Credit Scores for Everyone

The WSJ’s Suzanne Kapner reminds us of a newish trend in the calculation of consumer credit scores in the U.S., which came about as some big lenders decided to look for a solution to a nagging problem. As the mainstream models are designed to evaluate the credit worthiness of consumers who are already into the financial system, but do not take into account the usage of financial instruments that are the only game in town for those with impaired credit, traditional credit-scoring mechanisms exclude a vast chunk of the adult population — 64 million who are “shut out of the mainstream financial system due to a tarnished, incomplete or nonexistent credit file”, as one of Kapner’s sources puts it.

I’ve been following closely the lenders’ efforts to expand the credit score methodology and we’ve published several articles on the subject in this past year alone. It makes perfect sense to me that lenders will try to identify millions of new potentially credit-worthy customers who at present are, to use Kapner’s term, “credit invisible”. The only thing I can’t quite get is what took them so long. Surely part of the answer must be that it is not easy to design a system to enable you to sift through reams of consumer records gathered from a myriad of new sources, but I’m sure inertia played its part, too.

Bringing the ‘Credit Invisible’ into View

As Kapner says, each of the three national credit reporting agencies, and others, have started tapping into new sources of data to complement the traditional ones and this serves the interests of everyone involved — lender and borrower alike:

[S]ome of those consumers are worth the risk, and several credit bureaus have devised new credit-scoring methods to identify them. Those efforts could offer a reprieve to millions of Americans who have been denied credit, not to mention deliver a windfall to banks scrambling to find new sources of revenue.

Experian and rival Equifax Inc…. in recent months launched new measures derived from rent, phone, cable, gas and electric payments, as well as employment histories and address changes. Meanwhile, credit-card company American Express Co…. for the first time is evaluating the spending habits of prepaid card customers in a pilot program to determine whether they might be eligible for a charge card.

American Express’ effort is perhaps the most innovative of these new initiatives. While the AmEx prepaid card doesn’t directly affect its users’ credit scores, it does provide an opportunity for cardholders with poor credit scores who prove to be responsible users to obtain a charge card, which is a form of credit card and as such does have a direct effect on credit scores. So, in effect, AmEx is sidestepping the credit reporting bureaus in its underwriting process, instead relying exclusively on its own internal data.

How New Data Affect the Outcome

Kapner mentions that Fair Isaac — the maker of FICO — the most widely used consumer credit score in the U.S. — has been using rental data in calculating its scores for years. But Fair Isaac has done more than that. The company has recently launched a much more ambitious project, which shows us just how big of an effect the new data can have on consumer credit scores.

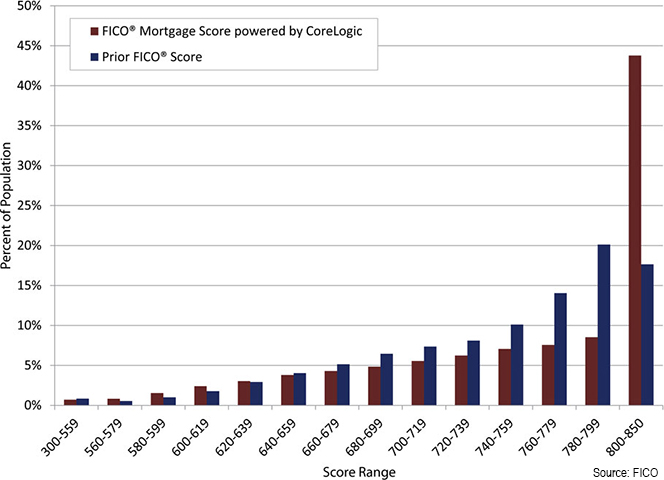

FICO has developed a new credit score model in cooperation with CoreLogic, a provider of financial data and analytics, which is designed specifically to be used by mortgage lenders. It enhances the current version by taking into account previously ignored data, such as “property transaction data, landlord/tenant data, borrower-specific public data, and other alternative credit data”. How much of an effect do these new data have? Well, as the chart below shows, more than two-thirds of American consumers have better credit scores when calculated using the new model.

Of course, it is also evident that the new model hasn’t been nearly as beneficial to consumers at the lowest ends of the spectrum, as it has been to those who had above-par credit scores to begin with and especially consumers who started off with excellent scores — in the range 780 – 799 — more than half of whom have moved into the highest category. On the contrary, the share of consumers with scores in the range 300 – 639 has actually expanded under the new model. Even so, FICO has calculated that, if applied, its new model would significantly increase the rate approval of mortgage applications:

For a top-20 lender processing 300,000 applications a year, adopting this new score could translate into 3,900 more loans approved every year along with a net financial benefit of $14.5 million.

And what makes this higher approval rate possible is the addition of new data to the existing models.

The Takeaway

Presumably, the results would be similarly positive if the FICO / CoreLogic model was expanded to evaluate the credit worthiness of previously unscored consumers: recent immigrants, young adults, the unbanked, etc. But then, as Kapner says, others are already doing just that and it’s very probable that Fair Isaac is working on such a model, too. There is a lot of money to be made from being able to identify previously undetected segments of credit worthy consumers and the technology to enable such discoveries seems to have being developed and is now being perfected. Employing it should benefit everyone involved.

Image credit: Identityguard.com.