Americans Load up on Credit Card Debt

The outstanding amount of U.S. consumer debt rose for yet another month in December of last year, the Federal Reserve told us in its latest consumer credit data release. This was also the 28th consecutive monthly increase. Following a slightly upwardly revised $12.4 billion increase in November, the December total rose by $18.8 billion — more than anticipated.

As typical of the post-crisis years, December’s overall consumer debt growth was predominantly the result of yet another big rise of its non-revolving portion and, particularly, of the auto and student loan totals, the former of which has been driven by the strengthening economic recovery. The latter, on the other hand, has just kept growing through crisis, recession and recovery alike.

The inexorable increase of the federal student loan total slowed down considerably at the beginning of last year, which was good news, considering the enormous expansion it had experienced over the past decade, and particularly in the past five years, as you can see in the chart further down. That growth, coupled with high unemployment, has led to a spike in charge-off and delinquency rates, a process which, unfortunately, is still ongoing.

In stark contrast to November, when the credit card debt total remained virtually flat, the December total spiked by the biggest amount in seven months. Now, I should be quick to point out that, so far in the post-Lehman period, every single time we’ve had a larger-than-usual monthly increase in the revolving total, it has been promptly reversed in the following months, which is why, even with the latest spike, that total is only marginally higher than the one reached at the end of 2008.

But isn’t it just possible that this time is indeed different and the post-crisis era of subdued credit card spending is finally over and Americans have rediscovered their penchant for a more liberal credit card use? After all, the economic recovery seems to have found a firm footing and the unemployment rate continues to fall. Furthermore, Americans now have a firmer grip on their credit card debt than they’ve had in decades, as evidenced by record-low credit card delinquency and charge-off rates and record-high monthly repayment rate (MPR) and as long as that is the case, the absolute debt level will not matter much. Well, even so I admit to having no idea whether we’ve turned a corner on credit card spending or the December splurge was just another blip. But let’s take a look at the latest Fed data.

Credit Card Debt up by 7% in December

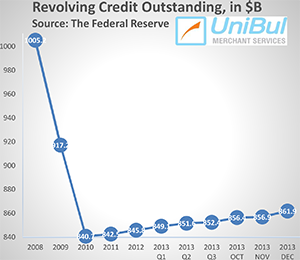

The total amount of consumer revolving credit in the U.S., which is comprised almost entirely of outstanding credit card balances, rose in December at a seasonally adjusted annual rate of 7 percent, or $5 billion, from the previous month’s level, after a 0.7-percent decline in November. As you can see in the chart to your right, that total went into a free fall in the immediate aftermath of the financial crisis in September 2008 and then just kept falling uninterruptedly until the end of 2010. Since then, however, it has moved up and down, but has remained virtually unchanged.

The total amount of consumer revolving credit in the U.S., which is comprised almost entirely of outstanding credit card balances, rose in December at a seasonally adjusted annual rate of 7 percent, or $5 billion, from the previous month’s level, after a 0.7-percent decline in November. As you can see in the chart to your right, that total went into a free fall in the immediate aftermath of the financial crisis in September 2008 and then just kept falling uninterruptedly until the end of 2010. Since then, however, it has moved up and down, but has remained virtually unchanged.

The total for December — $861.9 billion — is only 2.5 percent, or $21.2 billion, above the total recorded at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process. Furthermore, the current total is lower by 14.3 percent, or $143.3 billion, than the all-time record-high of $1,005.2 billion, measured at the end of 2008.

Non-Revolving Consumer Credit up by 7.4%

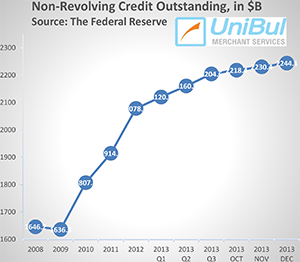

The non-revolving portion of the U.S. consumer debt total, a mixture of student loans, auto loans and loans for mobile homes, boats and trailers, but not including home mortgages and loans for other real estate-backed assets, kept growing, in keeping with a long-standing trend. The Federal Reserve reported a $13.8 billion — or 7.4 percent — uptick for December, bringing the total up to $2,244.1 billion. That followed a 7.5 percent ($13.9 billion) increase in November.

The non-revolving portion of the U.S. consumer debt total, a mixture of student loans, auto loans and loans for mobile homes, boats and trailers, but not including home mortgages and loans for other real estate-backed assets, kept growing, in keeping with a long-standing trend. The Federal Reserve reported a $13.8 billion — or 7.4 percent — uptick for December, bringing the total up to $2,244.1 billion. That followed a 7.5 percent ($13.9 billion) increase in November.

As you can see in the chart to your right, the non-revolving component of the consumer debt total didn’t fall nearly as much as the revolving one in the aftermath of the financial meltdown and then it was much quicker to recover the lost ground.

On the whole, with the sole exception of August 2011 when it fell by 5.2 percent, the non-revolving debt total has increased in every month since July 2010. The figure for December of last year was higher by 38.7 percent, or $626.7 billion, than the pre-crisis peak of $1,617.4 billion, recorded in July of 2008.

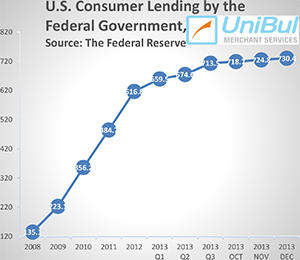

Student, Auto Loans Up

As already stated, the federal student loan total’s growth slowed down quite a bit at the beginning of 2013, but then it picked up in August. The latest Fed data show that lending to consumers by the federal government — which is primarily made up of educational loans — rose by $5.6 billion, or less than one percent, in December to $730.4 billion, following a $6.1 billion increase in November. The biggest increase in 2013 was reported in January when that total spiked by $25.9 billion. Overall, since the end of 2008, when it stood at only $135.1 billion, the total of outstanding federal government loans to American consumers has skyrocketed by an astonishing 440.6 percent, or $595.3 billion.

As already stated, the federal student loan total’s growth slowed down quite a bit at the beginning of 2013, but then it picked up in August. The latest Fed data show that lending to consumers by the federal government — which is primarily made up of educational loans — rose by $5.6 billion, or less than one percent, in December to $730.4 billion, following a $6.1 billion increase in November. The biggest increase in 2013 was reported in January when that total spiked by $25.9 billion. Overall, since the end of 2008, when it stood at only $135.1 billion, the total of outstanding federal government loans to American consumers has skyrocketed by an astonishing 440.6 percent, or $595.3 billion.

Spurred by low interest rates, sales of cars and trucks in the U.S. increased to 15.6 million in 2013, the auto industry’s best year since 2007, even as sales in December slowed down a bit due to unusually cold weather, according to researcher Autodata Corp., as cited by Bloomberg. We should expect the trend to continue as the economic environment continues to improve.

Overall Consumer Credit up by 7.3%

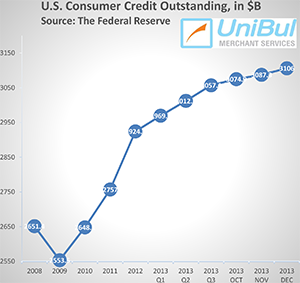

The total amount of outstanding U.S. consumer credit — the sum of the revolving and non-revolving components — rose by 7.3 percent, or $18.8 billion, to $3,106.0 billion in December, following a $13.4 billion (4.8 percent) increase in November.

The total amount of outstanding U.S. consumer credit — the sum of the revolving and non-revolving components — rose by 7.3 percent, or $18.8 billion, to $3,106.0 billion in December, following a $13.4 billion (4.8 percent) increase in November.

The new total is greater by $518.5 billion, or 20 percent, than the pre-Lehman record-high of $2,587.5 billion, measured in July 2008. The entire gain during the post-crisis period is due to the rise in the non-revolving credit segment, as the revolving total has actually fallen quite substantially, as we saw above.

The Takeaway

So non-home-mortgage-related consumer credit, as a whole, has picked up quite substantially in 2013 and there is every reason to expect the trend to hold, and very possibly strengthen, in 2014. Even credit card debt has risen a bit in 2013 and we should expect Americans to continue to add to that total in the months to come. Yet, there is no indication that credit card borrowing will grow at anything remotely close to the pre-Lehman rate anytime soon. On the contrary — every bit of data I’ve seen indicate clearly that Americans are still quite averse to using more of their credit card balances than they can repay in full at the end of the month. In fact, both the credit card charge-off and delinquency rates have ended the fourth quarter at record-lows and the MPR has ended the year at a record-high.

The U.S. credit card delinquency rate ended 2013 at 1.20 percent — the lowest point ever recorded by Fitch Ratings since the credit ratings agency began tracking the index in 1991. The delinquency rate has declined by 26 percent on an annual basis and now stands 74 percent below its peak level reached at the end of 2009, we are told. The charge-off rate — at 3.15 percent — has increased by 14 basis points from the previous month’s level, but was nevertheless 73 percent below the historical high of 11.52 percent, recorded in September 2009.

Even more impressively, Fitch’s monthly payment rate (MPR) — the portion of Americans’ total credit card debt they pay at the end of each month — reached a new high. The MPR rose by 10.8 percent from the previous month’s level to an all-time high of 27.13 percent. December’s MPR was up by 18 percent year-over-year and is 35 percent above the levels reached before the financial crisis, we learn. As long as these three indices remain anywhere close to their present levels, credit card debt will not be an issue.

Image credit: Flickr / Images_of_Money (the original image has been modified).