How to Manage Chargeback Reason Code 96

All types of unattended point-of-sale (POS) terminals can be programmed to not process credit card transactions above a pre-set amount. There are also, however, limits on the highest allowable amounts that merchants can process on cards at unattended terminals, which are set by the Associations and exceeding them leads to automatic chargebacks.

Visa issuers use Reason Code 96 to designate chargebacks resulting from transactions that exceed the limit. In this article I will review the specific circumstances in which this reason code can be used and what merchants can do to prevent or remedy it.

What Causes Reason Code 96

Chargeback Reason Code 96 is initiated by Visa issuers when they receive a transaction that exceeds the allowable amount from a Limited-Amount Terminal, a Self-Service Terminal, or an Automated Fuel Dispenser (AFD) transaction. The specific cause will be that the merchant processed a transaction from:

- A Limited-Amount Terminal and exceeded $25.

- A Self-Service Terminal (excluding AFD) and exceeded $50.

- An AFD and exceeded:

- $150 for Visa Fleet cards.

- $75 for all other cards.

- $500 for a real-time clearing transaction.

This reason code is used for international transactions as well, but the conditions are different and I will not review them here.

How to Respond to Reason Code 96

As with all other types of chargebacks, your response to a Reason Code 96 will be determined by the specific circumstances, the most typical of which are listed in the table below, along with my suggestions on the course of action you should take:

|

If: |

Then: |

| The transaction was less than the allowable amount of $25, $50 or the amounts specified for AFDs. | Provide your processor with documentation showing the transaction amount (for example, a copy of the sales receipt or audit tape). |

| The transaction amount exceeded $25, $50 or the amounts specified for AFDs. | Accept the chargeback, as the transaction exceeded the applicable allowable limit for the type of terminal you operate. |

| A credit was processed on the disputed transaction. | If you processed the appropriate credit on the disputed transaction to your customer’s card, send your processor evidence of the credit. |

| A credit was not processed on the transaction that exceeded the allowable amount.* | If you have not yet processed the appropriate credit on the disputed transaction, accept the chargeback. Do not process the credit at this time, as the chargeback has already done this for you. |

| The transaction was not processed at an unattended terminal. | Provide a proof to your processor. For example, if you received a chargeback, because your issuer claims that you exceeded the allowable amount for an AFD transaction, which was actually completed inside your convenience store, the chargeback is invalid. Provide your processor with a sales receipt with your customer’s signature.** |

*For AFD transactions, the chargeback amount is limited to the amount exceeding the specified amounts listed above.

**To avoid such chargebacks, make sure that your processor has programmed your convenience store and AFD terminals with the correct Merchant Category Codes (5541 and 5542, respectively).

How to Prevent Reason Code 96

The only thing you need to do to prevent this type of chargeback is to make sure that your POS terminals are properly set with the transaction amount limits, so that your customers are not allowed to complete a transaction above this threshold. Your processor and terminal vendor should be able to help you do that. In fact, your processor should be proactive in setting the applicable limits.

The Takeaway

Unlike most other types of chargebacks, the actions of your customers have nothing to do with Reason Code 96, which is entirely the result of improper POS terminal set-up. It is arguable whether or not you should be aware of the allowable amounts applicable to the types of transactions you process at your terminals. What is not at all arguable, however, is that your processor should know what these limits are and should ensure that your terminals are compliant. If they failed to prepare you for something as basic as that, what else may they have missed?

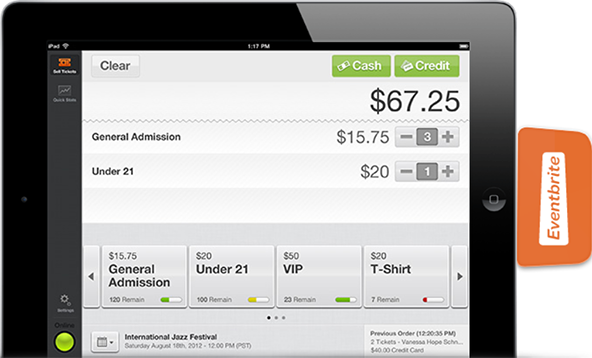

Image credit: Followthel.com.