On the Evolution of E-Commerce and the Rise of E-Wallets

The global volume of online transactions is growing at a rapid pace, payment processor WorldPay tells us in a newly-released report, and the trend is expected to intensify in the coming years. As it expands, the e-commerce is also evolving, as consumers are increasingly embracing “alternative payments” — a rather broad group of disparate payment methods, which the authors define as “any payment type that is not a credit or debit card” and which includes bank transfers, direct debits, e-wallets, mobile payments, cash on delivery, local card schemes, pre-pay, post-pay, e-invoices and digital currencies.

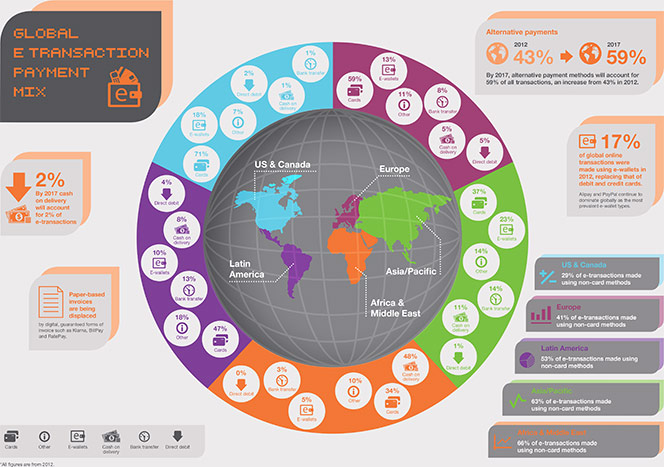

While traditional payment methods (credit and debit cards) are still more popular in mature markets such as the U.S. and the U.K., alternative payments are growing fast in developing markets. The aggregate value of alternative payments increased by 21 percent in 2013, the authors have calculated, with turnover value up by 44 percent, compared to 2012. In 2017, WorldPay estimates, alternative payments will account for 59 percent of all web-based transactions, up from 43 percent in 2012. Needless to say, WorldPay aims to benefit from these developments, but we can benefit from the processor’s research. Let’s take a look at their findings.

Alternative Payments

The authors give us a short overview of the alternative payment methods under examination, including each type’s main proponents. Here is the list:

1. Bank transfers. Online bank transfers attract merchants with immediate online authorization, usually followed by next-day settlement. Example platforms include iDEAL, eNets and Sofortuberweisung.

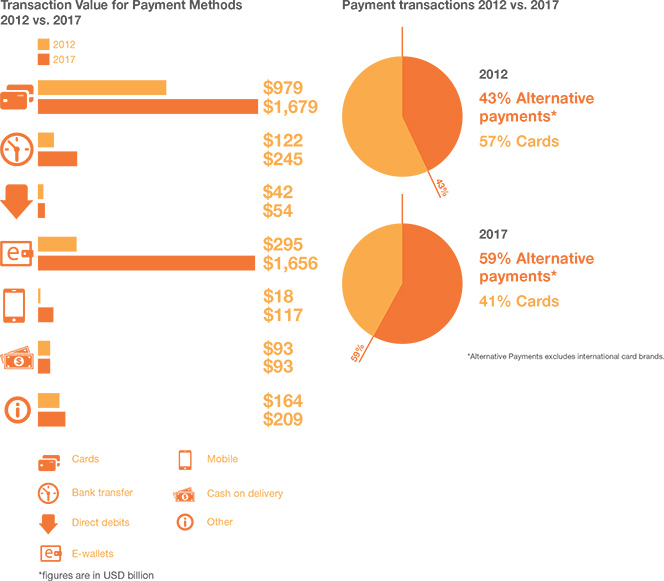

The global transactional value of bank transfers in 2012 was $122 billion, or 7 percent of the payments market. By 2017, WorldPay expects the volume to grow to $245 billion, but the share to fall to 6 percent.

2. Direct debits. Mostly limited to low-value or recurring transactions, direct debits are not relevant to all merchants. They are popular with consumers and businesses for regular, predictable payments such as subscriptions. Example platforms include SEPA, ELV (Elektronisches Lastschriftverfahren in Germany) and Domiciliacion Bancaria (Spain).

The global transactional value of direct debits in 2012 was $42 billion, or 2 percent of the payments market. By 2017, WorldPay predicts that the volume will grow to $54 billion, but the share will fall to 1 percent.

3. E-wallets. This is the fastest growing payment type around the world, we are told. E-wallets are increasingly popular for purchasing digital goods and video games because they are easy to use. In more mature e-commerce markets such as the U.S. and the U.K., new e-wallets from traditional payment providers, such as V.me by Visa, are increasingly being accepted by merchants. Globally, AliPay and PayPal continue to dominate the e-wallet market.

The global transactional value of e-wallet payments in 2012 was $295 billion, or 17 percent of the payments market. By 2017, WorldPay predicts that the volume will jump to $1,656 billion and the share will rise to 41 percent.

4. Mobile payments. M-payments, as defined by WorldPay, fall into two categories: direct carrier billing and mobile wallets. Direct billing has benefited in a huge way from the rise of smartphones, app stores and in-app payments, where it is one of the principal payment methods. The process is fast and enables customers to make payments simply by providing their phone number at checkout. The number of mobile wallet platforms has increased quite a bit in the last 12 months. Most of them still operate exclusively in their own countries, but some of them have gone global. Example platforms are Boku, MoPay, Zong, Zapp, SEQR, Znap (MPayME), Pingit and PayBox.

The global transactional value of mobile payments, as defined by WorldPay, in 2012 was $18 billion, or 1 percent of the payments market. By 2017, WorldPay predicts that the volume will grow to $117 billion and the share will increase to 3 percent.

5. Cash on delivery. I don’t know why this payment method is included in WorldPay’s report, but here it is. Cash on delivery is becoming ever less popular both with merchants and customers, we are told.

The global transactional value of cash on delivery in 2012 was $93 billion, or 5 percent of the payments market. By 2017, WorldPay predicts that the volume will remain the same, but the share will fall to 2 percent.

6. Other alternative payment methods. As already noted, this group features several less widely used payment types, which, however, include digital currencies like Bitcoin.

The global transactional value of “other” alternative payments, as defined by WorldPay, in 2012 was $164 billion, or 10 percent of the payments market. By 2017, WorldPay expects that the volume will increase to $209 billion, but the share will be cut in half to 5 percent.

Developed Economies Lead the Way

Between them, North America and Europe accounted for 70 percent of the global e-commerce market in 2012, WorldPay tells us, with a combined turnover of just over $1.2 trillion.

The Asia-Pacific region’s share of the market was 27 percent, for a turnover of $461 billion. Middle East and Africa combined to make up only 1 percent of the e-commerce market.

Compared in the chart below is 2012’s e-commerce transaction volume with WorldPay’s forecast for 2017. As you see, transactions made with payment cards and e-wallets are expected to increase dramatically over the next five years. Cash payments are forecast to remain stagnant at $93 billion and bank transfers and other payment methods are expected to rise only moderately by 2017.

And here is WorldPay’s vision of the global “e-transaction payment mix” in 2017 (click on the image for a larger view):

Mobile Payment Adoption on the Rise

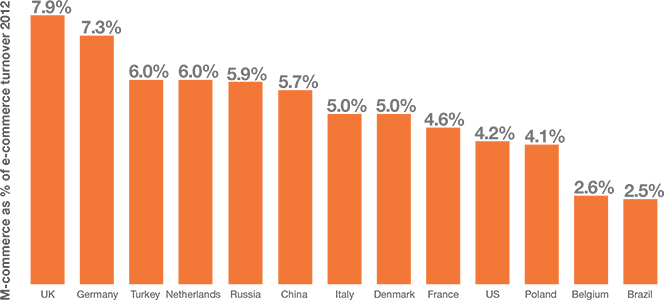

The number of smartphones around the world is now greater than 1.4 billion and the average annual smartphone ownership growth rate is 44 percent, WorldPay tells us. More importantly, technology has now advanced sufficiently to make mobile payments a feasible option and the industry has experienced a rapid growth and innovation over the past year. Furthermore, consumers are becoming more comfortable with making higher value purchases through their phones, as the overall user experience improves. The chart below shows the share of m-commerce sales of the overall e-commerce volume in selected markets in 2012:

Top 10 Alternative Payment Platforms

Below is WorldPay’s comparative chart of the ten leading alternative payment processors. As you see, PayPal is by far the biggest platform, but China’s AliPay is not that far behind.

The Takeaway

WorldPay expects that, by 2017, credit and debit cards, which “have long dominated as the payment method of choice for online transactions”, will be overtaken by the “alternative schemes”, with the latter accounting for 59 percent of all web-based transactions.

Yet, as I’ve argued on many, many occasions, that is a false comparison. To understand why, you only need to take a look at the biggest of the “alternative platforms” — the e-wallet, which WorldPay expects will make up 41 percent of the payments market in 2017. Well, what do users have in their PayPal, AliPay and V.me e-wallets? That’s right, they have credit and debit cards, as well as bank accounts, with most transactions in the U.S. being funded through payment cards (oh, and the card market in China is exploding). So, yes, credit and debit cards will remain the dominant payment method in the foreseeable future.

Image credit: Wikimedia Commons.