How Private Is Bitcoin?

In a newly-released paper, a team of researchers from the University of California at San Diego and George Mason University, led by Sarah Meiklejohn of the UCSD, argues forcefully that Bitcoin transactions are not nearly as anonymous as it is generally assumed. As the authors note, such assumptions have been fed by previous researches, such as FBI’s 2012 Intelligence Assessment, which warned that, when Bitcoin is used for payment, “law enforcement faces difficulties detecting suspicious activity, identifying users and obtaining transaction records”. Moreover, it has been widely believed that Bitcoin is used for payment in the “Silk Road” — a virtual marketplace for illegal drugs that is hidden by software for online anonymity called Tor.

While Meiklejohn et al concede that it is impossible to “de-anonymize all Bitcoin users”, they demonstrate that there is enough available data to enable law authorities to obtain subpoenas and to eventually identify who is paying money to whom. What makes this possible, the authors argue, is the combination of the increasing dominance of a small number of Bitcoin currency exchanges, like Mt. Gox, the public nature of Bitcoin transactions and the ability to track monetary flows to major institutions. This is not the first paper to poke holes into Bitcoin’s veil of anonymity, but it is the strongest effort I’ve come across so far. Let’s take a closer look at it.

Bitcoin Keeps Identities Secret, but Transactions Are Transparent

Let’s begin by examining how Bitcoin keeps the identity of transaction participants private. On the one hand, we have the established (for example Visa and MasterCard) and virtually all alternative payment systems (like PayPal, Google Checkout, WebMoney and eBillMe), which are denominated in mainstream fiat currencies like the U.S. dollar, identify each transaction’s participants and are centrally administered.

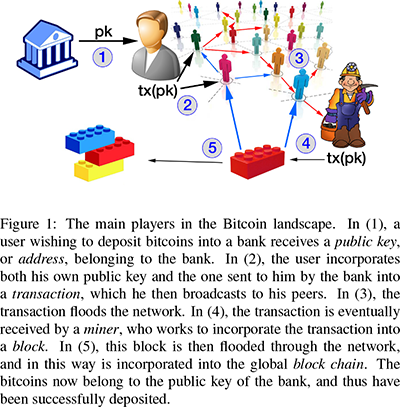

Bitcoin, on the other hand, is an independent and decentralized online monetary system, which combines some of the features of cash with those of existing payment methods. Like cash, Bitcoin payments do not identify transaction participants and take the shape of cryptographically-signed transfers of funds from one Bitcoin account to another. However, owners of Bitcoin accounts are identified not by their names, but by public keys, which serve as pseudonyms and they can use any number of public keys. Crucially, activity associated with one such key is not linked to another key’s activity. To make their point clear, the authors give the example of someone using one key to deposit bitcoins into his Silk Road account and then another to withdraw bitcoins from his Mt. Gox account. This person can expect that these activities cannot be linked to either his real identity or to each other.

Furthermore, and this is a feature loved by all merchants, Bitcoin transactions are irreversible, meaning that there isn’t an equivalent to the chargeback from the credit card world. Unlike cash, however, and similarly to credit cards, Bitcoin payments require third-party mediation. This takes the shape of a global peer-to-peer network of participants, which validates and certifies all transactions. Each network participant is required to maintain the entire transaction history of the virtual currency system, which, according to the authors, currently amounts to “over 3GB of compressed data”. Bitcoin identities are therefore pseudo-anonymous: even though they are not explicitly linked to specific individuals or organizations, all transactions are completely transparent. The figure below offers a representation of a Bitcoin transaction.

Tracing the Silk Road

The researchers bought some bitcoins and used them in 344 transactions to purchase a wide variety of goods, including coffee, CDs, cupcakes and more, as seen in the figure below.

Participation in all these transactions allowed the researchers to associate a number of public keys with specific entities, such as Mt. Gox (a detailed explanation of how this was done is offered in the paper). Of specific interest are keys, which are found only once in the master log, which usually means that they are “change addresses” — keys associated with the giving of change (much like you would get $3 back when using a $5 bill to buy a $2 cup of coffee). The reason this is of such interest is that each time a public key spends bitcoins, it must spend them all at once and the only way to divide them is through the use of a change address.

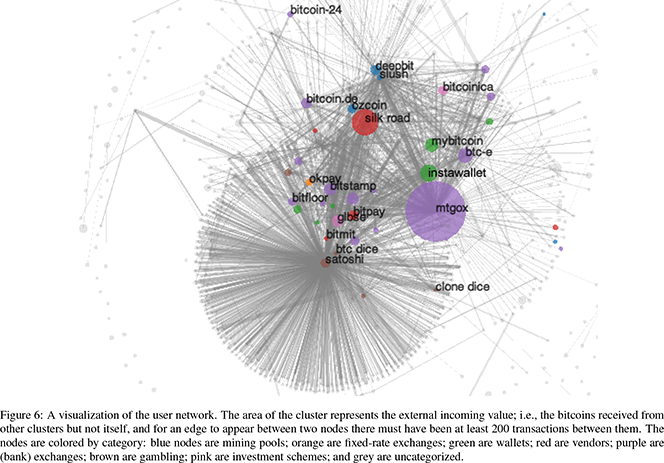

The researchers then tell us of one of the best-known and heavily scrutinized addresses in Bitcoin’s history, which is believed to be associated with Silk Road and which received a series of large transactions between January and September 2012. In total, 613,326 bitcoins ($82.3 million at the exchange rate at the time of writing) were deposited into the address during the examined period. And that’s a lot of bitcoins: at its height, we are told, the address contained 5 percent of all generated bitcoins. The chart below visualizes the concentration of the network’s value. Then, starting in August, bitcoins were withdrawn from this address and sent to separate addresses.

The researchers were then able to trace where all of these bitcoins went and it turned out that a good number of them ended up in exchanges. They speculate that the evidence that the deposited bitcoins were the direct result of the sale of drugs or other illicit activities might motivate Mt. Gox or any other exchange (as in response to a subpoena) to reveal the account owner corresponding to the deposit address, and so provide information to link the address to a real-world user. Yes, a subpoena could indeed prove an irresistible motivation.

The Takeaway

Here is the researchers’ verdict:

The increasing dominance of a small number of Bitcoin institutions (most notably services that perform currency exchange), coupled with the public nature of transactions and our ability to label monetary flows to major institutions, ultimately makes Bitcoin unattractive today for high-volume illicit use such as money laundering.

I’ve argued before that law enforcement agencies in the U.S. and around the world will eventually force Bitcoin processors to ensure that only legitimate merchants can accept the currency for payment and that the irreversibility of Bitcoin transactions is a myth. Therefore, should the virtual currency manage to gain traction, the payment processors would be forced to ensure that their merchants keep customer complaints and chargebacks low — and credit card rules offer a ready template to copy. When it is all said and done, Bitcoin payments will be indistinguishable from the credit card variety.

Image credit: Wikimedia Commons.

I think that bitcoins have a way to go before they really become mainstream. It worked when ETFs were introduced to the marketplace, let’s see if they can follow suit.

As with anything you really need to investigate the matter and Bitcoins are no exception. It has become more recognized today than ever and the trend is looking to continue.