announced its PayPal-like Wallet upgrades in August, a spokesman for the payment processor crowed that Google’s changes represented “another validation of PayPal’s approach”, pointing out that

We’ve had a cloud-based digital wallet for well over a decade that’s already regularly in use by over 110 million people.

Well, that PayPal spokesman did make an undeniably valid point. Furthermore, Google didn’t exactly help its cause by initially taking its wallet into what the management should have known to be an unsustainable direction. You may remember that the original plan of action was for Google to work separately with each individual bank on integrating its wallet into the bank’s system. The idea was that by doing so, the search giant would have gained a ready access to each participating bank’s customers. But they should have known that, even in the best of circumstances, this process would take many years to run its course. And they just didn’t have that much time.

So Google’s PayPal pivot, overdue though it may have been, made perfect sense in August and so do these latest upgrades. It is true that, as it is copying PayPal, Google is becoming the butt of a fair amount of ridicule coming from its better established competitor, but the trade-off is well worth it.

The Takeaway

I think that the search specialist just may stand a better chance against PayPal in the m-commerce realm than it did in the e-commerce one. It seems to me that the smaller screen size of mobile devices will discourage merchants from offering too many payment choices, as they do on their e-commerce websites, because there is simply not enough space to put all of their icons and still make it look good. M-commerce websites may end up supporting no more than one or two payment options and Google may just be able to somehow bribe induce merchants to select its checkout system.

My point is that, if you put Google Wallet and PayPal side by side, the sheer size of PayPal’s user base would ensure that the majority of customers check out with PayPal. Why would you go through the trouble of setting up a Google Wallet account, if you could check out with PayPal? On the other hand, if Google Wallet were the only option, the customer might well be forced to open up a Google Wallet account. And yet, I am not prepared to place any bets on how events will actually turn out.

Image credit: Google Commerce.