The Future of Mobile Payments

A recent Deutsche Bank paper looks into the current state of the mobile payments industry and offers four scenarios of what its future might look like. More to the point, the authors attempt to conjecture the place traditional banks (like their employer) would occupy in the future mobile payments universe, urging them to “pursue a multi-technology and multi-channel strategy”.

Given the multitude of technological choices to pick from, it is understandable that the researchers are mostly preoccupied with the question of which one has the best chance of dominating the industry. Incidentally, a correct answer would also help us imagine the ultimate shape of the m-payments world more accurately. The contenders are well known and include high-tech giants like Google, Amazon and Apple and payment processor PayPal, who are all developing “walled garden strategies” and are “increasingly putting out their feelers in segments outside of their own territory”. Payment card companies like Visa and MasterCard are “re-positioning themselves” and are pursuing “various strategies”, we are told, whereas telecommunications providers are “in a good position” and of course we also have the big retailers and legions of start-ups to keep an eye on. While we don’t get a definitive prediction, we do get plenty of interesting data, which I wanted to share with you.

The Growth of E-Payments

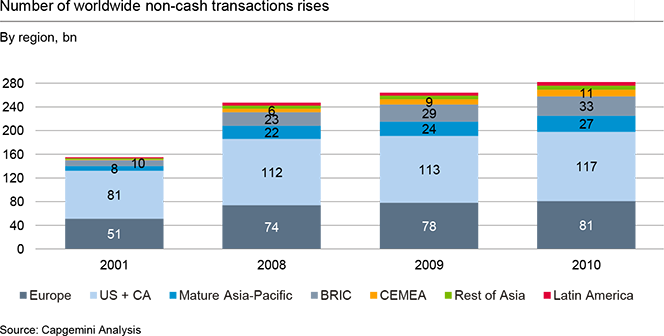

Overall, between 2001 and 2008 the number of non-cash transactions worldwide increased at an average rate of 7.1 percent per year. Even though growth has been especially strong in emerging markets, the U.S. and Europe still have a combined share of almost 70 percent of the market, as you can see in the chart below.

Americans Prefer Credit Cards, Europeans — Credit Transfers, Direct Debit

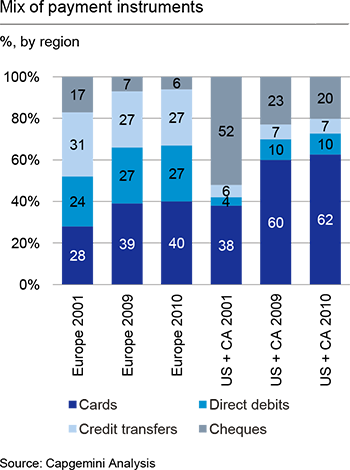

That is what the next chart illustrates. The paper tells us that national payment preferences differ due to “income levels, customer preferences and regulatory conditions”. Payment markets have developed differently in different countries and are subject to strong legacy effects.

As you can see, payment cards are used much more widely in the U.S. and Canada where they make up 60.8 percent and 72.7 percent of all non-cash transactions. By contrast, in Europe the share of cards in cashless transactions was 40 percent in 2010, up from only 28 percent in 2001. In this category growth is also strongest in emerging markets. For example, in the BRIC countries (Brazil, Russia, India and China), the share of card payments in the total number of transactions increased from 14 percent in 2001 to 38 percent in 2010 (not shown in the chart).

The Rise of M-Payments

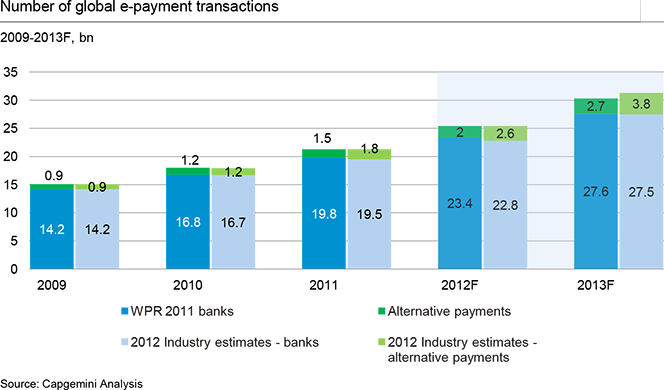

Payments are still primarily handled by banks, the researchers tell us. For example, 51 percent of the 90.6 billion payment transactions processed in the E.U. in 2011 took the form of traditional credit transfers or direct debits and card payments made up another 41 percent. However, new regulations designed to promote competition in the payments market through lowering the entry barriers for new players and technological changes are putting pressure on the banks’ market share and are already having an effect.

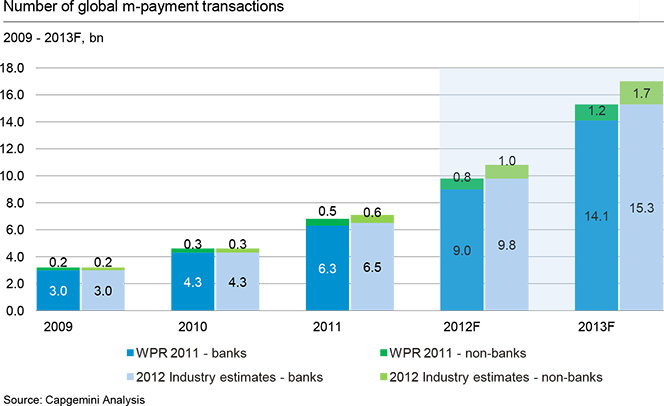

In the area of mobile payments, where growth is projected to be strong, non-banks handled about 6 percent of transactions in 2010 and their share is expected to grow to almost 8 percent in 2013.

E-Commerce Keeps Growing

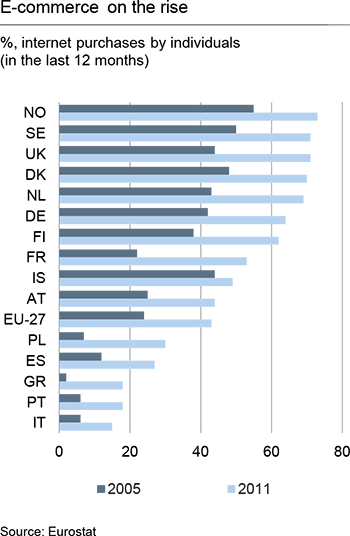

Online retailers are enjoying higher sales growth than physical ones, the researchers remind us, and offer an interesting European comparison, which shows an incredibly uneven rate of adoption of online shopping by consumers in different parts of the continent. Norway leads the field with 73 percent of its population having ordered products and services online in 2011, followed closely by Sweden, the U.K., Denmark and the Netherlands. At the bottom of the chart are Greece, Portugal and Italy (yes, Italy is last on the list!), each with a share of internet shoppers lower than 20 percent.

The Power of Digital Ecosystems

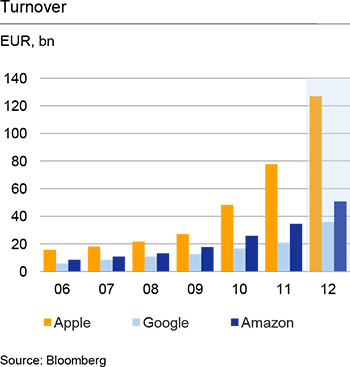

The Deutsche Bank paper pays quite a bit of attention to Google, Apple and Amazon, crediting the tech giants with the “shaping of the internet in recent years” and with determining “large sections of the marketable innovations online”. A couple of charts remind us of just how huge these three companies have become in recent years. The first one tracks their revenue growth between 2006 and 2012.

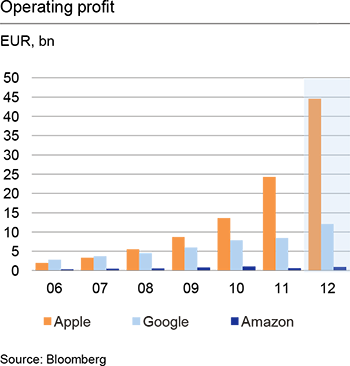

The second chart tracks the three companies’ profitability for the same period.

So how exactly will these non-financial companies influence the payments market of the future? Well, here is Deutsche Bank’s take:

Over the next few years it is to be expected that the four US players (besides perhaps one or two others) will largely determine the conditions (not only) for the digital consumption of media and information, but that they will also make inroads into hitherto unexplored business segments and markets (e.g. financial services). All of them combined thus constitute a serious and perhaps even worryingly strong market position with regard to competition and innovation (not only for the payments segment).

This “worryingly strong market position” is achieved through building exclusive distribution models:

All of them have similar objectives: they integrate a large volume of digital content, mobile devices and internet services under a single umbrella so that their customers ideally no longer have to leave the ecosystem/platform. The vendors thereby solidify their own market position, increasingly (also) enter new business areas in order to reinforce their long-term growth and establish their own standards (technologies) within their systems.

One of these new business areas just happens to be the payments industry.

Consumers Want Mobile Payments from Their Bank

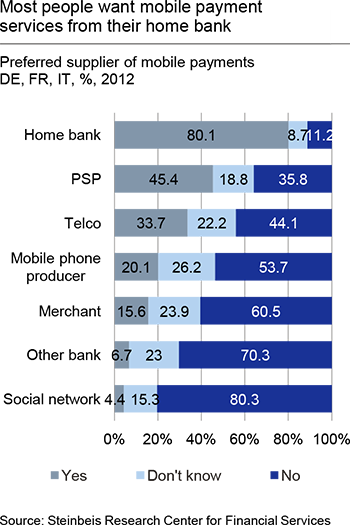

Yet, for all the high-tech giants’ prowess, people in Germany France and Italy prefer their mobile payments to be handled by their bank. As you see in the chart below, payment service providers and telecommunications companies lag quite a distance behind.

The Takeaway

The Deutsche Bank researchers lay out four different scenarios for the possible near future of mobile payments services. These are all mostly concerned with how well the banking industry will be able adjust to the new mobile reality and don’t really tell us much. For example, in one of these scenarios—the “early bird” one where banks act proactively—we are told that they will manage to survive the “looming destructive competition”, whereas in the “late arrivals” scenario where they take a more passive approach and fail to offer the “appropriate mobile financial services”, they will end up losing market share.

For my part, I think that the most likely outcome is one in which the banks do what they are designed to do—move money from one place to another—whereas the product development and the management of the customer relationships are handled by the Googles and Amazons of the world. See, banks have never been good at creating awe-inspiring consumer-facing products (have you seen Bank of Americas Mobile Pay service?) and that is unlikely to change anytime soon. On the other hand, there are plenty of companies, which do that part quite well, but lack the licenses and expertise needed to handle the banking part. So I expect that the type of partnership that Google Wallet represents is what the future of mobile payments holds for us.

Image credit: Visa.com.