Authorization, Clearing, and Settlement of MasterCard Transactions

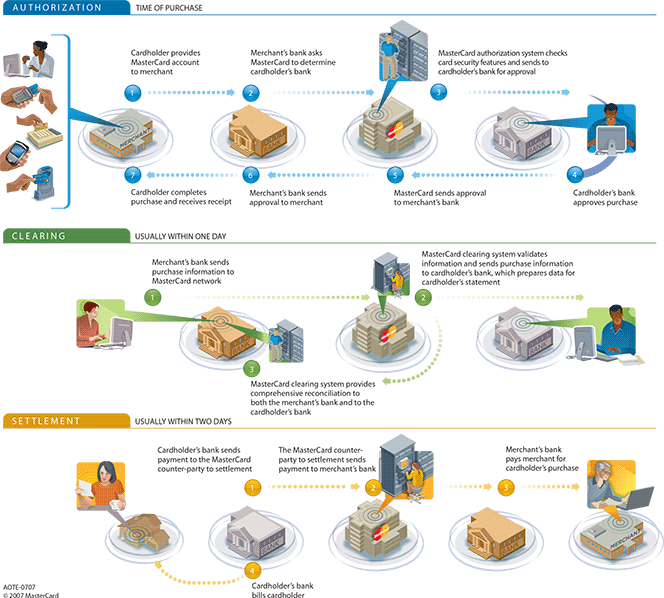

MasterCard transactions are processed through the MasterCard Worldwide Network using the Authorization Platform, the Global Clearing Management System (GCMS) and the MasterCard Settlement Account Management (S.A.M.) system. There are three stages in each card transaction process and you should have at least a basic understanding of how the process works.

As a merchant, you participate directly in the first stage of the transaction process — authorization — and so you need to understand the applicable rules and follow them to the letter — it is in your own best interest, as it will protect you from fraud and chargebacks. I will begin by giving you a basic overview of the process, which will be sufficient for most readers. Then I will dig much deeper into MasterCard’s system for those of you who are interested in learning more than the mere basics. Let’s get started.

Transaction Authorization

Each one of your authorization requests receives a response, in the form of a code, that directs you how to proceed with the transaction. The response always identifies one of the following actions that you should take:

| Response | Description |

| Approve | The transaction is authorized for processing. When it approves a transaction, the issuer provides a six-digit authorization code to the processor. The merchant still needs to perform its regular review process to verify the validity of the card and the cardholder before completing the transaction. |

| Decline | The merchant is not allowed to complete the transaction, but should return the card and request another form of payment. |

| Refer to card issuer | The merchant should contact the issuer for further instructions. |

| Capture card | The merchant is required to keep the card, if possible by reasonable and peaceful means. |

| Valid | A response to balance inquiries, address verification requests or other non-financial types of requests, a valid response means that the transaction is not declined and indicates that the request was completed successfully by the issuer. The returned message is then used by the merchant to provide information to the cardholder or to decide whether further authorization is needed. |

Partial Authorization Approvals

A partial authorization approval enables merchants and cardholders to complete debit and prepaid card sales in cases where the balance available on the card is less than the transaction amount. All U.S. debit and prepaid card issuers are now required to support partial approvals.

Issuers use partial approvals to authorize a portion of the transaction amount in the authorization request (which is submitted for the full amount) when the transaction amount is greater than the amount available on the debit or prepaid card, provided the point-of-sale (POS) terminal supports partial approvals. For automated fuel dispensers (AFDs), the partial approval amount may be greater than the one provided in the authorization request.

Once the issuer provides a partial approval, the processor typically sends a balance due message to the POS terminal and the cardholder can use a different payment method to pay the outstanding balance and complete the sale. This is known as a split tender transaction.

Clearing and Settlement

Clearing is the process of exchanging transaction data between processors and issuers. From the information provided in clearing, GCMS calculates the amounts for settlement. Clearing includes sending transactions from the processor to the issuer for posting to the cardholder’s account (which is known as “presentment”). GCMS gathers the information, edits it, assesses the appropriate fees, and sends it on to the appropriate receiver. The clearing messages contain data but do not actually exchange or transfer funds.

While clearing is the process of exchanging transaction data, the actual exchange of funds is a separate process, called settlement. These funds are exchanged daily between processors and issuers for the net value of the cleared transactions. Here is a visual representation of MasterCard’s transaction process (click on the image for a better view):

Now let’s dig deeper.

Dual-Message vs. Single-Message System

MasterCard operates two distinct types of payment networks on which card transactions are processed. The first one is the dual-message system, which was initially designed for credit cards but today it is also used for MasterCard debit card transactions. This network typically relies on a cardholder signature to authenticate the transactions.

The second payment network is the single-message system, which is designed for automated teller machines (ATMs) and point-of-sale (POS) Maestro (a MasterCard-owned debit card brand) transactions. In most situations, this system requires cardholders to enter a pre-selected personal identification number (PIN) as a way to authenticate the transaction.

There are some differences in the clearing processes of these two network types (which will be discussed later in this document), but the governing role of MasterCard is identical in each of them. In both systems, MasterCard facilitates transactions among the key participants: cardholders, merchants, issuing banks and acquiring banks. MasterCard is equally responsible for collecting all transactions and for operating a payment gateway. MasterCard exchanges data between issuers and acquirers, establishes rules and processes for participation in the network, creates formatting standards for information flowing across the network and facilitates the settlement between the participating banks. Now let’s look at the specifics.

Clearing of Dual-Message Transactions

The dual-message protocol is used by MasterCard for credit and signature-authenticated debit transactions. Dual-message transactions typically require a physical or virtual signature. This category includes credit card transactions (except when credit cards are used for ATM cash advances) and signature-authenticated debit transactions. When a merchant’s card processing system receives an authorization message (see above), it creates a record of that authorization through what is known as “electronic draft capture” (EDC). EDCs are then stored in a “batch” until the merchant initiates a “batch processing”, which typically takes place at least once a day. However, whereas high-volume merchants may process their batches multiple times per day, very low-volume merchants may do it on less than a daily basis. Whatever the frequency, however, merchants submit their authorized transactions to their acquirer in a batch mode, not as individual transactions.

MasterCard rules spell out specific time frames for submission of transaction information and you should submit your transactions to your acquiring banks within that period. The acquiring banks, for their part, have their own time period to comply with for entering that information into network clearing. If those time periods are met, the issuers are obliged to honor the transaction. Additionally, issuers are required to honor transactions cleared outside of the specified time period, if the cardholder’s account is still open and in good standing.

As you may imagine, MasterCard receives many millions of electronic drafts for clearing each processing day. Still, its system identifies the issuing banks for each of these millions of drafts. The data are then organized into electronic reports to be transmitted to the respective issuers. Those reports contain all the information that issuers need to conduct their activities, including posting transactions to cardholder accounts and facilitating disputes on behalf of their cardholders.

By crunching all these data, MasterCard is also able to calculate the total amount owed by each issuer and owed to each acquirer. This function of the clearing process, as we’ve seen above, is critical to the final settlement stage of the process.

Clearing of Single-Message Transactions

Except for Europe, all MasterCard transactions for which a PIN is used for cardholder authentication are single-message transactions. (Europe uses dual messaging for all card transactions, whether they are authenticated with a signature or with a PIN.) With single messaging, the authorization and clearing are performed in one dispatch and all the information necessary to post the transaction to the cardholder’s account is communicated right at the time of each transaction. As you see, this eliminates the batch processing, which the dual-message process requires. In single-message processing, transactions are entered directly into clearing and only monetary settlement is then required.

Single-message transactions have only one cut-off time each day and that cut-off time is the same for all network participants and is non-negotiable. MasterCard has changed its cut-off time a couple of times over the past 15 years, but when that happens, it is changed for all network participants at the same time, so there is no adjustment period.

At the cut-off time, MasterCard calculates the total monetary positions for all its client banks (acquirers and issuers) for the day’s single-message transactions. These include PIN-based purchase transactions, as well as ATM transactions which take place at “foreign” ATMs (these are ATMs that are not operated by the bank that has issued the card used during the transaction). The ATM category includes ATM withdrawals made with debit cards and ATM cash advances made with credit cards.

MasterCard’s Settlement

Whether the transaction is dual-message or single-message, there is only one settlement window and settlement is done on an aggregate net basis. In other words, all credits and debits of a given bank are summed up and the net amount is transferred in a lump sum to the bank’s account with MasterCard, in the case of an acquirer, or from the bank’s account, in the case of an issuer.

For issuers, most of their cardholders’ activities are debits: cardholders are buying things with their cards, for which the issuer will pay into settlement on the cardholders’ behalf. However, some cardholder transactions, particularly product returns, fall into the credit category. The issuer may also have made cash disbursements through its ATMs to cardholders of other issuing banks, in which case transactions would be accounted for as credits to the issuer’s settlement amount. MasterCard calculates the total of the debits, subtracts the total value of the credits and the net resulting amount will be collected from the issuer through settlement.

For acquirers, on the other hand, most of their merchants’ activities will be credit transactions: merchants are selling things to other banks’ cardholders, for which the acquirer will be paid through settlement. However, merchants will also be processing refunds and returns, which generate debits to the merchant (and credits to the cardholder, as we’ve just seen in the previous paragraph). These debits will be subtracted from the total amount owed to the acquirer and the net resulting amount will be deposited into the acquirer’s account through settlement.

Another type of transaction that generates debits for the acquirer (and its merchants) and a credit for the issuer (and its cardholder) is the chargeback. Chargebacks occur when a sales transaction is reversed and the transaction amount is credited back into the issuer’s account (and from there into the cardholder’s account). Chargebacks are typically caused by cardholder disputes, which have not been resolved with the merchant. There are specified time limits for exercising chargeback rights and a list of valid chargeback reasons for entering a dispute. Some of the most common chargeback reasons include duplicate processing (the merchant has processed a sales transaction more than once), defective or not as described merchandise, services not rendered or goods not received, failure to discontinue billing after a recurring payment plan has been canceled, etc.

I won’t be getting deep into chargebacks here, but for the purposes of our present exercise I will only note that a chargeback may be disputed by the acquirer and its merchant and MasterCard is the final arbiter. If the chargeback is adjudicated in the merchant’s favor, no settlement activity takes place. However, if the cardholder wins the chargeback, MasterCard will debit the transaction amount from the acquirer’s net settlement and process a credit for the same amount to the issuer’s net settlement.

It is also during settlement that interchange fees are collected from the acquirers and credited to the issuers for all sales transactions. For cash advances, cash withdrawals, credits and returns, the isin the opposite direction and the issuers pay interchange fees to the acquirers. Interchange rates are set by MasterCard and vary depending on a number of factors, such as the type of card used (e.g. rewards card, purchase, etc.), merchant category (e.g. airlines or passenger transport), transaction type (card-present or card-not-present), merchant’s sales channel and fraud rates associated with merchant and channel categories.

Once all these calculations are done, MasterCard notifies each of its client bank of these amounts. Banks with a net debit position are informed of the amount they need to remit to MasterCard’s clearing account to be distributed to other clients. Banks with a net credit position are informed of the amounts that will be deposited into their settlement accounts. MasterCard pays most credits within an hour after the settlement cut-off time and most of the debits come in as quickly.

Once the funds have been settled between issuers and acquirers, these banks proceed to post the appropriate debits and credits to their cardholder and merchant accounts and the cycle is then complete.

The Takeaway

It is important to understand that MasterCard, just like its rival Visa, is neither an issuer of the cards bearing its logo, nor a processor of transactions made with these cards. Both organizations are associations of member-banks, which are licensed to issue MasterCard and Visa cards and to acquire the associated transactions. The two associations facilitate the processing of these transactions and, when applicable, the transferring of settled funds between members. MasterCard and Visa are also the final arbiters of any disputes that their members are unable to resolve between themselves.

Image credit: Banknerd.ca.

Is there an equivalent article for Visa transactions ? If so, the link please.

Thanks

Excellent..Thanks!

Good article.

Thanks