How You Use Facebook May Determine the Interest Rate of Your Next Loan

CreditCard.com’s Kelly Dilworth is skeptical of WePay CEO Bill Clerico’s claim that social media data can be trusted when evaluating a person’s creditworthiness. Social data is too easy to manipulate, Dilworth contends, which makes it unreliable. A “sophisticated scammer”, she writes, would be more than happy to invest the time and effort necessary to build a solid and realistic social media profiles, which could then be used to dupe lenders.

Well, of course social media fraud is rampant — we’ve all seen statistics about the tens of millions of fake Facebook and Twitter accounts, “friends”, “followers”, “likes”, “shares”,”retweets”, etc. These things are still incredibly easy to manipulate and that is likely to remain the case for a long time to come. But I think that Dilworth may be underestimating the ability of data-crunchers to sift through the tons of social media garbage and find what a loan applicant is really about. Moreover, the lenders will keep improving their algorithms and the exponential growth of social media data will make their job easier. Yes, there will always be fraudsters who will be smart enough to find and exploit cracks in the system, but on balance, the use of social data for underwriting purposes will bring value that hugely outweighs the potential risks.

Manipulating Social Data

Dilworth points out how “ridiculously easy” it is to falsify social media data:

According to a 2012 estimate, around 83 million Facebook accounts are fakes. Facebook doesn’t bother to verify the identities of its users before handing out accounts. Neither does Twitter, LinkedIn or Pinterest. And as Bloomberg News points out, if you need friends and followers to quickly boost your status, you can pay for that as well.

You can also just randomly “friend” real people and hope they accept. Or, if you’re really determined, you can create genuine relationships on the Web and scam other users into thinking you are who you say you are. (The former Notre Dame linebacker Manti Te’o certainly isn’t the first person to be duped into believing that someone he or she met online actually exists.)

Moreover, Dilworth continuous, even legitimate “online social connections are tenuous”:

Among the hundreds of Facebook friends that I’ve accumulated since joining the site in 2004, for example, I actually only see about a quarter of them in person. Most are people I went to elementary, high school or college with and some are people I’ve never met.

I think many of us will relate to this statement and so we can understand where Dilworth’s skepticism is coming from:

That’s also why I don’t buy the argument that the company you keep online should somehow help determine how risky you are to lenders. There are just too many different and often shallow reasons why people become friends through networks such as Twitter, LinkedIn or Facebook.

I have also yet to hear a credible reason for why mining someone’s Facebook likes, speech patterns or online community of friends is an effective — and fair — barometer for determining who they are, or whether they’ll lapse on a loan.

Well, understandable though Dilworth’s skepticism may be, there already is plenty of evidence that using social data to determine an applicant’s creditworthiness does indeed work.

I Know What You Did on Facebook

Several months ago, The Economist told us how a couple of start-ups were using social media data to evaluate creditworthiness:

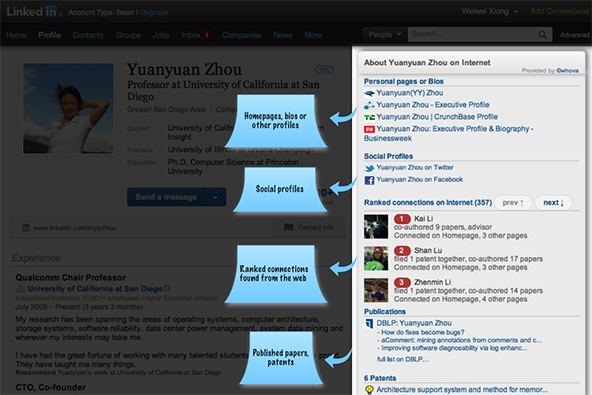

Professional contacts on LinkedIn are especially revealing of an applicant’s “character and capacity” to repay, says Navin Bathija, the founder of Neo, a start-up that assesses the creditworthiness of car-loan applicants. Neo’s software helps determine if applicants’ claimed jobs are real by looking, with permission, at the number and nature of LinkedIn connections to co-workers. It also estimates how quickly laid-off employees will land a new job by rating their contacts at other employers.

…

Facebook data already inform lending decisions at Kreditech, a Hamburg-based start-up that makes small online loans in Germany, Poland and Spain. Applicants are asked to provide access for a limited time to their account on Facebook or another social network. Much is revealed by your friends, says Alexander Graubner-M??ller, one of the firm?ÇÖs founders. An applicant whose friends appear to have well-paid jobs and live in nice neighbourhoods is more likely to secure a loan. An applicant with a friend who has defaulted on a Kreditech loan is more likely to be rejected.

An online bank that opens in America this month will use Facebook data to adjust account holders’ credit-card interest rates. Based in New York, Movenbank will monitor messages on Facebook and cut interest rates for those who talk up the bank to friends. If any join, the referrer’s interest rate will drop further. Rates and fees will also drop if account holders spend prudently. Efforts to define customers “in a richer, deeper fashion” might eventually include raising rates for heavy gamblers, says Brett King, Movenbank’s founder.

But how do we know how authentic a prospective borrower’s social network is? After all, as Dilworth says, setting up fake accounts is incredibly easy, and getting people to “friend” and “follow” you is not any more difficult (if all else fails, you can always buy them by the thousands for a few dollars). Well, she underestimates just how sophisticated social data mining algorithms already are, even at this fairly early stage. The Economist told us that one start-up, called Lenddo, uses software which checks Facebook messages for shared slang or wording that suggests affinity. Moreover, you are unlikely to have much to talk about with your fake “followers” and “friends”, beyond discussing “who are you?”, “where do you live?” and “what do you do?”, and well-designed software should be able to easily identify such fake connections and take them out of the pool of evaluated data.

The Takeaway

Clerico tells us that using social data to evaluate risk has helped his company prevent fraudulent transactions worth $30 million over the past six months, even as it has simplified and sped up the application process. More than 40 percent of his merchants are automatically approved, without having to disclose their social security numbers. So whatever algorithm WePay is using for sifting through social data, evidently it works. And again, these are still early days for this type of data crunching, so I fully expect that, as it evolves, data-mining software will play an ever more prominent role in evaluating a borrower’s creditworthiness.

Image credit: Wikimedia Commons.