American Express Takes on PayPal with Serve

Earlier this week American Express launched a service that is pretty much identical with PayPal. Just as eBay’s payment service provider, AmEx’s allows users to send and receive money from other users, make purchases, pay for bills, services, etc.

American Express’ Serve

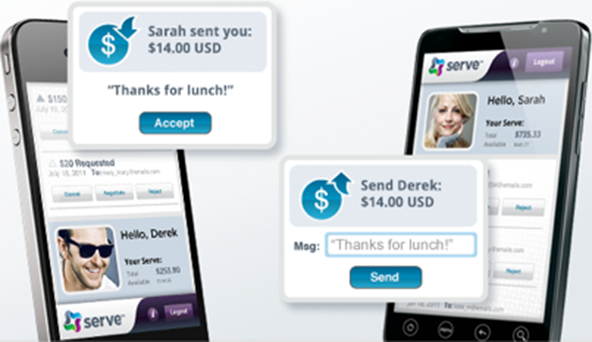

Serve, as the new service is called, can be set up either online at serve.com or through a smart phone app (currently supported are Android devices and the iPhone). Accounts can be funded through transfers from bank accounts, debit cards, credit and charge cards, or other Serve accounts.

A prepaid card is linked to and funded from the user’s Serve account and can be used for payments anywhere American Express cards are accepted. A credit or debit card that is already linked to the Serve account can be designated as a back-up funding source for the prepaid card.

Serve users can also create up to four sub-accounts, linked to the master account, for anyone thirteen and older. Master users can set various limits on how the sub-accounts can be used, including on transaction amounts and types.

Pricing: Serve vs. PayPal

The fee structures of the two competitors are almost identical, with some minor differences. Both Serve and PayPal charge 2.9% + $0.30 for most transactions, including sending and receiving payments and funding from credit cards. ACH funding is offered for free by both companies. Serve is waiving its funding fee for the next six months.

However, PayPal uses a tiered fee structure for business transactions, which charges heavy users lower fees if they exceed a certain monthly volume. So if in any given month you receive between $3,000 – $10,000 in payments, your fee for the next month will drop to 2.5% + $0.30. Higher volumes lead to even lower fees. On the other hand, Serve is exclusively targeting consumers and no such high-volume provision is considered.

Serve has an advantage in the person-to-person (P2P) payments category, for which it charges no fee, provided the funds are loaded via ACH or debit. PayPal makes no such distinction and all P2P payments carry a fee.

The Takeaway: Do We Need Another PayPal?

I am not really sure what to make of Serve. For all practical reasons, it is a PayPal clone. Most of us already have a PayPal account and most of the people we are likely to exchange money with have one too. So why would you want to open up a Serve account?

I guess the prepaid card could be seen as a convenience, but I would never use it, because I have credit cards which are accepted at more places and actually give me rewards, which the Serve card does not do. Plus, I could make anyone I trust an authorized user of my existing credit cards.

Moreover, I could perfectly well control the spending habits of a son or daughter through their checking account, which has a debit card linked to it anyway. I can transfer money into it for free from my own bank account.

So really, what’s the point?

Image credit: Serve.com.

After using Serve for 4 months, I have written a full comparison with payPal in my blog, check it out http://onecentatatime.com/its-american-express-serve-vs-paypal-in-digital-payment-landscape/

Thanks for the effort. I don’t share your enthusiasm for Serve, but you’ve really taken the time to match it up with PayPal.

i don?ÇÖt exactly have a personal use for it- but now that paypal has competition perhaps it will lower its prices

So the big question is. Are we the cutomer holders for American Express serve. Are we able to use the card for PayPal. I recently got a serve American Express prepaid card temp. Added funds to it. Signed up for the prepaid official card. But when I tried to use my temp card on PayPal. Said it was invalid? Why if I have funds in it. And also called it in to make sure it’s ready for use. But no luck still can’t use it for PayPal. Any suggestions why ??