Getting Rid of Credit Cards the American Way

About a quarter of American consumers now have no open credit card accounts, up from 16 percent only two years ago, two Cleveland Fed economists reported earlier this month. Another quarter of consumers own only one active credit card and these two groups together are largely responsible for the overall decrease in the aggregate number of active bank cards in the U.S., we learn.

Moreover, the researchers — Yuliya Demyanyk and Matthew Koepke — have found that the pattern of reduction in the number of open bank card accounts was almost identical across groups of consumer with different credit scores, suggesting that the deleveraging is consumer-driven, rather than caused by bank closures of underperforming or charged-off accounts. Furthermore, we learn that bankruptcy was not found to be a major factor in the decline of credit cards. It’s a very interesting report and I thought I’d share some of its findings with you.

Getting Rid of Credit Cards the American Way

1. Credit limits, balances decline. As you can see in the graph below, prior to the financial crisis, both credit card balances and limits were rapidly increasing, relative to personal income, and decreasing afterwards.

2. Number of open accounts falls. To explain the falling credit limits and balances, the researchers have first looked at the number of active credit card accounts. And they found that more than half of American consumers now have just one open account or none at all. The share of consumers with no credit cards at all jumped by 50 percent in the past two years, from 16 to 24 percent, we learn.

Here is a graph showing the distribution of consumers by the number of cards they own:

Moreover, the pattern of decreasing number of open card accounts is the same across all age groups:

3. Pattern is “almost identical” for consumers with different credit scores. The researchers have produced no graph to illustrate the effect of credit scores on the reduction of the number of open cards, but here is what they have to say on the subject:

We analyzed the average number of bank cards that consumers with different VantageScores hold. VantageScores are credit scores produced by the three major U.S. credit bureaus. They range from 501 (lowest credit quality) to 990 (highest), and we picked a score of 700 as a reasonable threshold between more and less creditworthy borrowers (lenders may be using a different threshold, which is determined by their business lending goals).

We found almost identical deleveraging behaviors for consumers with different credit scores. According to our results, since the second quarter of 2007, the average number of bank cards held by those with scores above and below the 700 threshold declined by approximately 30 percent. The fact that the number of cards fell by a similar amount for high- and low-risk borrowers suggests that it is consumers who are driving the deleveraging trend, not the banks.

4. Bankruptcy is not a factor. Once again, there is no graph to illustrate this point, but here is what the two economists have to say:

We also found evidence that the decline in credit cards is not being driven by consumers falling into bankruptcy. When we redid our analysis and included bankruptcies, the change in the average number of cards was nearly identical to the result we got when we controlled for bankruptcy.

5. Debt consolidation is also not a factor. Again there is no graph, but here is the explanation:

If people are consolidating their debt by moving debt balances from some cards to others or combining their card and mortgage debt, we would miss it by looking only at the average number of credit cards held. To check for that possibility, we analyzed total consumer debt.

Our results show that total consumer debt has followed a pattern similar to the number of bankcards. We also repeated the exercise of splitting consumers into two credit score groups in this analysis. Overall levels of debt have fallen for both groups.

6. Biggest pre-Lehman debt accumulators are now the biggest debt-cutters. Demyanyk and Koepke:

The consumers cutting the most debt now are those who accumulated more before the recession. Individuals in the top 25 percent of the debt distribution are those driving the trend to close card accounts. The average reduction in the number of cards was much smaller for people who did not have a lot of debt before the crisis.

7. Credit inquiries decline. Consumers with all levels of debt before the crisis are now much less interested in getting fresh credit:

8. Credit card offers rebound. Having reached a post-crisis low of 270,000 in the second quarter of 2009, down from 1.2 million in Q4 2007, credit card solicitations were up nearly 250 percent to 940,000 solicitations in Q4 2011:

9. APRs increase. Interest rates on new credit cards are rising together with the number of offers:

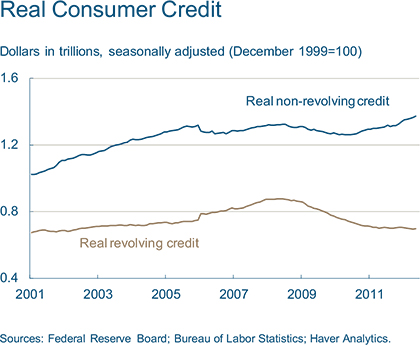

10. Credit card debt down, non-revolving credit up.Finally, here is a graph from another Cleveland Fed paper showing the divergent paths of the revolving and non-revolving portions of the outstanding consumer debt total. Non-revolving credit is comprised of loans for automobiles, mobile homes, trailers, durable goods, vacations, and other purchases, but it excludes home mortgages and loans for other real estate-backed assets.

Image credit: Kathykristof.com.