Americans Cut Back Sharply on Credit Cards Use

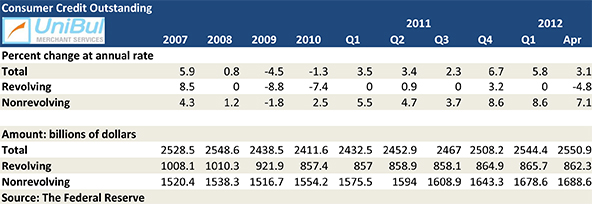

Americans have once again put the brakes on credit card spending, focusing instead on paying down existing debt. A month ago both Visa and MasterCard reported a lower growth in U.S. card payment volumes in April. Then this past Friday the Federal Reserve told us that, following two consecutive monthly increases, the aggregate amount of outstanding credit card debt fell sharply in April, all but reversing the cumulative gains from the previous two months.

The total amount of outstanding U.S. consumer debt did increase in April, pushed up by rises in the student and auto loan categories, but the growth rate was twice lower than the one measured in March. Yet, even with this latest gain, the U.S. consumer debt total is still below the all-time record reached in July 2008, two months before the collapse of Lehman Brothers set off the biggest financial crisis since the Great Depression and exacerbated the recession which we are still trying to dig ourselves out of. However, while it is very likely that we will finally surpass the overall pre-Lehman debt total in a month or two, that will not be the case with the credit total for years to come.

Credit Card Debt down 4.8% in April

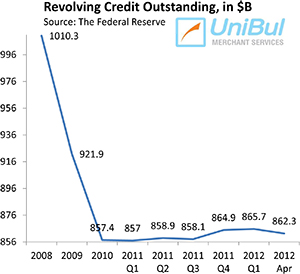

The aggregate amount of outstanding consumer revolving credit in the U.S., which is made up almost exclusively of unpaid credit card balances, fell in April by 4.8 percent, or $3.4 billion, from the previous month’s level, pushing the total down to $862.3 billion.

The aggregate amount of outstanding consumer revolving credit in the U.S., which is made up almost exclusively of unpaid credit card balances, fell in April by 4.8 percent, or $3.4 billion, from the previous month’s level, pushing the total down to $862.3 billion.

Following Lehman’s collapse, U.S. revolving credit had been falling unceasingly until the end of 2010. Then, in 2011, half of the Federal Reserve’s monthly reports showed an increase in the outstanding credit card debt total, including each of the last four. Now, following the fall in April, the current total is lower by 14.6 percent, or $148 billion, than the $1,010.3 figure measured at the end of 2008.

Overall Consumer Credit Up 3.1%

The non-revolving component of the consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, rose in April. The Federal Reserve reported a $10 billion — or 7.1 percent — increase from the previous month, lifting the total up to $1,688.6 billion.

The non-revolving total has now risen every month since July 2010 with the sole exception of August 2011 when it fell by 6.4 percent. The current number is higher by 8.9 percent, or $150.3 billion, than the total of $1,538.3 billion, recorded at the end of 2008.

The aggregate amount of outstanding consumer credit in the U.S. — the sum of the revolving and non-revolving debt numbers — rose by 3.1 percent, or $6.5 billion, to $2,550.9 billion in April, its eight consecutive monthly increase, but the smallest one in six months. The new total is still lower by about $30 billion, or 1.2 percent, than the all-time high of $2,558 billion, measured in July 2008, but the gap is closing quickly.

The Credit Card Takeaway

The total amount of credit card debt reached its post-Lehman bottom in April 2011 and Americans have kept it near that level ever since. What has made this possible has been the combination of the ceaselessly falling delinquency and charge-off rates and the record-high monthly payment rate (MPR).

The credit card delinquency rate in April of this year was 2.59 percent, the lowest ever recorded, according to Moody’s. The charge-off rate for the month was reported at 5.21 percent, up from March, but certain to resume its downward trajectory in May and projected to fall to around four percent by the end of the year. The monthly payment rate (MPR) — the ratio of the amount of credit card debt which Americans are paying back at the end of each monthly cycle, in relation to the total outstanding principal balance — was at 21.49 percent in April, below the 22.11 percent record-high measured in March, but still very high by historical standards.

All available data indicate rather strongly that Americans are still very much in a credit card debt repayment mood. Spending is rising in absolute terms, but its growth rate is decelerating. And the bad unemployment news from the past couple of months seems to be deepening the deleveraging mood.

Credit cards are pretty much the only type of debt that is flat. But the big problem now are student loans and something will have to be done to slow them down before it gets too late.

Student loans are out of control and I think that it may already be too late to prevent the future damage. Even if they pass a law to cut the interest on existing student loans, the principal is often so huge that it will not provide much relief.

Looking at your credit card graph, it is clear that the credit card debt deleveraging process has ended in mid-2010 and it’s stayed there ever since. Still, considering the rising population, keeping it so low for a long period of time is quite an achievement.

“The new total is still lower by about $30 billion, or 1.2 percent, than the all-time high of $2,558 billion, measured in July 2008, but the gap is closing quickly.”

I think that’s the key. Whatever debt deleveraging may have been happening in the immediate post-crisis months, that’s gone and over. Debt is rising again and fast.