Falling Credit Card Debt Result of Higher Consumer Payments, not Charge-offs

That is what a new TransUnion report tells us. The credit reporting agency’s study makes the latest entry into a debate that started as soon as it became evident that the slashing of consumer credit card debt in the U.S. was not a one-off event in the wake of the scare induced by the Lehman Brothers’ collapse and the ensuing financial meltdown. Rather, Americans had been continually decreasing their outstanding credit card balances until May of this year when a 5.1% increase was reported by the Fed. That figure will almost certainly be revised downwards and we don’t yet know if the tide has now turned, so we shouldn’t jump to conclusions.

But there are plenty of data available now to help us understand how much of the huge drop in consumer indebtedness to credit card companies was caused by higher levels of charge-offs and how much was attributable to consumer payments.

The Charge-off Argument

A study by CardHub.com, a credit card comparison website, released about a year ago, told us that each quarter from early 2009 through early 2010, card issuers had been charging off about $20 billion of outstanding credit card balances, which is about equal to the amount of aggregate decline in consumer credit card debt for the period.

So the CardHub.com researchers seemed to have found an unequivocal answer to the question what caused the fall in consumer credit card debt. But the charge-off rates have now been decreasing continually for more than a year and yet credit card balances kept falling.

The Consumer Payment Argument

Now TransUnion tells us that “consumers made an estimated $72 billion more in payments on their credit cards than purchases between the first quarters of 2009 and 2010.” This is precisely the time period studied by CardHub.

By contrast, back in 2004, the report claims, Americans had made $2.1 billion more in purchases than payments. So we have a $75 billion turnaround in consumer payment patterns from 2004 to 2009.

By contrast, back in 2004, the report claims, Americans had made $2.1 billion more in purchases than payments. So we have a $75 billion turnaround in consumer payment patterns from 2004 to 2009.

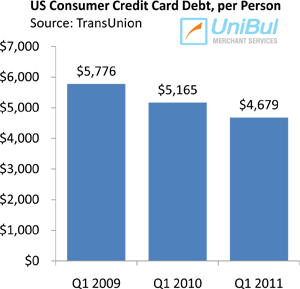

On an individual level, the debt reduction is no less striking. Between Q1 2009 and Q1 2010, the average American cardholder had reduced his or her outstanding credit card balances from $5,776 to $5,165, according to TransUnion. At the end of Q1 2011, the figure had dropped to $4,679, a 10-year low and 19% below the Q1 2009 level. Moreover, credit card debt was falling for about equal proportions of consumers from groups across the credit risk spectrum:

|

Credit Score Range |

Percent of Consumers with Decreasing Balances |

|

801-850 |

58.30% |

|

701-750 |

58.97% |

|

601-650 |

54.98% |

|

501-550 |

53.44% |

The Takeaway

The two sets of data seem to be contradicting each other. According to CardHub.com, in 2009 “$81.6 billion of the $93 billion decrease is the direct result of Americans defaulting on their debt. The real decrease in credit card debt is only $11.6 billion.” TransUnion, on the other hand, tells us that consumer credit card repayments did play a major role in the debt deleveraging process.

There is no doubt that both factors played a role in the huge decrease in credit card debt in the post-Lehman world. However, while banks did lose vast amounts in charge-offs in the first two years following the meltdown, both defaults and delinquencies are now at record lows. On the other hand, consumers are now paying down their credit card balances at record-high levels. Even as consumer credit card spending is now accelerating, the credit card monthly repayment rate (MPR) for June was 21.40%, about a quarter above the historical average of 16.20%, according to Fitch Ratings, a credit ratings agency. So for at least a year now, repayment has been the major driver behind falling debt levels.

Image credit: Elitedaily.com.