Time to Go Prepaid?

Bluebird, the new prepaid card issued jointly by American Express and Wal-Mart, is all over the news this morning, and for good reason. It is by far the best prepaid card ever offered to American consumers and, unlike its predecessors, it is a real alternative to checking accounts. It is better than American Express’ own truly excellent prepaid card, which was launched in June of last year. In fact, Bluebird is better than most currently available checking accounts.

Not only does Bluebird come with no monthly fee and is virtually free of other charges, but it offers something no other prepaid card does: cardholders can deposit checks into their prepaid accounts via the Bluebird mobile app. Furthermore, as Bluebird is built on the American Express Serve platform, it incorporates a host of capabilities that are not to be found in other prepaid cards. So, unless you still write paper checks to pay your bills, you should seriously consider replacing — or supplementing — your existing checking account with Bluebird.

Bluebird at a Glance

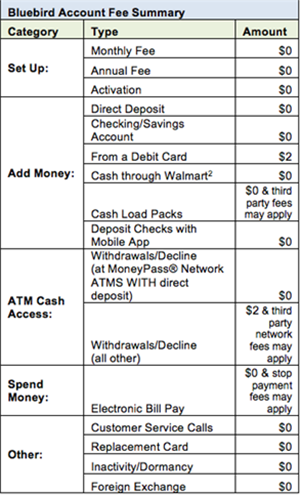

So let’s take a more detailed look at what AmEx and Wal-Mart are offering. To begin with, take a look at the fee summary at right. As you see, Bluebird is virtually fee-free. Just as is the case with the original AmEx card, there is no monthly fee and there are no other fixed fees. Another similarity is that the issuer charges no usage fees. However, the Bluebird advantage is that it is backed by an ATM network of more than 22,000 machines nationwide. So, as long as the card is used at any one of MoneyPass’ ATMs, the operator would charge no fee at all. If used at any other operator’s ATM, the issuer’s charge would be $2 per transaction, on top of whatever fee the ATM owner would assess. The only other fee that may ever be applied is a $2 charge for deposits from a debit card.

So let’s take a more detailed look at what AmEx and Wal-Mart are offering. To begin with, take a look at the fee summary at right. As you see, Bluebird is virtually fee-free. Just as is the case with the original AmEx card, there is no monthly fee and there are no other fixed fees. Another similarity is that the issuer charges no usage fees. However, the Bluebird advantage is that it is backed by an ATM network of more than 22,000 machines nationwide. So, as long as the card is used at any one of MoneyPass’ ATMs, the operator would charge no fee at all. If used at any other operator’s ATM, the issuer’s charge would be $2 per transaction, on top of whatever fee the ATM owner would assess. The only other fee that may ever be applied is a $2 charge for deposits from a debit card.

As already mentioned, Bluebird is built on AmEx’s Serve platform, which means that the cardholder is automatically signed up for a mobile wallet. Serve enables its users to send and receive money to and from other consumers by email, text and Facebook, make payments at merchants which accept American Express cards and, as you would expect from a mobile wallet, link to credit and debit cards and bank accounts. And you would get access to all that just by opening up a prepaid card account!

The Case for Prepaid

I realize that this post may already sound a bit too much like a press release and fear that readers may accuse me of turning this blog into a TechCrunch or something, but Bluebird really gives me nothing to gripe about. And if you aren’t convinced, let me point you to Felix Salmon, whose Bluebird review is the best one I’ve read. While there, make sure you read Salmon’s analysis of the effects the Durbin Amendment has had on the issuers’ ability to offer checking-account-like prepaid cards. In fact, let me give you the gist here:

Being able to deposit money into your account for free is a key feature of checking accounts which prepaid debit cards have historically had a very difficult time replicating. This is one area where banks have a clear advantage over other prepaid debit-card providers. If you have a debit card from Chase or US Bank, for instance, then you can deposit money into your account at any of their branches or ATMs. But the bank cards have their own limitations: Chase doesn’t offer bill-pay, for instance, while US Bank doesn’t offer check deposit.

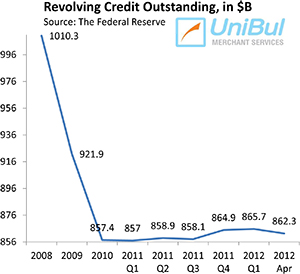

Interestingly, the loophole which is making all these prepaid cards possible is exactly the same as the loophole which prevents Chase from offering bill-pay. The Durbin Amendment to Dodd-Frank forced interchange fees on debit cards to come down substantially, while carving out an exception for prepaid cards. So Durbin allowed the prepaid industry to keep on growing — but because Chase is a big bank, it’s not allowed to offer bill-pay on its prepaid card, since at that point it would fall foul of the rules about the interchange fees charged by big banks on their checking-account debit cards.

Note that AmEx, whose overall payment card operations are bigger than Chase’s, can and does offer bill-pay on its prepaid cards, even as Chase is prevented from doing so, because of its size! The difference that matters here, however, is that AmEx doesn’t issue debit cards, while Chase does.

By the way, you will also note that Salmon’s take on the Durbin Amendment’s overall merits is diametrically opposed to mine, but that is a subject for another post.

The Takeaway

As Salmon says, opening up — and closing — a prepaid card account is a quite straightforward affair: you just sign up online or buy the card in person and start using it; if you aren’t satisfied, you close it down, with no possible adverse effects. No credit checks are involved and the product is available to everyone who wants it. In contrast, checking accounts are not an option for consumers whose prior bank account history has landed them on the ChexSystems list. So, in effect, Bluebird, as all other new-age prepaid cards, is giving the unbanked the opportunity to get back into the traditional financial system and that is a chance they should take. For all others, Bluebird can at the very least be a great addition to their more mainstream payment products.

Image credit: Wal-Mart.

When will it be on the market?