Americans Still Cautious with Credit Cards, not so with Auto and Student Loans

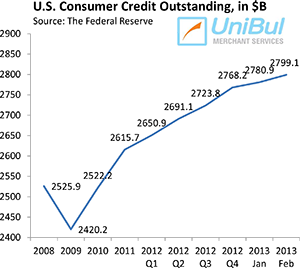

The U.S. consumer debt total notched its biggest gain in six months in February, we learn from the latest Federal Reserve consumer credit data release. It is the seventh consecutive such increase and once again it is almost exclusively the result of continuing strong growth of the non-revolving component of the total and especially of its student loan and car loan parts, both of which rose by more than anticipated.

On the other hand, even as they were busy taking out auto and student loans, Americans were once again much more cautious with their credit cards, keeping a close eye on their outstanding balances whose total at the end of February was only slightly higher than the level measured in January. So, four and a half years after the collapse of Lehman Brothers set Americans into a credit card debt deleveraging mode, there is no sign of a trend reversal, even as the housing market continues to improve, the stock market keeps setting all-time records and unemployment is falling (albeit painfully slowly). Let’s take a look at the latest Fed data.

Credit Card Debt Slightly up in February

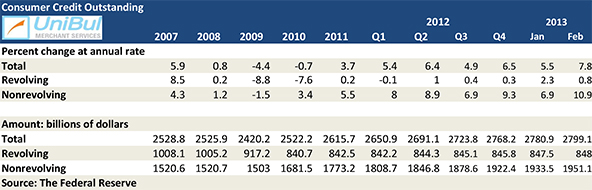

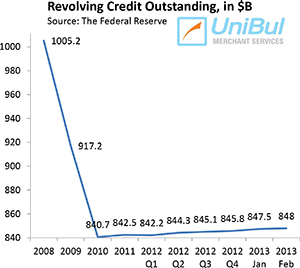

The total amount of outstanding consumer revolving credit in the U.S., which is comprised almost exclusively of unpaid credit card balances, rose in February at a seasonally adjusted annual rate of 0.8 percent, or $532.8 million, from the previous month’s level, after an upwardly revised $1.65 billion increase in January, bringing the total up to $848 billion — just 0.9 percent, or $7.3 billion, above the total measured at the end of 2010 — at the height of the credit card debt deleveraging process.

The total amount of outstanding consumer revolving credit in the U.S., which is comprised almost exclusively of unpaid credit card balances, rose in February at a seasonally adjusted annual rate of 0.8 percent, or $532.8 million, from the previous month’s level, after an upwardly revised $1.65 billion increase in January, bringing the total up to $848 billion — just 0.9 percent, or $7.3 billion, above the total measured at the end of 2010 — at the height of the credit card debt deleveraging process.

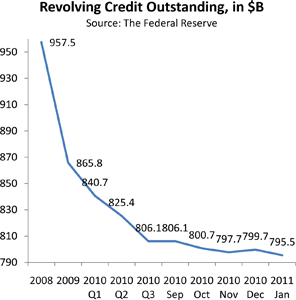

The U.S. consumer credit card debt total had been falling continually since the onset of the financial crisis in September 2008 until the end of 2010. The precipitous fall ended in 2011, for which year half of the Federal Reserve’s monthly credit releases, including each of the last four reports, showed slow increases in the revolving debt total. However, as the chart to the right clearly illustrates, the revolving debt total has barely changed since reaching its lowest point at the end of 2010. And now the Fed’s latest report tells us that at the end of February the revolving total was still lower by 16.1 percent, or $162.3 billion, than the $1,010.3 total measured at the end of 2008.

Overall Consumer Credit up 7.8%

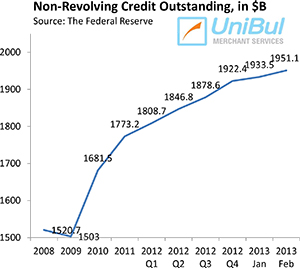

The non-revolving component of the U.S. consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, maintained its long-standing upward trend. The Federal Reserve reported a $17.6 billion — or 10.9 percent — increase in February from January’s level, lifting the total up to $1,951.1 billion. This latest increase is the biggest one since at least 2006 and only the latest in a series of strong gains.

The non-revolving component of the U.S. consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, maintained its long-standing upward trend. The Federal Reserve reported a $17.6 billion — or 10.9 percent — increase in February from January’s level, lifting the total up to $1,951.1 billion. This latest increase is the biggest one since at least 2006 and only the latest in a series of strong gains.

February’s rise of non-credit-card debt was once again driven primarily by increases in the auto and federal educational loan totals. The report showed that lending by the federal government — mostly educational loans — rose by $4.2 billion for the month, before seasonal adjustments, after a $25.9 billion growth in January.

Lower interest rates are keeping up demand for cars and trucks, which sold at a 15.3 million annual rate in February after a 15.2 million showing in January, according to the Ward’s Automotive Group. In March, the figure was once again 15.2 million and General Motors reported its best March in five years.

The Fed has now reported an increase in the non-revolving debt total in every month since July 2010, with the sole exception of August 2011 when it fell by 5.2 percent. The figure for February is higher by 22 percent, or $352.4 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The Fed has now reported an increase in the non-revolving debt total in every month since July 2010, with the sole exception of August 2011 when it fell by 5.2 percent. The figure for February is higher by 22 percent, or $352.4 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The total amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving parts — rose by 0.7 percent, or $18.1 billion, to $2,799.1 billion in February. The new total is larger by $211.7 billion, or 8.2 percent, than the pre-Lehman record-high of $2,587.4 billion, recorded in July 2008.

The Takeaway

So the Fed’s latest data tell us nothing new about the attitudes of U.S. borrowers toward different types of consumer debt. Americans keep diligently paying down their credit card balances just as quickly as they can, which is confirmed by the fairly static level of the Fed’s revolving debt total, but also by the historically low, and still declining, delinquency rates. According to the latest data released by the American Bankers Association, at the end of the fourth quarter of 2012, bank card delinquencies in the U.S. had fallen to 2.47 percent — an 18-year low and well below the 15-year average of 3.87 percent.

Of course, the big concern is the incredibly fast growth of the student debt total. But why are Americans taking out student loans at such a brisk pace? Well, as some economists have noted, persistently high unemployment rate has hit younger Americans particularly hard and their share in the labor force is still declining. Consequently, limited job opportunities are forcing younger consumers to stay in school and rack up student loans in the process. I think that explanation makes a lot of sense. It doesn’t make the problem any less acute, though.