False Credit Card Experts, Free Advertising and why Home Depot Loves PayPal

Computerworld’s Matt Hamblen gives us the latest on PayPal’s Home Depot experiment, which has, understandably, been attracting a great deal of attention over the past few months. It’s a not a bad piece, so far as it provides a glimpse into the project’s evolution. And I’ll look into that.

However, I would also have to say that Hamblen could and should have done a better job at selecting his experts or at the very least at verifying the information provided by the one he’s been talking to. As it is, he is making false statements about the size of card processing fees and absurd ones like the claim that Square “has negotiated lower rates with banks to make the new technology attractive”. There are plenty of people who actually know what’s going on in the payment card industry and would be happy to talk to him. It doesn’t take that much of an effort to locate them.

Why Home Depot Loves PayPal

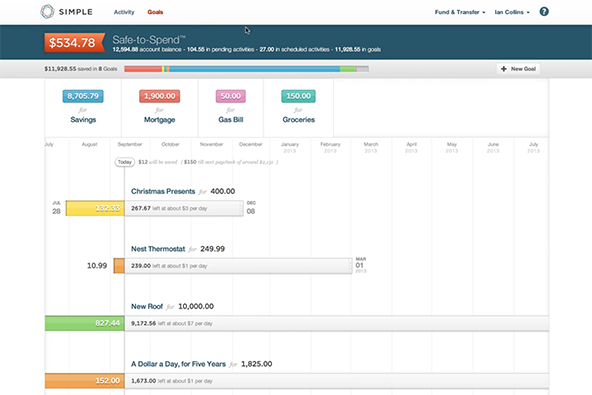

First, let’s take a look at the Home Depot part of Hamblen’s piece. As you may recall, earlier this year Home Depot added PayPal as a payment option at the checkouts of many of its stores (1,976 by Hamblen’s count). To check herself out using her PayPal account, a Home Depot customer would enter a PIN and her cell phone number. The receipt would then be stored into the customer’s PayPal account and could also be texted to her cell phone. So the process is a bit cumbersome, but that didn’t prevent Home Depot from embracing it. Why? Well, because it made perfect sense for them. We’ve explained it before:

About 55 percent of PayPal’s transactions are funded from its users’ debit or credit card accounts (and are subject to interchange fees, which are the fees collected by the issuers for each transaction involving one of their cards), while the rest are funded from the users’ bank accounts. What PayPal is indicating is that it is offering merchants to be processing bank card payments at a cost that is lower than interchange. And if the merchant is paying less than the full interchange amount, the processor would have to make up the balance. So PayPal is willing to not only forgo any profit on the card-funded transactions it will be facilitating, but to lose money on them. All of them!

Of course PayPal is not being charitable. On aggregate, it would still be in the black, because its margins on the transactions funded directly from its users’ bank accounts are huge and in any case enough to more than offset the losses from the bank card transactions.

So it’s a win-win for both parties and we should not be surprised when Home Depot is telling Hamblen that the test “has generally been a success”, even though “the system still accounts for a very small percentage of overall transactions.” Still, I’d like to know what PayPal’s share is.

12 Percent Processing Fees and All That

Now let’s move on to the false expert part of my current exercise. Hamblen’s payment card industry source — a Gartner analyst by the name of Avivah Litan — tells him that:

[The] fees charged by banks to merchants for credit card and debit card transactions… generally range from 1.5% to 12% of a transaction depending on the size of a store or retail chain.

Evidently someone forgot to tell Litan that since the beginning of October of last year the debit interchange fees have been limited to 0.05 percent of the sales amount plus $0.22 per transaction. Now, that doesn’t mean that some merchants are not still paying debit transaction fees to the tune of 1.5 percent or more. Many still do, because they have agreed to the wrong pricing model. However, the Home Depots of the world are paying no more than a hair (more likely half of that) above interchange. Now let’s do some basic calculations. I don’t know Home Depot’s average transaction size, but I’ll be charitable and suppose that it is only $35 (and it certainly is considerably higher than that). In that case, Home Depot’s average debit interchange rate would be 0.68 percent. Let’s again be extremely charitable and suppose that the processor’s cut is 0.10 percent above interchange (I know, I know; an impossibility, but again, we are being generous with our assumptions here; and anyway, just bear with me). So even after all this generosity, Home Depot’s processing rate for debit card transactions comes up to 0.78 percent, 48 percent below the figure at the lower end of Litan’s range.

As far as the upper end of Litan’s range is concerned, yes, I’m sure that some merchants are paying transaction fees at the rate of 12 percent. But you know what, such rates are about as commonplace as $10-a-pound tomatoes. They do exist, but only under extremely rare conditions (think newly-launched porn sites, generic Viagra-selling online pharmacies, etc., although even there such rates are virtually unheard of).

Finally, here is Litan’s Square comment:

The technology has been a hit with about 1 million small retailers, such as artists at craft fairs, she said, noting that the vendor charges such users just 2.75% per swipe for all major credit cards.

Square still relies on the traditional credit card system and the cards themselves, but the company has negotiated lower rates with banks to make the new technology attractive…

Square currently has more than two million merchants, but never mind that. Just 2.75 percent? All I would say to that is try selling it to Home Depot. They’ll tell you just how low this rate is. And what does “negotiated lower rates with banks” mean? What banks? Just like all other processors, Square is incorporating the interchange rates into its own aggregate processing rates. And interchange rates are set not by “banks”, but by Visa and MasterCard and are not negotiable.

The Takeaway

Now, we all make errors every now and then and I am certainly no exception. But there are errors and errors. The expert in Hamblen’s piece displays an utter lack of knowledge in the field of her supposed expertise. But then there may be more to this story than meets the eye. Going through the comments, I stumbled upon one that perhaps summarizes it best:

You know this really kind of smells like a marketing campaign. Use the old appeal to prejudice angle with “abusive banks” and people will fall all over themselves to link to your article. Free advertising for Home Depot and Paypal. Mostly Paypal because they’re fighting the image of not being a mainstream processor.

You know, I think this commenter may be on to something.

Image credit: FastCompany.com.