How Payday Loans Affect Financial Health

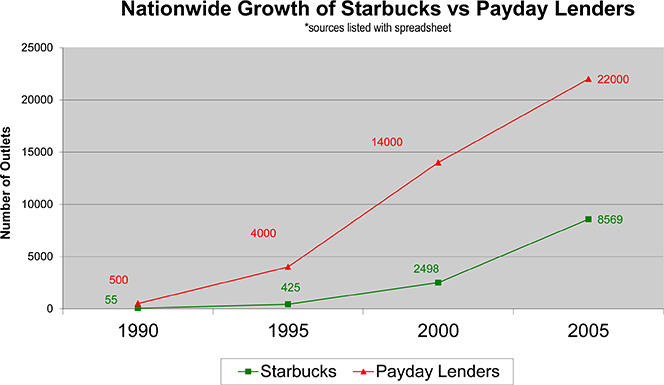

You’d be hard-pressed to find a financial expert who would utter a single positive word for the payday loan industry, and for good reason: the typical payday loan’s annual interest rate is more than 10 times the one of a traditional bank loan. And yet, the market for this type of financial services has grown tremendously in the past decade, even though not every state permits payday lending. Famously, where permitted, payday lenders are more common than Starbucks (see chart below).

Now, considering the fact that they are typically taken out by severely cash-strapped consumers at sky-high interest rates, you might conclude that payday loans would adversely affect the borrowers’ financial health. But that’s not what Neil Bhutta — a Federal Reserve researcher — finds in a recent study. So I thought I should highlight some of the most interesting findings of Bhutta’s paper.

What Are Payday Loans?

Payday loans are high-interest loans taken out by consumers against the promise to pay them back with their next paycheck (hence, payday loans). In reality, however, most such loans are repeatedly rolled over from one month to the next. The interest rate varies, but is typically in the range between 15 percent and 30 percent for the 1 – 4 week duration of the loan, which translates into a range of 390 – 780 percent per annum, but the APR can in some cases exceed 1,000 percent.

Here is how Bhutta describes the processing of a payday loan application:

To qualify for a payday loan, an applicant typically must show proof of residence, identification, employment and a valid checking account, and must have some minimum level of monthly earnings. If approved, applicants then provide the lender with a postdated check for the amount of the loan and fee (or provide authorization to debit their checking account).

Bhutta estimates that in 2008 there were about 34,500 establishments in the U.S. that fit the payday loan description. And, as mentioned above, the number of payday lenders has been growing faster than the number of Starbucks stores:

How Do Payday Loans Affect Consumers’ Financial Health?

It is difficult to imagine any possibility that a payday loan can have a positive effect on the borrower’s financial health. In his study, Bhutta uses the consumer credit score as a barometer for overall financial health. And here is what he finds:

Overall, I find little evidence that access to payday loans either improves or worsens credit scores, even among those who have relatively low credit card limits and those who have recently been denied more traditional credit — people who might be most likely to use payday loans. The results, to some extent, contrast with previous research that finds payday loans affect the likelihood of bankruptcy and foreclosure, but could reflect differences in empirical strategies that identify the effect of payday loans off of different marginal borrowers.

And here is the researcher’s conclusion:

I find little evidence that access to payday loans affects consumers’ financial health, as measured by credit score levels in 2008 and score drops over a two year period during the recent recession. The point estimates are generally close to zero and precise. One possible conclusion is that payday loans are, financially, neither destabilizing nor greatly beneficial simply because they are small and unsecured, which limits their potential risks and benefits.

The Takeaway

Now, the fact that payday loans have no measurable effect on borrowers’ credit scores does not make them any less costly. Nor is Bhutta suggesting that payday lending should be accepted as equal to the mainstream forms of lending. On the contrary, a bank loan or even credit cards, for example, are much less costly borrowing options than a payday loan. But not everyone has access to mainstream forms of lending and for these consumers, the researcher argues, a payday loan is no more or less damaging than, say, a bounced check. This is no exuberant praise, but it is not a damning verdict, either.

Image credit: Fansshare.com.