Fewer Americans Use Bank Accounts

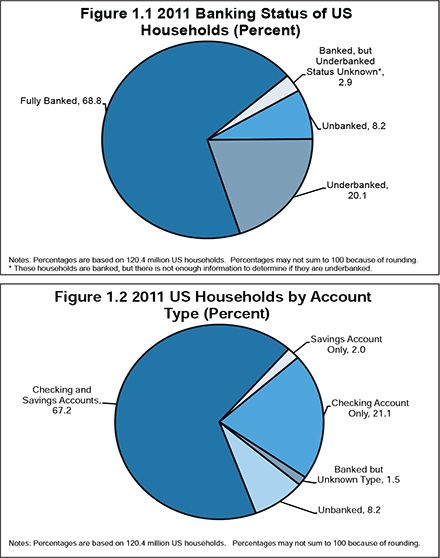

That is the gist of a recently released FDIC report on unbanked and underbanked U.S. households. More than one in four American households (28.3 percent) fall into one of these two categories, relying instead for some or all of their financial transactions on alternative financial services (AVSs), such as prepaid cards and payday loans, we learn.

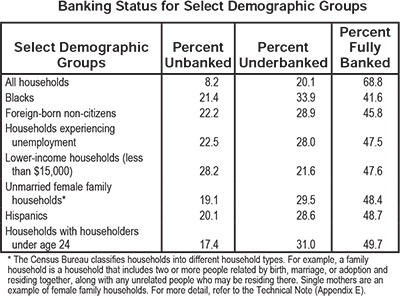

As was the case with the 2009 survey, the groups that are more likely to be unbanked or underbanked include non-Asian minorities, foreign-born non-citizens, unmarried families, less educated households, younger households, unemployed households, non-homeowners, and lower-income households.

The FDIC defines unbanked households as those that lack any kind of deposit account at an insured depository financial institution. Underbanked households, on the other hand, do have a bank account, but also rely on AFS providers. Finally, fully banked households are those that have a bank account of any kind and have not recently relied on any of the AFSs included in the survey. Now let’s take a look at the data.

8.2% of U.S. Households Are Unbanked

Here are the survey’s key findings:

- 8.2 percent of U.S. households are unbanked. That is 10 million households in total, in which live approximately 17 million adults. The share of unbanked households has increased slightly—by an estimated 0.6 percent, or 821,000 households—since the 2009 survey.

- 20.1 percent of U.S. households are underbanked. That is 24 million households with 51 million adults. By comparison, the 2009 rate was 18.2 percent, but the ratios are not directly comparable because of methodological differences in the two surveys.

- 29.3 percent of households do not have a savings account.

- 10 percent of households do not have a checking account.

- 67.2 percent of households have both checking and savings accounts.

Here are the charts:

Who Are the Unbanked?

Unbanked and underbanked groups have diverse demographic characteristics, past banking experiences, reasons for not having a bank account, and future banking plans, we learn. Close to half of all households that include non-Asian minorities, younger, unemployed and lower-income individuals fall into one of these categories. Here is the table:

Slightly more than half of all unbanked households have never had a bank account, including 14.7 percent of Hispanic and 18.9 percent of foreign-born non-citizen households. The most common reasons for not having bank accounts are that the unbanked feel that they do not have enough money for an account, or they simply do not need or want one.

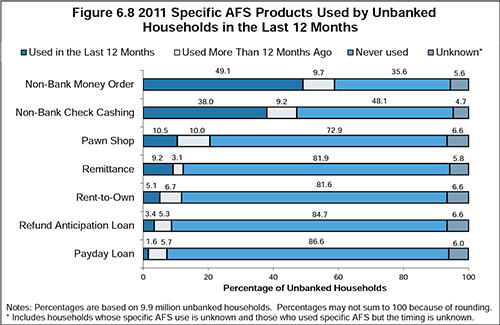

What Financial Services Are the Unbanked Using Instead?

The money order tops the list of the most widely used alternative financial services. Close to a fifth (18.3 percent) of all U.S. households have used a non-bank money order in the last year and, as expected, the ratios are higher for underbanked households—71.2 percent—and for unbanked ones—49.1 percent. Here is the full list of products used by the unbanked:

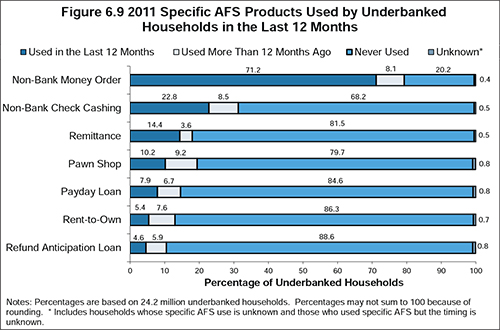

And now the underbanked:

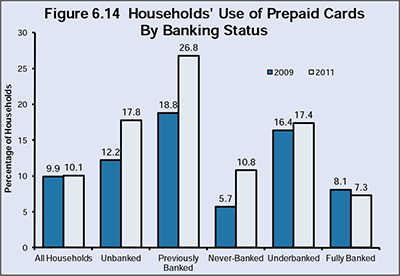

10.1% of Households Have Used Prepaid Cards

Moreover, prepaid card use is higher among households that do not have a checking account (16.5 percent) than it is among those that do (9.3 percent). Prepaid card use does not differ with savings account ownership. The share of unbanked households that have used a prepaid card rose from 12.2 percent in 2009 to 17.8 percent in 2011. For underbanked households the increase was much less significant (up from 16.4 percent in 2009 to 17.4 percent in 2011). Here is the chart:

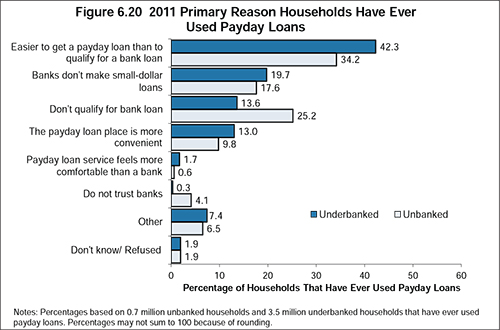

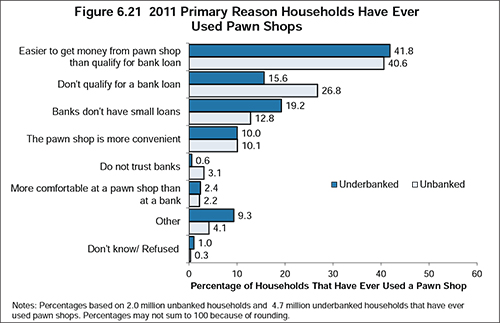

Why Do Households Use Payday Loans and Pawn Shops?

Well, the biggest reason—stated by about 40 percent of the respondents—is that it is easier to get payday loans or to get money from a pawn shop than to qualify for a bank loan. Additionally, about a fifth of the respondents said that they do so because they think that banks do not provide small-dollar loans. Here is the full list for payday loans:

And here is the list for pawn shops:

The Takeaway

One of the survey authors’ conclusions is that a better understanding of the varying demographic characteristics, banking behaviors, and AFS usage patterns of the unbanked and underbanked household groups could lead to the development of products and strategies that are better designed to engage these consumers. However, you would still have to convince them of the benefits of opening up a bank account in the first place and that is not exactly a trivial exercise, as we learned from a Federal Reserve survey earlier this year.

Image credit: Wikimedia Commons.

First want to say fantastic blog! I was curious to know how you clear your mind prior to writing. I have had a hard time clearing my mind in getting my thoughts out there. I do take pleasure in writing but it just seems like the first 10 to 15 minutes tend to be lost simply just trying to figure out how to begin. Any recommendations or tips? Many thanks!