QR, NFC and Mobile Payments

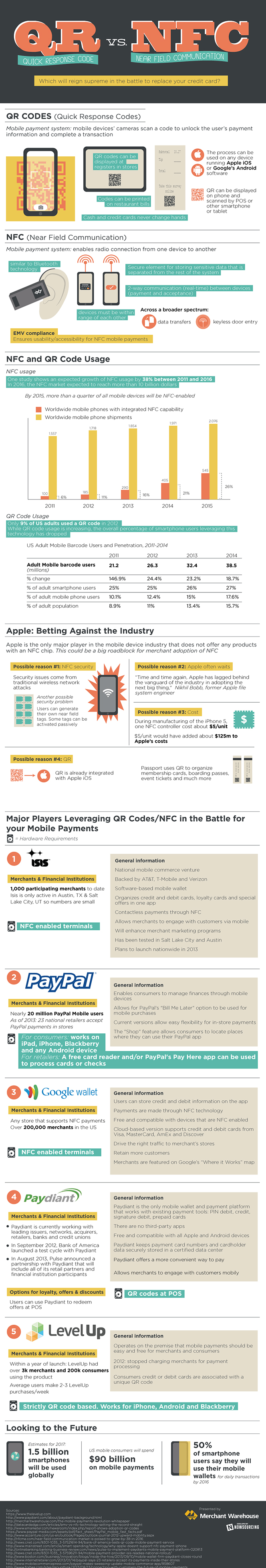

Payment processor Merchant Warehouse pits two of the more prominent mobile payments technologies against each other in a new infographic. “QR vs. NFC: Which will reign supreme in the battle to replace your credit card?”, the graph’s headline asks. However, the authors don’t really attempt to answer that question, and I suspect that this is not only because it is impossible to tell which of these two technologies will turn out to be the more successful one. I think the bigger reason for their reticence is that there is a host of competing m-payments technologies, some of which could end up becoming the consumers’ favorites, in the process beating out the two under examination in this graph.

At first I was a bit annoyed with this infographic, because it had highlighted mobile payments companies, which have achieved little or nothing — Isis is a prime example — even as it has ignored some of the most successful ones, such as Square in the U.S., iZettle in Europe and M-Pesa in Africa. And, by the way, you would note that PayPal is among the examined processors, even though its wallet is based neither on NFC nor on QR. But then I realized that the graph was actually quite useful in reminding people just how little headway the QR and NFC technologies have made, even after all the billions poured into them over the past few years. So I thought I’d show you the graph and let you draw your own conclusions.

QR vs. NFC

So the graph’s authors tell us that the QR (quick response) and NFC (near-field communication) are the two technologies, which are currently “leading the charge in the race to for mobile wallet supremacy”. I have a quibble with this statement. Is any NFC- or QR-based digital wallet more widely used than, say, PayPal’s or even Square’s? I haven’t seen statistics for the usage of either Google Wallet or Isis, but I suspect that the reason is that these are not numbers the two companies would want anyone else to see.

It should be noted that QR has made a bit more headway than NFC and, on the payments front at least, LevelUp has been the technology’s flag-bearer. Yet, two years, many millions of dollars and a hugely misleading marketing campaign later, LevelUp claims to have only signed up 5,000 merchants nationally. And keep in mind that only a fraction of these merchants’ customers are actually using LevelUp at the checkout. So, for all its breast-beating, LevelUp is not remotely close to even proving its concept. Small wonder that most of our readers believe that the company will go out of business within two years.

Paydiant is another QR-based m-wallet provider and one we have not yet covered on this blog. In contrast to LevelUp, Paydiant’s main targets are not the end-users, but banks, retailers, and payment processors to whom the company offers a “white label mobile wallet” and to “to deploy third party branded mobile wallets and platforms, inserting intermediaries into the payments process, diluting brand equity, and putting customer relationships — and data — at risk”. So Paydiant aims to be a technology provider to financial companies, rather than a service provider to consumers. Here is its wallet in action:

As many others have done before them, the graph’s authors muse over the reasons why Apple obstinately refuses to make its mobile devices NFC-compatible, but I just don’t find this topic all that interesting. And in any case, given the failure of NFC to take off, is Apple’s snub of the technology really surprising?

Here is the graph:

Image credit: YouTube / Paydiant.