Now Is the Time to Get Paid for Opening up a New Credit Card

Over the past three or four years I’ve been bombarded with some amazing credit card offers, much better than what I used to get before the financial crisis struck in 2008. They’ve been coming in two general types: incredibly generous sign-up bonuses (I think the record was a $600-worth of prepaid cards, provided certain conditions were met) and extremely lengthy promotional periods with a zero-percent interest rate on outstanding balances (up to 21 months, although I seem to remember a 24-month offer). Both types of offerings would also feature some sort of a rewards program or other. I did take advantage of one of these offers — an American Express card — and have been happy with my choice; so much so that I ended up making that card my primary one. That is precisely the type of outcome American Express would have had in mind when they sent me their proposal, so I would count as a qualified success story for them (qualified, because I pay off my monthly balances in full).

But I’ve always suspected that such outcomes are the exception, rather than the rule, which has made me doubt the soundness of the credit card companies’ rationale for running these incredibly expensive promotional campaigns. See, in order for the issuers to benefit from their campaigns, they have to succeed in convincing a sufficiently high share of those consumers who accept their promotional offers to make that new card their primary one, rather than just collect the sign-up bonus and close down the account or otherwise move back to another card. But in order to achieve this objective, the issuers need to not only dangle an incredibly tempting sign-up bonus in front of their targets, but also to offer post-promotional terms that are better than their competitors’. So going after such a prospect is quite an investment and unfortunately I haven’t seen any data to show how well these investments have been paying off for the issuers. But The Wall Street Journal’s Robin Sidel reports that even the boss of one of the country’s biggest credit card companies has his doubts about the effectiveness of this strategy. Let’s take a look at the latest goings-on.

Why Are the Issuers Doing It?

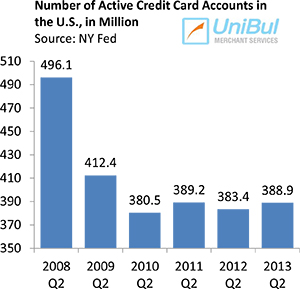

As Sidel says, issuers have ramped up their promotional campaigns in order to “bulk up their loan portfolios”, which shrank in the wake of the financial meltdown of 2008, as credit card defaults went through the roof. As you can see in the chart to the right (data source), the number of active credit card accounts decreased from a peak of 496.1 million at the end of the second quarter of 2008 to a trough of 377.9 million at the end of the third quarter of 2010 and was still only at 388.9 million at the end of the second quarter of this year.

As Sidel says, issuers have ramped up their promotional campaigns in order to “bulk up their loan portfolios”, which shrank in the wake of the financial meltdown of 2008, as credit card defaults went through the roof. As you can see in the chart to the right (data source), the number of active credit card accounts decreased from a peak of 496.1 million at the end of the second quarter of 2008 to a trough of 377.9 million at the end of the third quarter of 2010 and was still only at 388.9 million at the end of the second quarter of this year.

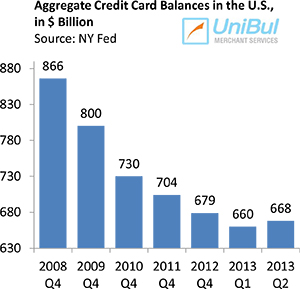

Moreover, the aggregate outstanding balances on credit cards in the U.S. fell from a peak of $866 billion  at the end of the fourth quarter of 2008 to a low of $660 billion in the first quarter of this year, only to nudge up to $668 billion at the end of the second quarter (see chart to the right). And that is a problem if you are a credit card company, for the lower the outstanding balance, the lower the amount of interest you can collect. A similar decline has been recorded in the aggregate amount of available credit card balances — a fall from a peak of $2.84 trillion in 2008 Q3 to a low of $1.93 trillion in 2010 Q4, only to rebound moderately to $2.13 trillion at the end of 2013 Q2.

at the end of the fourth quarter of 2008 to a low of $660 billion in the first quarter of this year, only to nudge up to $668 billion at the end of the second quarter (see chart to the right). And that is a problem if you are a credit card company, for the lower the outstanding balance, the lower the amount of interest you can collect. A similar decline has been recorded in the aggregate amount of available credit card balances — a fall from a peak of $2.84 trillion in 2008 Q3 to a low of $1.93 trillion in 2010 Q4, only to rebound moderately to $2.13 trillion at the end of 2013 Q2.

So Americans have been doing their very best to pay down their credit card debt and have been quite successful at doing it. As a result, charge-off rates and delinquencies have fallen to record lows, which has allowed issuers to recover from the post-Lehman stress and today their portfolios are as healthy as they’ve been in many years. The problem, however, is that they aren’t making money from customers who are paying it all off at the end of each month and so one can appreciate the urgency the issuers feel to explore alternative revenue sources. As Sidel says:

The goal of the 0% teasers is to reel in new customers with the lure of not paying interest on current balances, and then get them to rack up interest-bearing charges on new purchases. The lenders also make money by charging a one-time fee—usually 3% of the existing balance—for the balance transfer.

Sidel quotes a Chase executive who spells it out even more explicitly:

We view competitive balance-transfer offers as one potential way for acquiring new customers, similar to the way we view bonus-point offers on reward cards….We believe customers who try our products will like them and will want to remain long-term customers.

But is the strategy working?

Taking Advantage of the System

So the first question is whether or not consumers can be convinced to actually start using their new credit cards, once the zero-interest promotional period expires. What’s to stop them from, say, opening up a new card with a zero-percent rate and using it to pay off the entire balance on the existing one? And Kenneth Chenault, CEO of American Express, certainly has his doubts, as quoted by Sidel:

I have been in the business a while and, to me, putting out a substantial number of 0% [balance-transfer] offers doesn’t appear to target the affluent prospects some competitors claim to be after, nor is it a net revenue driver over the short term.

I share Chenault’s skepticism, although I’m coming at the issue from a different angle. See, the zero-percent offers are reserved for consumers with stellar, or at least very good, credit, whether they are affluent or not. These also happen to be the cardholders who are most likely to pay their balances in full at the end of each monthly cycle. Most of them don’t really need the zero-percent promotional rate to begin with — they pay no interest anyway — but may be persuaded to open up a new card if there is a good enough sign-up bonus. So, the issuer ends up paying a generous bonus (it will have to be worth at the very least $100 if it is to stand a chance of tempting the prospect) to a consumer who is not very likely to use her new card in the way the issuer would want her to use it — that is, to carry balances from one month to the next and pay interest in the process. So, what’s the point?

The Takeaway

Now, whether or not it makes sense for credit card companies to be running such incredibly expensive promotional campaigns, the fact is that they are and that is good news for you. If your credit score is high enough, the issuers would be clamoring to pay you hundreds of dollars to get you to sign up for a card with zero interest for 18 or 21 months. And I see no reason not to do it — you are using credit cards anyway, so why not pocket a few bucks while you’re at it.

Sidel’s experts who say that these offers will only be around for as long as the short-term interest rates remain at record-low levels may or may not be right, but the level of the interest rate matters only for those who roll balances over from month to month and if you are the type of cardholder who does that, you’d be doing it whatever the card you use. On the other hand, if you keep paying your balance in full at the end of the month, a rate increase would make no difference to you.

Image credit: Wikimedia Commons.

It is NEVER time to open a new credit account.

Criminal bankers have already purchased every politician in office.

Why continue to feed the beast that is hell bent on your own destruction.

Its like telling a serial killer.. “Sure.. I know you’ve had a rough day.. Here let me slit my own throat for you.”

Atwas911,

How exactly are you feeding the beast when you are actually taking money from him? Card companies are paying you to open up accounts with them: you can collect a bonus without even using your new card.

Please don’t tell me you’re foolish enough to think credit card companies are “giving” you anything.

YOU give them.. You give them interest, merchants have to give them a portion of what you pay..

Multiply that by 100 million times a day for every swipe and you get a basic realization of just how much money bankers are filtering out of our pockets and into their own private coffers.

NOW is the time to burn every plastic card you own. Cut them off totally.