What Do We Look for in a Mobile Wallet?

That is the primary question, which researchers from the Carlisle & Gallagher Consulting Group attempt to answer in a newly released report. Unsurprisingly, we learn that security is consumers’ top mobile wallet concern, although it is much less of an issue for younger users. However, the authors predict that security worries will gradually diminish, freeing service providers to “compete purely on functionality and usability” and I agree. The researchers then proceed to give us an insight into the types of functionalities consumers value most highly in a digital wallet.

The paper uses data collected in April of last year and we wrote about it at the time the survey’s preliminary results were released. However, in addition to offering an analysis of the old data, the newly-released report is also expanded to include a comparison review of 20 existing mobile wallets, based on payment capabilities and consumer satisfaction. Let’s take a look.

Do You Want a Mobile Wallet?

Firstly, let me give you the researchers’ definition of mobile wallet:

A mobile wallet stores your major credit cards, debit cards, prepaid cards, gift cards or vouchers (including coupon and loyalty programs) in your smartphone or tablet and can be organized using a payment application. Through this application you would be able to view and choose the method of payment for a transaction.

Now here are the results that highlighted the researchers’ findings in last year’s survey:

– Nearly half, 48%, of survey participants are interested in a mobile wallet.

– Eight in ten consumers interested in mobile wallets responded that they would use PayPal as their mobile wallet provider. Six in ten would use Google. Six in ten would use Apple.

– Consumers interested in mobile wallets said they would consider using alternatives to their primary bank for banking. Eight in ten would consider using PayPal if it offered banking. Six in ten would consider using Google. Six in ten would consider using Apple.

– Sixty-five percent of respondents rated the ability to make better payment choices — such as maximizing loyalty programs or minimizing interest payments — the most valued mobile wallet service.

Yet, even as respondents are professing their preference for PayPal as a primary m-wallet provider, they are keeping their options open. In fact, when the question is asked differently — “Who would you trust to provide services in your mobile wallet?” — we get markedly different answers. It turns out that 46 percent of the respondents trust their primary banks to provide their mobile wallets, while PayPal comes in second place with 30 percent and the credit card companies finish third with 14 percent.

What Should a Mobile Wallet Provide?

The survey finds that the most valued service a mobile wallet could provide — cited by 65 percent of the respondents — is the ability to make better payment choices, such as helping to pick the card which would maximize loyalty program rewards or minimize interest payments. The second most valued service — getting 57 percent of the respondents’ votes — is the management of receipts and other documentation. Here is the full list:

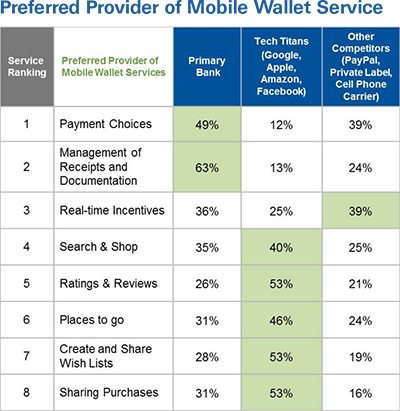

Things get more interesting when consumers are asked to choose a preferred provider for various mobile wallet services. Whereas the Apples and Googles of the world are, unsurprisingly, preferred in the shopping and social experience categories, the banks are far and away the leaders in the payment choices and management of receipts and documentation categories. Here is the full list:

The Traditionalists vs. the Rest

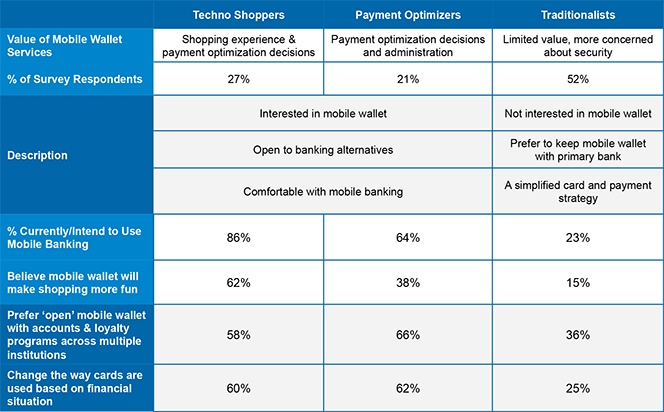

The researchers categorize the respondents into three “behavioral market segments”: techno shoppers (27 percent of the total), payment optimizers (21 percent) and traditionalists (52 percent). The table below tells you everything you need to know about each of these groups’ attitude toward mobile wallets.

The Current Landscape

Finally, as part of the press release, the researchers offer a comparison chart of the existing mobile wallets and find that LevelUp, PayPal and Square have taken the early lead. All of the three leaders’ digital wallets, we are told, are easy to set up and use and offer the ability to attach a credit or debit card. However, Square has a huge advantage over its rivals in what is arguably the most critically important category: its wallet is accepted at more than 200,000 merchants. After all, it wouldn’t much matter how good your service is, if there is nowhere to use it. Here is the chart:

The Takeaway

The report states that consumers who are open to the service would

prefer an open mobile wallet offering. By incorporating all accounts and loyalty programs across multiple financial institutions into a single platform, consumers can more easily consider alternatives to their banks. Consumers seem less interested in having multiple mobile wallets for each financial institution or retailer.

Yet, the fact is that one of the most successful mobile wallets, which gets barely a mention in the report — Starbucks’ mobile app — supports only one payment form — the coffee giant’s own prepaid card. Still, even as it is astonishing just how popular this app is, I agree with the researchers that an open platform is the way of the future. And perhaps the recent partnership deal Starbucks struck with Square is an indication that the coffee chain’s management has come to the same conclusion.

Image credit: Marketingfood.wordpress.com.