Do We Need Credit Card Companies?

That is the underlying question, which a new infographic, published jointly by the Strawhecker Group, a consultancy to the payments industry, and the Electronic Transactions Association (ETA), attempts to answer. Unfortunately, much like many payments industry insiders before them, the two authors have done an exceptionally poor job at getting their point across. And I thought I should weigh in, even though I find the question itself rather meaningless; or actually, I’m doing it precisely because of it.

See, ever since I can remember, there have always been payments industry insiders who have felt the need to justify their existence. Why? Well, probably because credit card companies are constantly under attack from all kinds of directions: processing fees are too high and requirements too burdensome for merchants, interest rates are too high and security insufficiently robust for cardholders, business practices are anti-competitive and opportunities for facilitating payments for illegal organizations always present for governments, etc. Of course, at any given time there has been a class action suit or several of them going on against one or more of the major card brands, some big issuer or acquirer or even merchants who have had credit card information stored on their servers stolen by hackers.

So I guess you can argue that it’s only natural for people under such an unremitting onslaught to feel the need to convince the world around them that they are not really quite as vile bad as they are usually portrayed and that they perform a function that actually benefits the society. Well, whatever the motive, such an objective cannot possibly be achieved. For one thing, a great many people simply hate credit card companies and no argument, however rational, can make a difference to them. Moreover, the way our legal system is set up guarantees that there is always going to be a legal firm or two, which will find something to sue a credit card company over. And I suspect that the government will never be satisfied with the existing regulatory framework.

But even if, in spite of these considerations, we accept the need for people in the payments industry to engage in a PR stunt or two every now and then, the infographic in question is not how we should go about it. In fact, it can be used as a case in point for how not to do it. Let’s see why.

Why Do We Need Payment Companies?

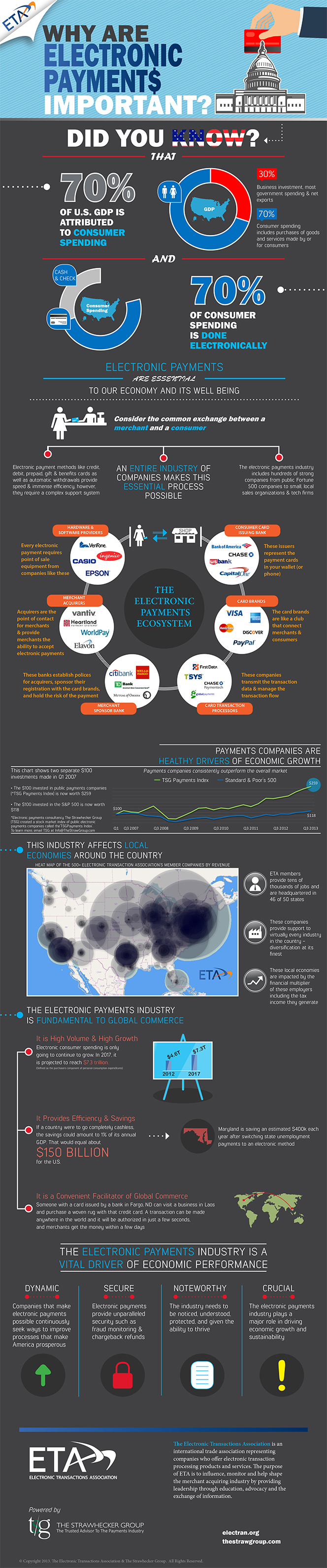

So, in order to convince the audience of just how beneficial the payments industry is to consumer well-being and the economy in general, the authors have decided to show how huge it is. In fact, the graph begins by telling us, in huge type, that “70% of U.S. GDP is attributed to consumer spending” and that “70% of consumer spending is done electronically”.

These statements are promptly followed by an incomprehensible illustration of the “electronic payments ecosystem”. Mind, it is incomprehensible even to this blogger, whose job it is to know how the system in question functions, never mind the intended viewer. Not to mention that, even if the intended audience somehow miraculously understood what was being shown, it would immediately dismiss it as irrelevant. And why wouldn’t they? After all, how many people do you know who care about the technical infrastructure that makes it possible for Facebook or Google to do what they do (oh, if you are an engineer, you’ve probably ended up on this blog by some horrible mistake; or else you may be a victim of a particularly cruel practical joke)? Why should things be different when it comes to credit cards?

But then comes the worst part. The authors focus on how well the payments companies’ stocks have done during the recession: a chart shows us how an index tracking their performance has increased by a factor of 2.59 between 2007 Q1 and 2013 Q3. Have these guys no idea how infuriating is for a huge number of consumers to be reminded how well banks have done during the Great Recession? Have they been living under a rock these past few years? This is truly, remarkably dense.

So how should the benefits from having payments companies around be presented? Well, to the extent to which such a thankless task should be undertaken in the first place, the focus should fall squarely on the consumer, not on the industry itself, as these guys have done. Tell consumers what you are doing for them, which they otherwise will not be getting!

In particular, as we are talking about an infographic here and top-line numbers are all important, I would place a huge graph somewhere at the very top showing people what an enormous dollar-amount of rewards has been distributed to consumers over a given period, and how that amount has been rising inexorably. I will show everyone how the share of rewards-based credit cards has been increasing relentlessly, even for sub-prime consumers. I will place a huge chart illustrating how much lower the average interest rate today is, compared to some point before the financial meltdown. On the merchant side, I will produce a chart showing how much bigger the sales volume of the average merchant accepting credit cards is in comparison to its otherwise identical cash- and check-only counterpart. Then, using the same approach, I will show how credit card acceptance has benefited e-commerce and MO / TO businesses to an even greater degree. I will tell a (visual) story of international merchants benefiting in a huge way from the ability, made available by payment processors, to accept credit cards from people all over the world and in a currency of their choosing.

I can go on, but I’m sure you get the idea. Instead, we’ve got this:

Image credit: Flickr / donuzz.