Americans still Wary of Credit Card Debt

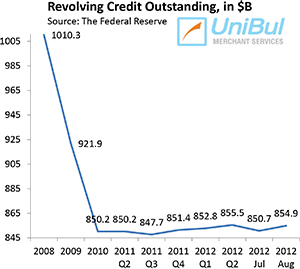

Following two consecutive steep monthly decreases in June and July, the U.S. consumer credit card debt total has rebounded in August, we learn from the latest Federal Reserve consumer credit data release. That increase fits well into a trend, which began about two years ago. Four years ago, following the collapse of Lehman Brothers, a combination of a sharply increased credit card debt repayment rates and sky-rocketing default levels caused the aggregate amount of credit card debt in the U.S. to plummet. However, that free fall ended sometime in late 2010 and since then the aggregate amount of U.S. credit card debt has been bouncing up and down, but has remained virtually unchanged.

In contrast, the financial crisis has had a significantly lesser impact on the much bigger consumer debt category that includes auto and student loans. The non-credit-card debt total did contract slightly in 2009, in relation to 2008, but it has been rising almost continually ever since. As a consequence, the aggregate amount of U.S. consumer debt — the sum of credit card and non-credit-card debt — is now well above its pre-Lehman level. Let’s take a look at the latest Fed data.

Credit Card Debt up 5.9% in August

The aggregate amount of outstanding consumer revolving credit in the U.S., made up almost exclusively of unpaid credit card balances, rose in August by 5.9 percent, or $4.2 billion, from July’s level, lifting the total up to $854.9 billion.

The aggregate amount of outstanding consumer revolving credit in the U.S., made up almost exclusively of unpaid credit card balances, rose in August by 5.9 percent, or $4.2 billion, from July’s level, lifting the total up to $854.9 billion.

As I said, ever since the financial meltdown of September 2008, the U.S. consumer credit card debt total had been falling uninterruptedly until the end of 2010. Then it all changed and in 2011 half of the Federal Reserve’s monthly data releases showed increases in the revolving debt total, including each one of the last four. Now, following the increase in August, the total is lower by 15.4 percent, or $155.4 billion, than the $1,010.3 figure measured at the end of 2008.

Overall Consumer Credit up 8%

The non-revolving portion of the consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued its long-standing upward trend. The Federal Reserve reported a $13.9 billion — or 9 percent — increase in August from the previous month’s level, bringing the total up to $1,870.7 billion.

The non-revolving total has risen in every month since July 2010, with the sole exception of August 2011 when it declined by 5.2 percent. The current figure is higher by 17 percent, or $272 billion, than the total of $1,598.7 billion, measured at the end of 2008.

Following a rare drop in July, the total amount of outstanding U.S. consumer credit — the sum of the revolving and non-revolving debt totals — rose by 8 percent, or $18.1 billion, to $2,725.6 billion in August. The new figure is now bigger by about $138.2 billion, or 5.3 percent, than the pre-Lehman record-high of $2,587.4 billion, set in July 2008, just over four years ago.

The Credit Card Takeaway

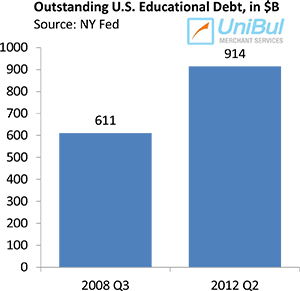

So the latest Federal Reserve data reveal no new trends. On the one hand, American consumers are still keeping a very close eye on their credit card balances and are very reluctant to expand them in any significant way, as they have been ever since the collapse of Lehman Brothers in 2008. At the same time, Americans are having much less qualms about taking out student and auto loans, if they can get them. Most strikingly, since the third quarter of 2008, the student debt total has risen by a half and is now greater than the credit card one. As many have pointed out, that shift in consumer debt repayment preferences is one of the major defining features of the post-Lehman period.

So the latest Federal Reserve data reveal no new trends. On the one hand, American consumers are still keeping a very close eye on their credit card balances and are very reluctant to expand them in any significant way, as they have been ever since the collapse of Lehman Brothers in 2008. At the same time, Americans are having much less qualms about taking out student and auto loans, if they can get them. Most strikingly, since the third quarter of 2008, the student debt total has risen by a half and is now greater than the credit card one. As many have pointed out, that shift in consumer debt repayment preferences is one of the major defining features of the post-Lehman period.

Furthermore, not only did the credit card debt total fall steeply in the first two years following the financial meltdown, but so did the delinquency and charge-off levels and these two rates are still declining, even as the revolving debt total has now stabilized. Perhaps more importantly, the credit card monthly payment rate (MPR), which measures the rate at which cardholders are paying down the principal on their credit card debt, keeps rising and has set another record-high in August. The current level — 22.71 percent — is higher by more than a third than the historical averages. So there is no indication of a trend reversal anytime soon.