Americans Like Payday Loans, Even If Their Government Doesn’t… And You Will Not Believe Why.

In its third annual Consumers and Mobile Financial Services survey, the Federal Reserve takes another close look into the payment choices made by America’s unbanked and underbanked consumers. And just as they did in the two previous studies, the researchers find that, more often than not, not being part of the traditional financial system is much more a matter of personal choice and lack of financial education, than it is the result of being shut out of it. For some reason or other, a substantial majority of unbanked and underbanked Americans just don’t want to have anything to do with mainstream bank services and are perfectly willing to substitute them with payday loans.

While it is distressing to see just how poorly motivated choices unbanked and underbanked consumers are making, the good news for them is that the quality of at least some of the alternatives has gotten much better in recent years and continues to improve. I’m talking, of course, about the excellent prepaid cards that have been launched over the past couple of years, which were designed specifically for the unbanked (although some of them are perfect substitutes for, and offer better value than, many checking accounts).

First Chase launched its Liquid prepaid card two years ago, which offered everything a checking account offered, with the exception of paper checks, for only $4.95 a month. Then American Express and Wal-Mart upped the ante with Bluebird, which offered everything Liquid did, but at no monthly fee. It seems to me that the availability of such products is blurring the distinction between unbanked and banked consumers. But let’s take a look at the report’s findings.

Why Are Americans Unbanked?

In 2013, the share of unbanked consumers — defined as consumers who do not have a checking, savings or money market account — rose to 11 percent of the adult population, up from 9.5 percent in 2012, but it was virtually unchanged from 2011’s level of 10.8 percent.

Of those currently unbanked, 34 percent told the researchers that they had a bank account at some point in the past. In contrast, 40 percent of those unbanked at the end of 2012 had obtained a checking, savings or money market account in 2013. Conversely, 4 percent of those who did have a bank account in 2012, no longer had one in 2013.

The share of underbanked consumers — defined here as having a bank account, but also using an alternative financial service such as a payroll card, payday loan, check cashing or auto title loan — has increased quite a bit in 2013, reaching 16.9 percent of the population, up from 10.2 percent in 2011 and 9.9 percent a year later. So why are there so many unbanked and underbanked Americans?

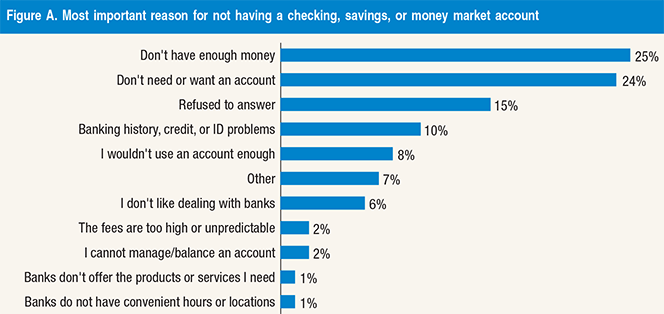

Well, the reasons given by the survey’s respondents for not having a bank account are once again quite revealing, as you will see in the table below. On the one hand, we have a tiny minority of consumers who offer genuinely good reasons — “banking history, credit or ID problems” and “I cannot manage / balance an account”. These account for a combined 12 percent of all respondents. And yes, if you’ve had credit problems in the past and have been placed on the U.S. bank blacklist (the ChexSystems), no bank will give you a checking or savings account. And if you know that you cannot manage or balance an account, you are indeed better off not opening one up in the first place.

However, you will note that all other answers, excluding the 22 percent which are divided between the “refused to answer” and “other” groups, display either a personal attitude towards the banking industry and its services — “I don’t like dealing with banks” and “I don’t need or want an account” — or misinformation (all other categories). And in some cases these two categories are related. For example, if you believed that the banks’ fees were too high, how could you possibly like them?

But it gets worse. These same respondents who tell us that they don’t have enough money to open a bank account or don’t need one would then turn to check cashing services when they could easily find a free checking account, especially at a local community bank or credit union. And even if they couldn’t find one, it is unlikely that a bank account with a monthly fee of $5 – $10 would cost more than a check-cashing service. So what we see is that a combination of lack of financial education and personal prejudices is keeping Americans who may qualify for mainstream banking services from using them.

Why Are Americans Using Payday Loans?

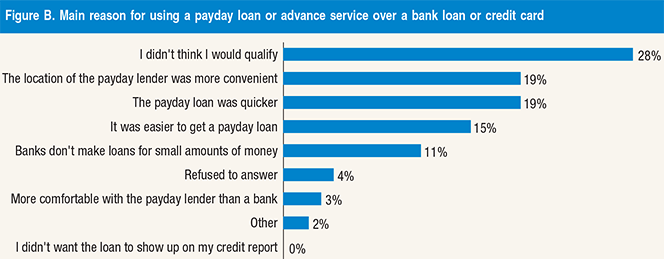

Once again, the Fed takes a close look at the use of payday loans — the high-interest short-term consumer loans, which have been under so much scrutiny over the past year. Only 6 percent of the respondents have confessed to using a payday loan in 2013, we are told, the same ratio as in the past year and slightly up from 2011’s level of 5 percent. As we know, this is a hugely expensive type of financing, with even the most mainstream of payday lenders charging annual interest rates of 300 percent. So why do consumers take out such expensive loans, rather than trying their luck with a bank loan or a credit card? Well, here is what they told the researchers:

This is quite amazing, and I mean that in the worst possible sense. The only way you can possibly justify taking out such an expensive loan is that you absolutely need the money for some hugely important purpose and you only did so after you tried, but could not get a more traditional type of loan. Yet, what we see in the chart above is that more than a half of payday loan borrowers are being severely overcharged, because they find payday borrowing more convenient (19 percent), quicker (19 percent) or easier (15 percent) than bank loans or credit cards. And of course we also have the two percent who feel “more comfortable” with payday loans.

The Takeaway

Once again, the good news is to be found in the rising popularity of prepaid cards. The researchers tell us that “[p]repaid cards have remained the most-used alternative financial service over the last several years” and add that 15 percent of the respondents reported that they have used a general purpose card in 2013. A sizable share — 8 percent — use a government-provided card and 3 percent use a payroll card. Overall, just over a fifth (22 percent) of all surveyed consumers use some type of prepaid card.

As prepaid products continue to improve in quality, I expect that this trend will continue. Gradually, consumers are bound to learn that depositing their paychecks into a prepaid card like, say, Bluebird — which is sold at Wal-Mart — is cheaper (well, it’s free) and more convenient than check-cashing services and comes with a number of additional benefits like bill payments. It really is a great substitute to having a checking account.

Image credit: Flickr / swanksalot.