France Takes over as Europe’s Top Location for Credit Card Fraud

That is the headline of a new FICO report, based on data for 2012 supplied by Euromonitor International, a London-based market intelligence firm. Up until last year, the credit score maker tells us, the top spot in the annual rankings had been invariably occupied by the U.K. I’m sure that this is one competition the Brits would gladly let the French win on any day of the week. While the news has been good for the Brits, however, the opposite has been true for Europe as a whole, as the overall European credit card fraud rate has gone up again in 2012, even though it has now been a while since The Old Continent has switched to the supposedly safer EMV (also known as chip-and-PIN) credit card technology.

So what’s going on? Are criminals making progress in breaking down the new technology’s smart-chip defenses? That seems to be the way one senior FICO executive reads the data, although this is all speculation at this point, as there is no convincing proof that fraudsters have identified a weak spot in the EMV transaction process. What we have known for certain for at least a year and a half, however, is that fraudsters have prefered taking stolen European cards to the U.S. where they can take advantage of the older, and easier to cheat, mag-stripe technology which is still used on our side of the pond. And yet, the data are clear — fraud is rising in Europe, too. Let’s take a look at the FICO report.

France Takes the Top Spot

In 2012, FICO tells us, the highest card fraud losses in Europe were measured in France which took 29 percent of the continent’s total losses, ahead of the U.K. with 27 percent. Moreover, as Martin Warwick, FICO’s fraud chief for Europe, says, whereas U.K.’s fraud losses have declined since the country switched to EMV in the middle of the last decade, the opposite has been the case across the Channel:

France was the founder of the chip and PIN strategy for Europe, but the UK has taken a particularly tough stance against fraud in recent years, using the latest advanced fraud technology. Despite a rise of 14 percent last year, UK card fraud losses were still 36 percent lower in 2012 than at their peak in 2008. By contrast, France’s overall fraud losses grew 65 percent between 2007 and 2012, which translated to an additional ?é¼174 million of card fraud losses over the period. France also has the highest lost-and-stolen card fraud level of all the countries in Europe.

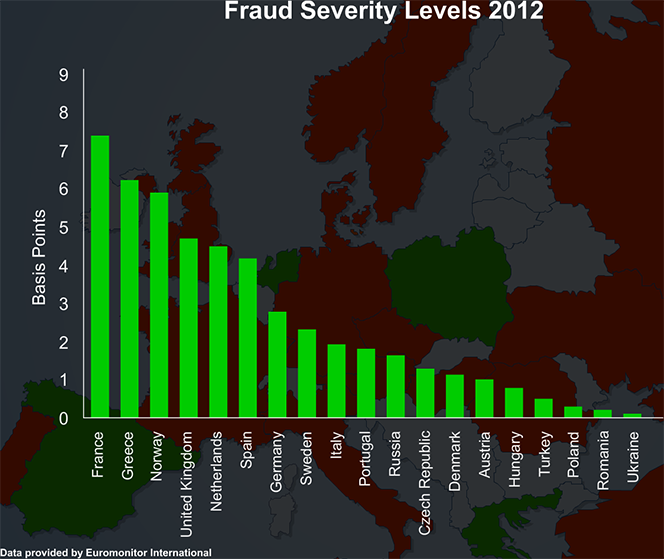

In addition to accounting for the largest share of European card fraud losses, France also had the highest fraud rate among the European countries included in the study and was the only country whose fraud level in 2012 was above seven basis points. By comparison, U.K.’s level was 4.6 basis points and Germany’s — 2.8 basis points (amazingly, whereas the U.K. has experienced a 10-percent drop in fraud since 2006, Germany has seen a 140 percent increase in the same period). Here is the full chart:

European Card Fraud Up

Card fraud in Europe went up by six percent in 2012, on an annual basis, FICO tells us, and there is more bad news for the French. Whereas France, Russia and the U.K. made up more than 80 percent of the total increase (measured in value), France alone accounted for nearly half of it. Russia’s fraud loss has grown the fastest, with its 2012 total reaching three times the level of the one reported in 2010. It should be noted, however, that the country’s credit card market was still hugely underdeveloped by European standards in 2006 and its starting point was therefore quite low.

As you see, the peak in fraud was reached in 2008. However, you can also see that, since 2009, credit card fraud in Europe has been increasing, on a year-over-year basis. Here is how FICO’s Warwick explains it:

Any successful reduction in fraud, like that driven by Chip & PIN, typically results in criminals changing their modus operandi to find a different weak spot, and fraud levels starting to climb again. Fraud is like a balloon — if you squeeze it out of one scheme, or one country, it bulges somewhere else.

In addition, clamping down on fraud can help banks minimize losses but can also result in a more frustrating customer experience, as shoppers’ cards may be blocked unnecessarily. When the negative impact on customers outweighs the benefits of tighter fraud prevention methods, banks relax their controls, inevitably leading to another rise in fraud. This means fraud losses tend to follow a saw-tooth pattern, with alternating peaks and troughs. Europe’s last peak was in 2008, and after a drop in 2009, levels have been steadily climbing since.

So Warwick tells us that there is a certain amount of fraud that will always exist and that’s all right. I agree. However, the European fraud level in 2012 was substantially higher than it was in 2006, which is not exactly a result the EMV proponents could be happy with, and nor should we.

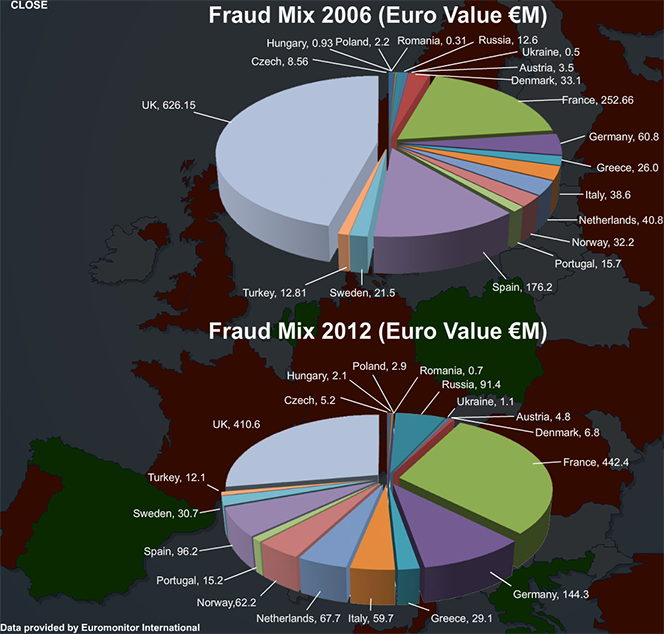

The European Fraud Mix

Finally, FICO has produced a couple of pie charts to illustrate the shift in the composition of European card fraud from 2006 to 2012 by country, and it’s a remarkable one:

As you can see, in 2006, the U.K. had close to half of the total European fraud losses, but by 2012 the British had reduced their losses by 34 percent and had relinquished the lead to the French. In contrast, France’s fraud losses have grown by 75 percent since 2006 and Germany’s — by 137 percent.

The Takeaway

So first we were told that the credit card fraudsters were using stolen European credit card data primarily in the U.S., because they knew how to deal with our mag-stripe technology, whereas the EMV presented them with a much tougher challenge, one they weren’t quite up to yet. Well, these latest data paint a somewhat different picture. Yes, the U.K. has benefited a great deal from the switch to EMV, and so has Spain, but very few other European countries can say the same. In addition to France, Germany and Russia, Italy, the Netherlands, Norway and Sweden have all experienced huge increases in their fraud levels. Not quite the result one would have expected to see.

Image credit: ITPro.co.uk.

I would like to see some analysis of where the fraud in Europe is occurring. For example, I suspect that the fraud in card-not-present transactions (like Internet purchases, where the card is not used in a POS terminal) has increased much more than the fraud in retail stores or other places where the EMV card is used in a terminal.

We’ve written about that several times before. Here is, for example, the breakdown for the U.K. Here is more data on the U.K. experience and on France (even some on Australia). There is more and you can search our blog yourself, if you need more data.

I would like to make a report on Canalplay canal vod etc. I live outside of

France and was surfing the web and found Canalplay. I decided to give them

a try by signing up not knowing that you have to be living in France with a

France credit card to get the service. So yes I was redirected right after I

entered my information to a page that said all of which I just stated etc. Now

comes the big deal, Canalplay has been charging my credit card with out me

knowing anything even after them not allowing me access to the site not

being in France and all that. How can a company be doing this I do not

know! After I contacted them over 100 times 3 weeks later, someone from

Canalplay and Canal vod told me via facebook message that I cannot get my

money back because I do not live in France, do not have a French bank

account and a French zip code. I am from the Caribbean first of all and

never got a subscription, yet they been stealing my money for a subscription

how? Is this how the French do things? Am I ever going to get justice or do I

not matter being from the Caribbean? Do all French people treat non

French people so terrible? I want back what Canalplay stole from me that’s

all. Please help…

J’aimerais faire un reportage sur Canalplay canal vod etc. Je vis hors de

France et je navigue sur le web et trouve Canalplay. J’ai décidé de leur

donner un essai en vous inscrivant sans savoir que vous devez vivre en

France avec une carte de crédit France pour obtenir le service. Donc, oui,

j’ai été redirigé juste après que je suis entré dans mes informations à une

page qui dit tout ce que je viens de dire, etc Maintenant vient la grosse

affaire, Canalplay a été la charge de ma carte de crédit sans me savoir quoi

que ce soit même après eux ne me permettant pas d’accès à Le site n’étant

pas en France et tout ça. Comment une entreprise peut-elle faire cela je ne

sais pas! Après que j’ai contacté plus de 100 fois 3 semaines plus tard,

quelqu’un de Canalplay et canal vod me dit via Facebook message que je ne

peux pas récupérer mon argent parce que je ne vis pas en France, n’ont pas

de compte bancaire français et un code postal français. Je suis des Caraïbes

d’abord et n’ai jamais eu un abonnement, mais ils ont été voler mon argent

pour un abonnement comment? Est-ce ainsi que les Français font les choses?

Suis-je jamais obtenir la justice ou est-ce que je n’aime pas être des

Caraïbes? Tous les Français traitent-ils les non-Français si terribles? Je

veux revenir ce que Canalplay m’a volé c’est tout. S’il vous plaît aider …