Credit Card Debt vs. Credit Card Use

Following Friday’s Federal Reserve release showing yet another drop in the total amount of consumer credit card debt, a number of observers commented that credit card use has fallen (for example here). In fact, such commentaries have become commonplace ever since the revolving debt total started to decrease in October 2008, following the collapse of Lehman Brothers. Yet, however prevalent, this perception of falling credit card use is wrong.

In fact, credit card use has been on the rise in the U.S. throughout most of the post-Lehman period and is certainly growing now. What has changed in the aftermath of the financial crisis is that Americans have become much more averse to credit card debt and are paying it back at a much faster rate than they have done since statisticians began to track their debt repayment behavior. Now let’s take a closer look at the numbers.

Credit Card Debt vs. Credit Card Use

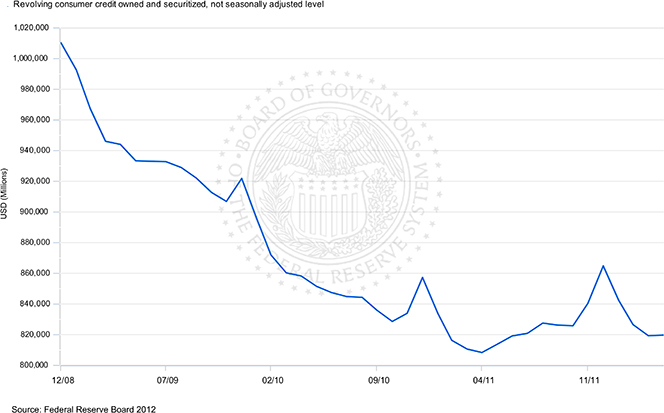

So here are the data. First credit card debt going back to December 2008:

So the credit card debt total has fallen rather precipitously. Following the latest drop in April, the total is now lower by 14.6 percent, or $148 billion, than the $1,010.3 figure measured at the end of 2008.

Now let’s take a look at credit card use. It is difficult to find relevant Federal Reserve data, so instead I am using figures provided by First Data, the biggest U.S. payment processor. According to the processor’s latest SpendTrend report, same-store dollar volume growth of spending by credit, signature debit, PIN debit, EBT cards and checks at U.S. merchants grew by 7.0 percent in May on annual basis, up from April’s growth of 5.7 percent. The number of transactions also grew, at 5.9 percent, in both April and May. Here are the data broken down by transaction type:

|

May Dollar Volume Growth |

Change from Previous Year |

|

Credit |

+8.2% |

|

Signature Debit |

+5.5% |

|

PIN Debit |

+7.2% |

|

Check |

-4.2% |

Source: First Data

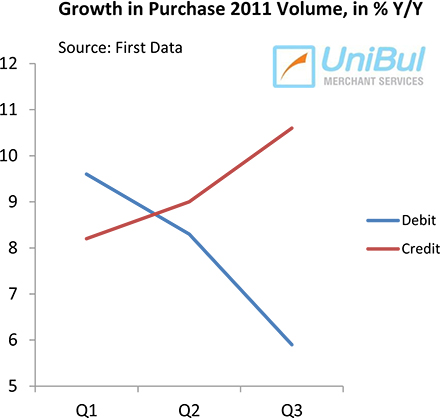

In fact, the growth in purchases made with credit cards has been outstripping the growth of debit card purchases since the second quarter of last year, reversing a trend of higher debit growth that began long before the crisis of 2008. Here is the chart, again using figures from First Data:

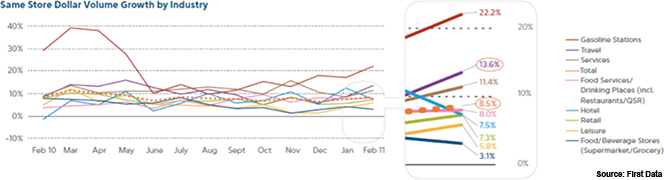

And now here is the same-store growth by industry for the period February 2010 – February 2011 (click here or the chart below for a higher-resolution image):

As you see, credit card use has been growing throughout the post-Lehman period.

Usage vs. Debt

So credit cards haven’t really fallen out of favor with Americans. Far from it, we have been just as fond of using them as ever. What did change in the aftermath of the financial crisis, and changed in a big way, was the consumer tolerance to credit card debt. While in the months immediately following Lehman’s collapse credit card charge-offs and delinquencies began to rise, reaching record highs in early 2010, both categories have been falling ever since. The headline delinquency rate — measuring the ratio of payments late by 30 days or more — now stands at 2.59 percent, according to data from Moody’s. For perspective, never before the crisis has that rate fallen below the three-percent threshold. Moreover, the early-stage delinquencies — payments late by 30 – 59 days — have fallen to 0.66 percent, which indicates that the headline rate will keep decreasing for some time to come.

But my favorite indicator for the huge shift in consumer tolerance to debt has been the monthly payment rate (MPR), which is measured as the ratio of the amount of credit card debt which cardholders are paying back at the end of each monthly cycle, in relation to the total outstanding principal balance. In April, the MPR was at 21.49 percent, according to Moody’s, the second-highest on record behind only March’s 22.11 percent. For perspective, historically the MPR has hovered in the mid-teens.

So, even as credit card spending has been on the rise, the record-high MPR has been preventing the outstanding monthly balances from increasing.

The Takeaway

A rough calculation tells us that, if Americans had stuck to their pre-crisis credit card debt repayment pattern, the revolving credit category in the Federal Reserve’s consumer credit table (which is made up almost exclusively of credit card debt) would have been rising pretty much in step with the non-revolving one, and possibly faster. However, that has not happened and all the indications point to further improvements in the months to come.

Image credit: Captico.com.

As long as you can pay back at the end on the month all credit card balance that you have spent you are in good shape. I know because I’ve been doing that since I got my first credit card 10 years ago.

What I find most surprising in your charts is that not only is credit card use increasing but it is doing so at a faster clip than debit card use. If people were really averse to credit you would expect the reverse to be happening.

8.2% growth in credit card spending and the unemployment rate is also 8.2%; both are way too high.

One of the very few positive things to come out of the Great Recession is that more people are paying back their credit cards. It would be even better if it lasted after we recovered (presuming that we would) but I doubt it.

People need to slow down on their credit cards. Now they are scared of the economy and are focused on paying back but once unemployment goes down and confidence improves, a lot of people will go back to the buy now pay later model that has caused us so many problems.

You need to do a similar analysis of the growth of student loans and I think you will find it off the charts. Student debt is now over $1 trillion, more than credit card debt and auto loans and is growing much faster than either of the other two categories. It’s the timebomb that will set off the next crisis.

Tuition cost needs to go down, the situation is already unsustainable and the longer it goes on the worse it will become and the more difficult to fix. Luckily I am student debt free, but I have several friends who owe $50,000 or more and it will take them many years to pay their debts off.