Americans Beginning to Use Credit Cards More Freely

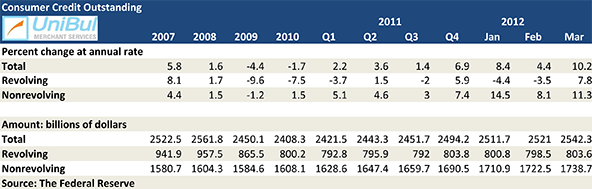

U.S. consumer credit grew in March at its fastest rate in more than a decade, according to the latest data released by the Federal Reserve on Monday. The aggregate amount of outstanding credit card balances rose following two consecutive monthly declines and is now back above the $800 billion mark. Both the student and auto loan categories spiked, pushing the total upward and very close to the pre-Lehman record-high.

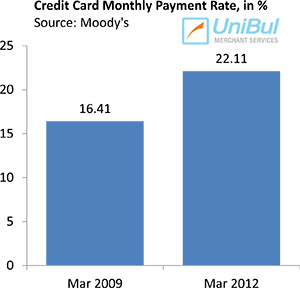

There have been several reports over the past few months showing that credit card spending in the U.S. was growing at an accelerating rate for at least a year, including one by payment processor First Data, which also showed that debit card use was growing at a decelerating rate. And yet, so far Americans have been able to keep the aggregate amount of outstanding credit card balances, even after the latest spike, at a level very close to the post-Lehman low that was reached in April of last year. What made this possible were the continually declining delinquency and charge-off rates and the rising monthly payment rate (MPR). But now it looks as if the credit card spending growth may have finally started to overcome the rate of deleveraging.

Credit Card Debt up 7.8% in March

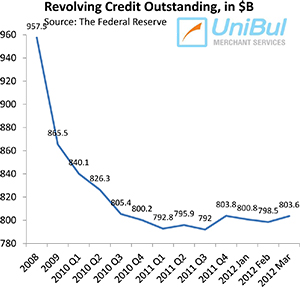

The total amount of outstanding consumer revolving credit in the U.S., which is comprised almost exclusively of unpaid credit card balances, rose in March by 7.8 percent, or $5.18 billion, pushing the total up above the $800 billion threshold again, to $803.63 billion. That is only 1.74 percent above the post-Lehman low of $789.6 billion recorded in April of last year, which was also the lowest total since October 2004.

The total amount of outstanding consumer revolving credit in the U.S., which is comprised almost exclusively of unpaid credit card balances, rose in March by 7.8 percent, or $5.18 billion, pushing the total up above the $800 billion threshold again, to $803.63 billion. That is only 1.74 percent above the post-Lehman low of $789.6 billion recorded in April of last year, which was also the lowest total since October 2004.

Since the onset of the financial crisis in September 2008, revolving credit in the U.S. had been falling continually, and precipitously, until the end of 2010. Then, in 2011, half of the Federal Reserve’s monthly releases reported an increase in the outstanding credit card total, including each of last four. Now, following the consecutive declines in January and February and the spike in March, the current total of $803.6 billion is lower by 17.46 percent, or $170 billion, than the $973.6 billion pre-crisis high.

Overall Consumer Credit Up 10.2%

The non-revolving portion of the consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, spiked in March. The Fed reported a $16.17 billion — or 11.3 percent — increase from the previous month, lifting the total up to $1,738.7 billion. These gains, although substantial, are still lower than the ones recorded in January when we saw the biggest dollar increase since November 2001.

The non-revolving total has risen in every month since July 2010 with the exception of August 2011 when it fell by 6.4 percent. The current amount is higher by 7.5 percent, or $121.3 billion, than the pre-crisis peak of $1,617.4 billion, reached in July 2008.

The total outstanding consumer credit in the U.S. — the sum of the revolving and non-revolving debt numbers — rose by 10.2 percent, or $21.36 billion, to $2,542.3 billion in March, its seventh consecutive monthly increase and the biggest spike since November 2001, in both absolute and percentage terms. The new total is still lower by $45.8 billion, or 1.77 percent, than the all-time high of $2,588.1 billion, measured in September 2008, but the gap is narrowing very rapidly.

The Credit Card Takeaway

The credit card delinquency rate in March was 2.73 percent, the lowest one ever measured, according to Moody’s. The charge-off rate for the month was at 4.94 percent, the lowest one in five years. The monthly payment rate (MPR) — the rate at which Americans are repaying the principal of their outstanding credit card balances — was at 22.11 percent, an all-time record and higher by 5.70 percent than the March 2009 level, which translates into a 35 percent increase in the principal amount paid back at the end of the month.

The credit card delinquency rate in March was 2.73 percent, the lowest one ever measured, according to Moody’s. The charge-off rate for the month was at 4.94 percent, the lowest one in five years. The monthly payment rate (MPR) — the rate at which Americans are repaying the principal of their outstanding credit card balances — was at 22.11 percent, an all-time record and higher by 5.70 percent than the March 2009 level, which translates into a 35 percent increase in the principal amount paid back at the end of the month.

So the rise in revolving credit hasn’t been caused by reckless consumer spending. On the contrary, Americans’ credit card accounts, on aggregate, were in a better shape in March than they have been in a very, very long time. What the data seem to indicate instead is that consumers are once again feeling more comfortable using their credit cards and are doing so well within their means.

Debt is what keeps our economy from tanking. Once people stop borrowing, businesses will start to fail. It’s a perverse system, but it’s the one we have. So we’ll just have to keep getting more and more in debt, with the occasional crisis breaking the cycle every now and then.

I know your blog is about credit cards but the rising consumer debt is about student and auto loans and especially the former. And remember that student loans, unlike credit card debt and auto loans, cannot be discharged in a bankruptcy, which makes the student loan bubble that is now inflating especially dangerous.

I agree. There will be a rerun of what happened in September 2008 and this time there will not be much that Bernanke and Geithner can do, with no support for a bailout and interest rates already at zero. And yes, it could be the student loan bubble that triggers the crisis, although it will not be at the heart of it.

I have a different view on the rising consumer debt. The unemployment is at a sky-high level and people are using credit lines just to get by. So while you are correct in pointing out that delinquencies and charge-offs are down, they will probably start rising again sometime soon, because people can only borrow so much and if they don’t have jobs, they can’t pay back the debt.

Well, with such low interest rates, now is the best time to take out auto loans and student loans, if you can get them, and these are the types of credit that are expanding the fastest. So unlike other commenters, I’m not all too worried about expanding credit, at least for as long as the interest rates are as low as they are.

I’m worried about student loans in particular because tuition is rising like crazy and will keep going upwards for as long as the government is giving out student loans. If loans were harder to get, tuition would go down and we wouldn’t be having the student debt explosion that we have now.

I agree with you, but up to a point and also, student loans should get a different treatment from auto loans. An investment in a higher degree can potentially lead to a higher salary, whereas an investment in a car only leads to further expenses in the future. But there is such a thing as too much debt and with student loans we have definitely reached that point.

If we reducing spending on education right now, we would hurt the economy even further, so expanding student loan totals are good for now. This is about the only thing the government is currently doing to increase demand. Of course at some point we’ll have to tighten up but that moment is still some years away.

Credit card debt may be back to health, but that isn’t the case with the other debt categories and especially student loans. People are saddled with tens of thousands of student debt well into their 30s and 40s and this is only going to get worse as the cost of tuition is getting ever higher.

It’s amazing to me how people can look at these reports and conclude that we are getting back to normal, because people are taking on more debt. Isn’t debt that got us in this crisis in the first place? How can rising debt can be seen as a precursor to a recovery?

Exactly! Things are not OK and are not getting better. I know so many people that are just barely making ends meet and are forced to get more debt. The solution is not more debt but more jobs.

Debt is up because inflation is up, but income is not and people need to somehow make up for the difference. And by the way I think that college tuition should be used when calculating inflation, because it’s such a huge part of the problem for many millions of people and it’s rising fast.

So as I understand it the idea is that increased consumer spending will pull us out of the recession. Were people living in a cave these past few years? I mean what else needs to happen for us to understand that living within our means is the only way to avoid crises?

Yes, credit card borrowing may be increasing (although we’ll have to wait for a few more months to know for certain), but consumers are still very cautious. And that’s a good thing that I hope will outlast the recovery, whenever it comes along.