How Visa Manages Chargebacks and What You Should Do to Minimize Them

As regular readers would have read many times on this blog, chargebacks are e-commerce merchants’ biggest scourge, much bigger than fraud. In the high-risk world, a merchant’s chargeback rate is invariably the first item a payment processor would inquire about from a prospective merchant (the decline rate is usually the second). The only reason a processor might not ask you about it right after saying “hello” would be if you are perceived as not high-risk enough to warrant concern about your chargeback ratio.

Yet, the thing which never seizes to amaze me is just how relaxed many high-risk merchants are about chargebacks. Yes, they know that these are very bad things, which should be avoided, but way too many merchants seem to believe that, if only their volume is big enough, there will always be a processor willing to work with them, whatever their chargeback rate may be. Well, I’m here to tell you that this is wishful thinking and if you are not taking chargebacks seriously, it’s about time you started to do so.

See, the thing is that we all have to abide by the rules set by the big credit card companies and there is no way around that. You may be able to get away with breaking a rule or two for some time, but eventually everyone is brought into line. So today I will give you a basic overview of Visa’s chargeback procedures and guidelines and I will also offer suggestions on how to minimize chargebacks. If you follow my recommendations, you stand a much better chance of keeping your merchant account in good standing, whoever your processor may be.

Visa’s Chargeback Process

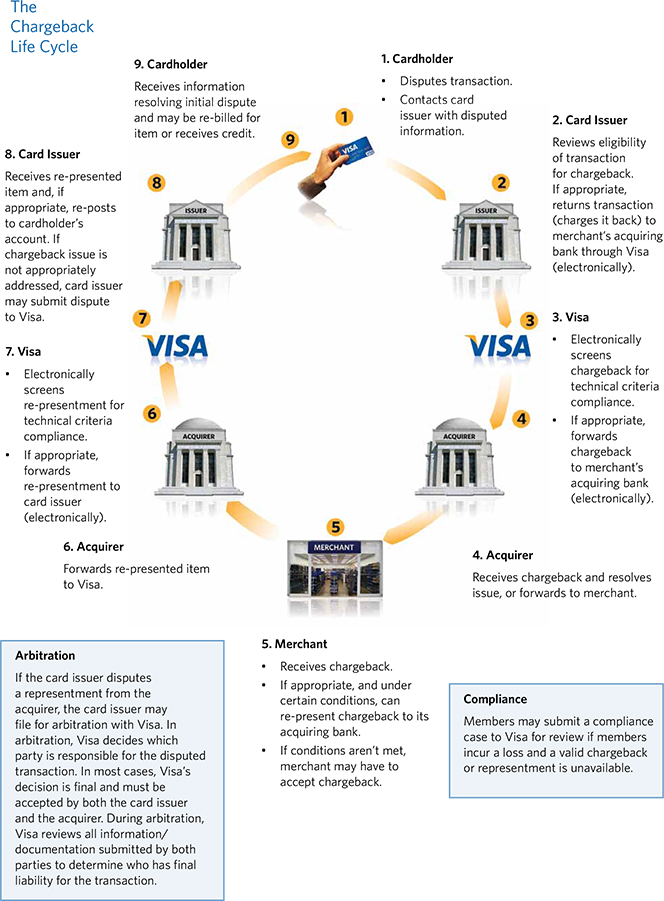

Visa tells us that a chargeback provides an issuer with a way to return a disputed transaction to the acquirer (the merchant’s bank). When a cardholder disputes a transaction, the issuer may request that she provides a written explanation of the problem and can also request a copy of the related transaction receipt from the acquirer. Once the issuer receives this documentation, the first step is to determine whether a chargeback situation exists. There are many reasons for chargebacks, including the following:

- The merchant failed to get an authorization approval.

- The transaction receipt is either altered or unsigned (or a PIN was not obtained).

- The merchant failed to obtain a card imprint (electronic or manual), when required.

- The merchant accepted an expired card.

If it is determined that a valid chargeback situation exists, the issuer sends the transaction back to the acquirer and debits (charges back) the dollar amount of the disputed sale to the acquirer’s account. The acquirer then researches the transaction and if the chargeback is valid, it deducts the disputed amount from the merchant account and informs the merchant.

If the merchant, in turn, disputes the validity of the chargeback, she may “re-present” the transaction in question to her acquirer, along with additional documentation to support her claim. At the end, if the chargeback stands, it is the merchant’s loss. If there are no funds in the merchant’s account to cover the chargeback amount, the acquirer covers the loss (now you can see why your processor is so nervous about your chargeback ratio, but there are other important reasons as well).

Here is a representation of the chargeback process, courtesy Visa:

Verifying a Disputed Visa Transaction

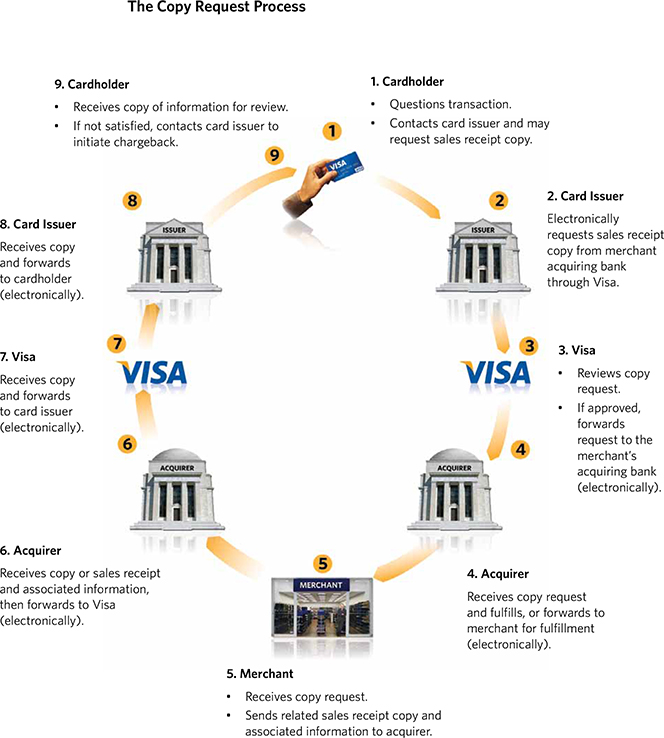

When a cardholder cannot recognize a transaction on her card statement, she would call her card issuer to help her determine whether the transaction is really hers. The card issuer would first try to answer the cardholder’s questions, but if no determination is made, the issuer would electronically send a “request for copy” (known in industry speak as a “retrieval request“) to the acquirer associated with the transaction.

If your transaction receipts are stored with your acquirer, the latter will immediately fulfill the copy request, without you even learning about it. However, if you store your transaction receipts yourself, the acquirer would forward the request on to you. You must then send a legible copy of the receipt back to the acquirer who, in turn, will send it on to the card issuer. There are specific requirements about the format of the transaction receipts, which we’ve covered in detail elsewhere.

When an issuer sends a copy request to an acquirer, the latter has 30 days from the date it receives the request to send a copy of the sales receipt back to the issuer. If the acquirer sends the request to you, it will tell you the number of days you have to respond (you will have less than 30 days, as the acquirer will need time to process the documentation). You must follow the acquirer’s time frame, otherwise your re-presentment will not be accepted, regardless of its merits.

So, once you receive a copy request, locate the corresponding sales receipt, make a legible copy of it and send it to your acquirer within the specified time frame. Your acquirer will then forward it on to the card issuer, which will, in turn, send it to the cardholder. The cardholder’s question or issue with the transaction is usually resolved at this point.

Here is a representation of Visa’s copy request process:

Merchants who keep copy requests to a minimum typically have lower chargeback rates and the best thing an e-commerce merchant can do about it is to help customers recognize his name on their statements. This is something which is entirely within your control, so there is no excuse for not doing it. If your customer cannot recognize a charge, she will dispute it, it is really that simple. Check with your processor to make sure it has the correct information on your “Doing Business As” (DBA) name, city, state/region/province and phone number. This is managed through something called a “Billing Descriptor” and your processor has full control over it.

Visa Chargeback Reason Codes

Visa’s chargeback reasons are organized into six general groups:

- Non-receipt of information.

- Fraud.

- Authorization error.

- Processing error.

- Cancelled / returned merchandise.

- Non-receipt of goods or services.

The following tables list Visa’s Reason Codes and time limits for processing a chargeback. As already noted, timeliness is essential when attempting to remedy a chargeback. Each step in the chargeback cycle has a defined time limit during which a specified action can be taken. If either you or your acquirer does not respond during the time specified on the request — which may vary depending on your acquirer — you will not be able to remedy the chargeback.

1. Chargeback reasons related to non-receipt of information.

|

Non-Receipt-of-Information-Related Chargeback Reasons |

Reason Code |

Time Limit (Calendar Days) |

|

Requested Copy Illegible or Invalid |

60 |

7 |

|

Cardholder Does Not Recognize Transaction |

75 |

120 |

|

Requested Transaction Information Not Received |

79 |

7 |

Except for Reason Code 75, the time limit is calculated from one of the following:

- The date the issuer received the illegible transaction receipt or invalid fulfillment.

- The date the issuer received an applicable non-fulfillment message.

- The date following the 30-calendar-day waiting period.

2. Chargeback reasons related to fraud.

|

Fraud-Related Chargeback Reasons |

Reason Code |

Time Limit (Calendar Days) |

|

Fraudulent Multiple Transactions |

57 |

120 |

|

Counterfeit Transaction |

62 |

120 |

|

Fraudulent Transaction — Card Present Environment |

81 |

120 |

|

Fraudulent Transaction — Card-Absent Environment |

83 |

120 |

3. Chargeback reasons related to authorization errors.

|

Authorization-Error-Related Chargeback Reasons |

Reason Code |

Time Limit (Calendar Days) |

|

Declined Authorization |

71 |

75 |

|

No Authorization |

72 |

75 |

|

Expired Card |

73 |

75 |

|

Non-Matching Account Number |

77 |

75 |

4. Chargeback reasons related to processing errors.

|

Processing-Error-Related Chargeback Reasons |

Reason Code |

Time Limit (Calendar Days) |

|

Late Presentment |

74 |

120 |

|

Incorrect Transaction Code |

76 |

120 |

|

Incorrect Transaction Amount or Account Number |

80 |

120 |

|

Duplicate Processing |

82 |

120 |

|

Paid by Other Means |

86 |

120 |

|

Transaction Exceeds Limited Amount |

96 |

75 |

5. Chargeback reasons related to cancelled orders or returned merchandise.

|

Chargeback Reasons Related to Cancellations and Returns |

Reason Code |

Time Limit (Calendar Days) |

|

Cancelled Recurring Transaction |

41 |

120 |

|

Not as Described or Defective Merchandise |

53 |

120 |

|

Credit Not Processed |

85 |

120 |

6. Chargeback reasons related to non-receipt of goods or services.

|

Chargeback Reasons Related to Non-Receipt of Goods or Services |

Reason Code |

Time Limit (Calendar Days) |

|

Services Not Provided or Merchandise Not Received |

30 |

120 |

|

Services Not Rendered — ATM or Visa TravelMoney Program Transactions |

90 |

120 |

Each reason code identifies a chargeback as caused by a specific issue that needs to be remedied and your acquirer will specify what this remedy should be.

Minimizing the Chargeback Damage

Even when you have received a chargeback, you may still be able to resolve it without losing the sale. Simply provide your acquirer with the requested additional information about the transaction or the actions you have taken related to it. For example, you might receive a chargeback because your customer is claiming that credit has not been issued for returned merchandise. You may be able to resolve the issue by providing proof that you have submitted the credit on a specific date.

The key in such situations is to always send as much information to your acquirer as possible to help it remedy the chargeback. With adequate information, it may be able to re-present the transaction.

Yet, although many chargebacks can be resolved without the merchant losing the sale, some cannot be remedied. In such cases you should accept the chargeback and move on to save the time and expense of needlessly contesting it.

Most chargebacks result from improper transaction-processing procedures and can be prevented with appropriate training and attention to detail. The following best practices will help you minimize chargebacks.

1. Use the Address Verification Service (AVS) and Card Verification Value 2 (CVV 2). The AVS and CVV 2 services provide chargeback protection in certain circumstances and you should be familiar with the chargeback re-presentment rights associated with their use. Specifically, your acquirer can represent a charged-back transaction if:

- You received an AVS positive match “Y” response in the authorization message and if the billing and shipping addresses are the same. You will need to submit proof of the shipping address and signed proof of delivery.

- You submitted an AVS request during authorization and received a “U” response. This response means that either the card issuer is unavailable or does not support AVS.

- You submitted a CVV 2 verification request during authorization and received a “U” response with a presence indicator of 1, 2, or 9. This response means the card issuer does not support CVV 2.

2. Use Verified by Visa (VbV). VbV provides cardholder authentication for online transactions. Based on the 3-D Secure protocol, the service allows cardholders to create a password through their card issuer and use it to authenticate themselves while making a purchase at a participating merchant. This helps ensure that their card cannot be fraudulently used on e-commerce websites.

Participating merchants are protected from receiving certain fraud-related chargebacks, provided the transactions are processed correctly, as shown in the table below.

|

If: |

Then: |

|

The cardholder is successfully authenticated |

The merchant is protected from fraud-related chargebacks, and can proceed with authorization using Electronic Commerce Indicator (ECI) of ‘5’.* |

|

The card issuer or cardholder is not participating in Verified by Visa |

The merchant is protected from fraud-related chargebacks, and can proceed with authorization using ECI of ‘6’.* |

|

The card issuer is unable to authenticate |

The merchant is not protected from fraud-related chargebacks, but can still proceed with authorization using ECI of ‘7’. This condition occurs if the card type (i.e., commercial card products) is not supported within Verified by Visa or if the cardholder experiences technical problems. |

*A VbV merchant identified by the Merchant Fraud Performance (MFP) program may be subject to chargeback Reason Code 93: Merchant Fraud Performance Program.

3. Clearly disclose your return, refund and cancellation policy. This policy must be clearly posted to inform your customers of their rights and responsibilities. Your website must communicate your refund policy and require customers to select a “click-to-accept” button or take some other affirmative action to acknowledge the policy. The terms and conditions of the purchase must be displayed on the checkout screen that is used to show the total sales amount or within the sequence of website pages the customer goes through during the checkout process. This policy page cannot be bypassed.

4. Ship the merchandise before depositing the transaction. Do not deposit sales receipts with your acquirer until you have shipped the related merchandise. If your customer sees a transaction on her monthly statement or activity report before she has received her order, she may contact her card issuer to dispute the charge.

5. Honor requests for cancellation of recurring transactions. If your customer requests the cancellation of a transaction that is billed periodically, process her request immediately and discontinue the billing process. Then advise your customer in writing that the service has been cancelled and provide the effective date of the cancellation. Be advised that your customer is not required to provide a written request for cancellation — a verbal notification is sufficient.

The Takeaway

So there is quite a bit that you can do to protect yourself against chargebacks and you should do it all. Some chargebacks are beyond your control — there is nothing you can do about some authorization errors, for example — but the majority of them can be prevented. Considering the alternative — excessive chargebacks can lead to a suspension or an outright termination of your merchant account, to say nothing of a TMF placement — it would make sense to be proactive in minimizing chargeback risk.

Image credit: Flickr / scriptingnews.