Free Credit Scores for All

That is what FICO is telling us it would do in the coming months and I think that this is very big news. Up until now, or at any rate until FICO fulfills its promise, we’ve never had free access to our credit scores, excluding the ten-day-free trial period you could get by signing up for myFICO — the company’s consumer-facing online operation. Yes, we’ve had access to other services giving us free credit scores — Credit Karma comes immediately to mind — but these are mere substitutes of the real thing, for FICO is what the vast majority of U.S. lenders use when estimating the creditworthiness of potential borrowers.

And it’s about time FICO opened up its service to us. After all, we’ve been able to check our credit reports for free for a long time through AnnualCreditReport.com, which is letting us view our files with each of the three national credit bureaus once a year. This website is also offering to show us our FICO scores when we download our credit reports, but only if we pay for them. Now we can get the whole package for free, although from two different sources. Hopefully, in future we’ll be able to get them all in one place. But let’s take a closer look at FICO.

What’s in Your FICO Score?

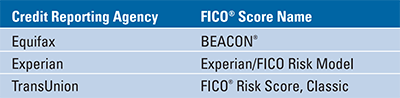

Firstly, let’s briefly go over the basics of the FICO score. It is created by the Fair Isaac Corporation and it is the most widely used credit score in the U.S. Lenders use the FICO score to evaluate the risk involved in extending credit to borrowers. The FICO score is calculated based solely on information available in the consumer credit reports maintained at the three major credit reporting agencies — Experian, Equifax and TransUnion. To make matters slightly complicated, Fair Isaac maintains three different FICO scores at each of these agencies, each with its own name, as shown in the table below. The reason is that consumer information kept in each of the credit bureaus may differ from one file to another.

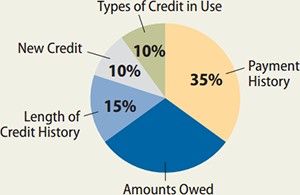

FICO credit scores range from 300 to 850 — the higher the score, the lower the consumer’s level of future credit risk. Each score is calculated when information in a consumer’s credit file is compared to the patterns in hundreds of thousands of past credit reports. There are five main categories of information that FICO evaluates and each of them is represented in the score, according to its relative level of importance, as shown in the chart to your right:

FICO credit scores range from 300 to 850 — the higher the score, the lower the consumer’s level of future credit risk. Each score is calculated when information in a consumer’s credit file is compared to the patterns in hundreds of thousands of past credit reports. There are five main categories of information that FICO evaluates and each of them is represented in the score, according to its relative level of importance, as shown in the chart to your right:

- Payment history. The first thing a lender would want to know is whether you have paid your credit accounts on time in the past, which is why this is by far the most important factor in the FICO score. One or two late payments would not necessarily kill your credit score, provided the overall credit picture is good, but would still have a negative impact. Needless to say, you should be pay your bills on time.

- Amounts owed. FICO measures the share of available credit that a borrower has used for each individual credit account, as well as for the total. When a high percentage of a borrower’s credit has been used, this is seen as an indication that this borrower may have overextended herself and is therefore more likely to be late on future payments. The company suggests that we keep these ratios at around 20 percent or at the very least under 30 percent.

- Length of credit history. The longer you’ve maintained a good record of paying your bills on time, the better your FICO score. Unfortunately, this is a factor over which a borrower has little control.

- New credit. Opening several credit accounts, or making multiple credit requests, in a short period of time represents greater risk, especially for borrowers with shorter credit histories. That is the reason the company recommends that we only apply for new credit when we really need it.

- Types of credit in use. FICO considers the borrower’s mix of credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. We are told that it is not necessary to have one of each and that it is not a good idea to apply for credit accounts if we don’t need them. The relevance of this factor increases when there is not much other data to go by.

The old accounts that we no longer use represent an interesting case. FICO tells us to keep them open, even when we don’t need them anymore, because they show we have a longer history of managing credit.

Free Credit Scores for All

FICO tells us that that credit card customers of Barclaycard US and First Bankcard can now access their scores completely free of charge through the new FICO Score Open Access program. Additionally, these customers will see the two most important factors affecting their scores, as well as educational materials to help them better understand how their scores are calculated and what they can do to improve them.

FICO’s Anthony Sprauve tells Bloomberg that eventually everyone will be given free access to their scores, all 60 billion of them. The company will still be charging lenders for its product.

The Takeaway

Just over half of Americans — 52 percent — don’t know their scores, FICO’s Sprauve told us in the interview above and until now there was a very good reason for it — these things cost money. Making them free would surely reduce that ratio and this is good news. If nothing else, many consumers would try to improve their scores just so that they can see them climb upwards — much like they would try to get ever more Twitter followers, even though it’s just a meaningless number. The difference, of course, is that the FICO score is quite a meaningful number. So I hope that the other banks would soon join Barclaycard and First Bankcard.

Image credit: myFICO.