Credit Card Issuers Go After Sub-Prime Borrowers Again

While still nowhere close to pre-recession levels, new credit card originations in the U.S. are growing very rapidly once again and the pace is even faster in the sub-prime borrower segment, we learn from a new report from Equifax, a credit reporting agency.

Even as the economy is still depressed and the unemployment rate is hovering at around nine percent, issuers are gaining confidence, buoyed by historically low delinquency and charge-off levels. They are also forced to find new sources of income to make up for the estimated $7 billion shortfall in annual revenues, following the Fed’s decision to place a cap on debit interchange fees.

5.4M New Sub-prime Bank Cards in First Half of 2011

Equifax’s report tells us that in the first half of this year banks issued more than 18 million new bank cards in the U.S., a three-year high and a 27 percent increase over the same period of 2010, while still well below the 34 million new cards originated in the pre-recession January – June 2007?átime-frame. New credit limits, on aggregate, rose at the same rate.

The numbers for sub-prime originations are much more impressive. The 5.4 million new bank cards issued to consumers with credit scores below 660 (which is Equifax’s definition of sub-prime) represented a 64 percent increase over the January – June 2010?álevels. What’s more, new sub-prime bank card credit limits rose even faster – by 68 percent.

Issuers Can’t Ignore Sub-prime Borrowers

There are many reasons for the issuers’ latest foray into sub-prime territory, but one of them seems to me to stand well above all others: the sheer size of the market. In May 2011 the average American had a credit score of 667, according to CreditKarma.com, a provider of free credit scores to consumers. So, by Equifax’s definition, close to half of all Americans are sub-prime borrowers. Now, you can’t really ignore half of the population, can you?

Moreover, as continually falling delinquency and charge-off rates clearly indicate, Americans are steadily becoming more creditworthy, even as it will take years for this trend to be reflected in their credit scores.

The charge-off rate — measuring delinquent credit card balances that issuers no longer expect to be repaid and write off of their books as losses — was in August 35 percent below the level measured a year ago and very close to the historical average, according to Fitch Ratings, a credit ratings agency.

Moreover, the charge-off rate is likely to drop further in the coming months, as delinquencies keep falling. The late-stage delinquency rate — payments late by 60 days or more — fell again in August for the 19th consecutive month, again according to Fitch. The rate is now at 2.15 percent, which is 52 percent below the post-Lehman peak of 4.50 percent reached a year-and-a-half ago.

The Takeaway

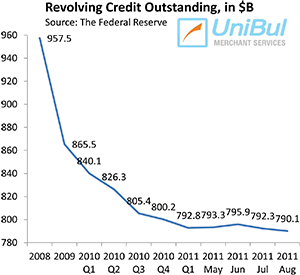

So there is nothing surprising in the issuers’ rediscovered love for sub-prime borrowers. The risks of excesses are now much lower and Americans are, on the whole, much more debt-conscious than at any point in a very long time. The monthly credit card payment rate in August was 21.14 percent (meaning that in August Americans paid back 21.14 percent of their outstanding credit card balances), as measured by Fitch, about 30 percent above the historical average of 16.3 percent. The aggregate volume of consumer credit card debt is at a record-low and falling, according to the Federal Reserve.

So there is nothing surprising in the issuers’ rediscovered love for sub-prime borrowers. The risks of excesses are now much lower and Americans are, on the whole, much more debt-conscious than at any point in a very long time. The monthly credit card payment rate in August was 21.14 percent (meaning that in August Americans paid back 21.14 percent of their outstanding credit card balances), as measured by Fitch, about 30 percent above the historical average of 16.3 percent. The aggregate volume of consumer credit card debt is at a record-low and falling, according to the Federal Reserve.

So the issue banks are now faced with is how to make consumers use their credit cards more freely again. They are trying hard, sharply increasing the volume of new credit card offers and sweetening them up with some amazing incentives (although the best offers are of course reserved for consumers with high credit scores), but so far Americans have not responded as issuers would have hoped for. And that’s not likely to change for as long as the economy is in such an anemic state and unemployment is so high, which probably means a long time.

Image credit: Websolutionspro.net.

Indeed a very nice post. I love to read the latest stuff and happenings on credit card merchant industry. I just came across your blog and find it so informative that I subscribed the same in my reader. Hope you will be posting sure worthy stuff over the coming days. Thanks