Why the Unbanked Take out Payday Loans and the Cost of Education

A new Federal Reserve survey attempts to explain the reasons behind the financial decisions of the unbanked and underbanked Americans. The researchers’ findings are not necessarily surprising, but they do provide plenty of fresh data to analyze. And the conclusion I get out of it is that staying out of the traditional financial system is as much a matter of choice and lack of financial education, as it is about being shut out of it.

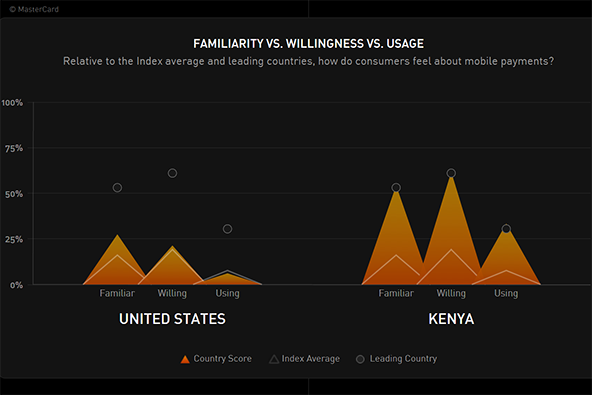

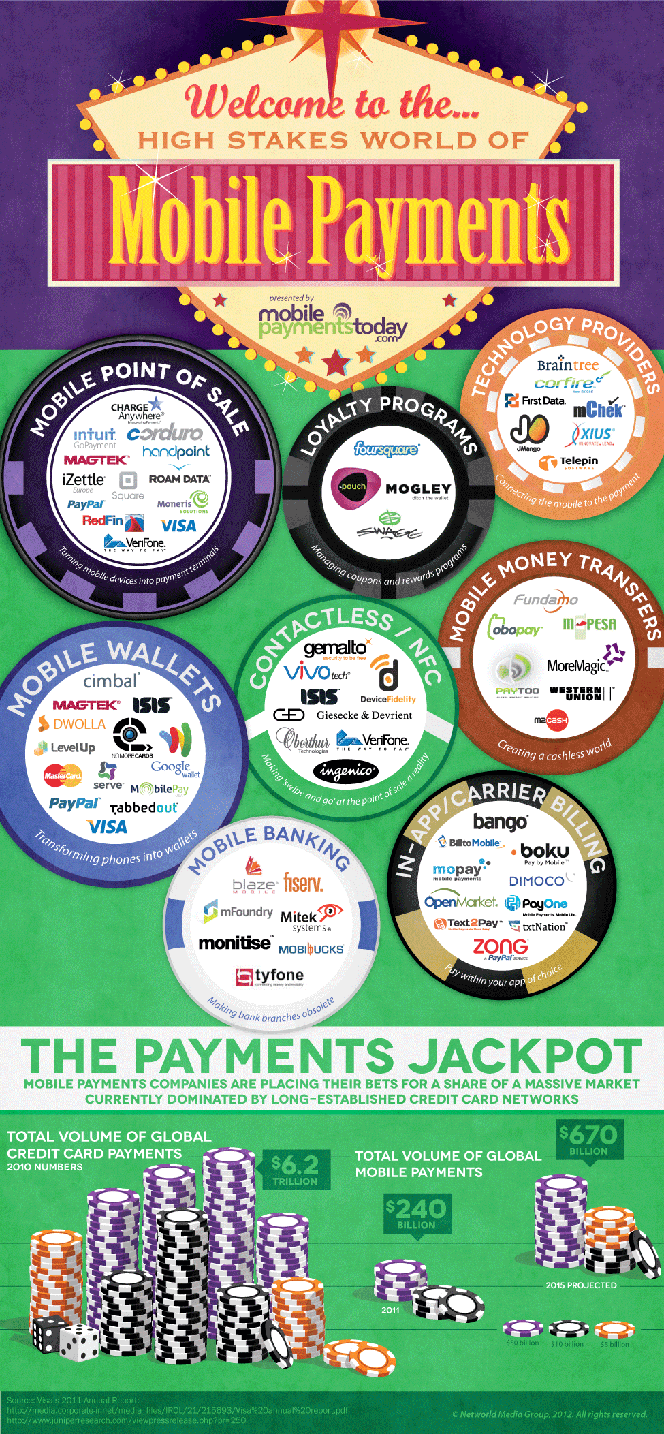

Now, the report’s primary objective is to examine “the use of mobile technology to access financial services and make financial decisions,” but I just didn’t find the data on that front nearly as interesting as the examination of the motives and behavior of the unbanked and underbanked segments of the population. So let’s take a look at what the Fed researchers have found.

First, though, let’s get the definitions straight. The Fed defines the unbanked as consumers who have no checking, savings, or money market accounts, while underbanked consumers do have one of these accounts, but they nevertheless use “an alternative financial service such as auto title lending, payday loans, a check-cashing service, or a payroll card.” By that definition, 11 percent of the U.S. adult population is unbanked and another 11 percent are underbanked, the researchers have found.

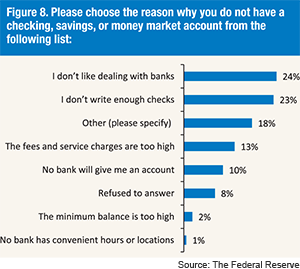

Why Are Consumers Unbanked?

So the first question is why there are so many unbanked Americans and you can see the answers in the table to the right. Now, when you look at them closely, only one of them — “No bank will give me an account” — offers a genuinely good reason. Indeed, there is nothing you can do if banks don’t want to service you.

So the first question is why there are so many unbanked Americans and you can see the answers in the table to the right. Now, when you look at them closely, only one of them — “No bank will give me an account” — offers a genuinely good reason. Indeed, there is nothing you can do if banks don’t want to service you.

However, all other answers betray either a personal attitude towards the industry (“I don’t like dealing with banks”) or misinformation (all other categories). And the two are very probably related. After all, if you believed that the banks’ fees were too high, you wouldn’t necessarily like them, would you? But too high, compared to what? Payday loans? Check-cashing services? Even if you cannot find a free checking account, although you should be able to, as there are plenty of them still around, there is no way that a bank account would cost you more than a payday loan or a check-cashing service. And not writing enough checks doesn’t add to the cost. So, we clearly see that a lack of financial education is holding down those Americans who do qualify for traditional banking services, but choose not to use them.

Why Are Americans Taking out Payday Loans?

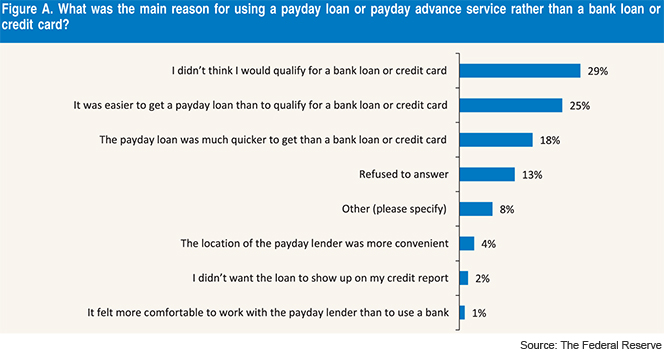

The Fed researchers report that 11 percent of the respondents to their survey, or their partners or spouses, have ever taken out a payday loan, and five percent had done so in the 12 months preceding the survey. This is an incredibly expensive form of financing, we are informed, with interest rates for a two-week loan ranging from 15 – 20 percent, which translates into an annual percentage rate (APR) of 390 percent to 520 percent. So why would you take out such an expensive loan? The table below lists the reasons given by the respondents.

Given these loans’ exorbitant interest rates, the only acceptable reason for using them would be that you absolutely needed the money and you tried, but could not get it from a traditional lender. What we have instead is that 29 percent of consumers who did take out such loans thought that they wouldn’t qualify for a bank loan or credit card and 47 percent found them more convenient (the sum of the “easier,” “quicker,” and “more convenient” reasons). So if we take these answers at face value, what we learn is that a substantial proportion of the U.S. adult population is hurt by a combination of a lack of understanding of the cost of taking out a payday loan and, to an even greater degree, by a lack of financial discipline.

The Takeaway

Again, these findings should not come as a surprise. Anyone who has spent any amount of time in the consumer finance department of a financial company would know full well that a very large proportion of the American consumers do not understand even the most basic financial terms, such as compound interest rate. Yet, even these consumers should be able to recognize that a payday loan is immeasurably more expensive than a bank loan or a credit card. So the most disturbing takeaway from the Fed’s survey is that great many Americans who have access to traditional lenders still make the wrong financial choice, simply because it is a more convenient one.

What can be done about that? I don’t know. I really don’t.

Image credit: Wikimedia Commons.

You seem to be assuming that banks actually *would* lend to many of these people who think the bank won’t lend to them. I can tell you that’s bull. Those people have substantial reason to believe banks won’t lend to them, because in fact most of the time it’s true.

You are correct that many of the respondents in this Fed survey don’t believe that banks will lend to them. After all, 29% of them are saying so. But 47% of the participants responded that it’s “easier,” “quicker,” or “more convenient” to take out a payday loan. So for close to a half of the respondents, whether or not a bank would work with them doesn’t even come into the picture.

American Express will permanently blsaclikt you, if you have a bankruptcy in your past. The only way that you might get around this is if you have a partner with good credit who will apply for the card on behalf of the business, and then add you as an authorized user later.If you need to establish business credit, you will need a Tax ID#, which I am sure you already have. Next, you will need a Dunn Bradstreet Number. Don’t let them force you to pay money to have a report established. They will try to sell you services, but you can get a number at no charge. Each year, you can voluntarily provide your business financial information to them. None of this costs money. They will try to tell you otherwise, but do not believe them!As far as cleaning your personal credit, work with National Consumer Rights Alliance. They have removed things that you would not believe could even be removed from reports! Even bankruptcies. Their website appears below.In order to get your business credit established, it helps to have about six people who have extended you credit to report to D B. Start with your CPA, attorney, local printer, and landlord. After that, you can set-up business accounts with Office Depot, Home Depot, Lowe’s, and others quite easily. As you build your credit with these companies, they will report your payment history to D B, and that will generate a PayDex Score. NEBS, Reliable Office Supplies, National Sanitary Supply, and U-Line all give easy business credit and report as well.Once you have been in business for two years, and you have a good payment record, you should have little problem getting business credit without a personal guarantee. Dell Computer will give you credit after you have already been established at least one year.Business credit cards (Visa, Amex, MC) do not report to D B, but may report to Experian Business. Do everything that you can to avoid having to provide a personal guarantee for any business debt. If you must give a PG early on, try to get it removed after six to twelve months of good payment history.The second link below will give you a large business credit line (up to $25,000) that will report as a positive account to D B. You can also set-up a personal line ($5K to $10K) with the same source.I wish you luck, both in your business, and with your personal credit situation.