Americans Continue Paying Down Credit Cards before Mortgages

The shift in U.S. consumer debt repayment priorities that began in the aftermath of the Lehman collapse in September 2008 continues. A new study by Experian, one of the three national credit reporting agencies, tells us that Americans are now making their credit card payments on time at a substantially higher rate than they did in 2007, while the inverse is true for mortgage payments.

Late Credit Card Payments down 20%

Since 2007, credit card payments late by 60 days or more — the late-stage delinquency rate — have decreased by 20 percent for the country as a whole, according to Experian. Even more impressively, credit card delinquencies have declined in each of the top 30 U.S. metropolitan areas. Here is a list of the leaders on both ends of table:

| Metropolitan Area |

Change in Bank Card Payments from 2007 through 2011 |

| 1. Cleveland |

34.7% |

| 2. San Antonio |

30.5% |

| 3. Cincinnati |

30.0% |

| 4. Dallas |

28.8% |

| 5. Houston |

28.6% |

| … |

… |

| 26. Riverside |

9.4% |

| 27. Seattle |

8.0% |

| 28. Tampa |

5.3% |

| 29. Phoenix |

2.4% |

| 30. Miami |

1.4% |

Source: Experian

Late Mortgage Payments up 25%

The marked improvement in timely credit card debt repayments during the examined four-year period has been more than matched by the continuing deterioration in the timeliness of mortgage debt repayments. Here is the list of leaders in this category*:

| Metropolitan Area |

Change in Missed Mortgage Payments from 2007 through 2011 |

| 1. Detroit |

-17.1% |

| 2. Denver |

-7.4% |

| 3. Minneapolis |

-5.9% |

| 4. Cleveland |

-3.8% |

| 5. St. Louis |

1.0% |

| … |

… |

| 26. New York |

49.4% |

| 27. Seattle |

65.1% |

| 28. Baltimore |

66.8% |

| 29. Phoenix |

78.4% |

| 30. Portland |

99.9% |

Source: Experian

*The above table ranks metropolitan areas by their performance, from best (lowest percentage change in missed mortgage payments) to worst.

The Trend Continues

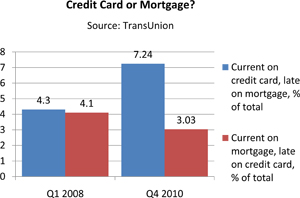

It was one of Experian’s rivals — TransUnion — that first directed our attention toward the shift in U.S. consumer payment hierarchy. TransUnion used a different methodology — their study measured the ratio of payments late by 30 days or more — and the examined four-year period was 2006 – 2010, but the results painted the same picture.

It was one of Experian’s rivals — TransUnion — that first directed our attention toward the shift in U.S. consumer payment hierarchy. TransUnion used a different methodology — their study measured the ratio of payments late by 30 days or more — and the examined four-year period was 2006 – 2010, but the results painted the same picture.

TransUnion reported that the ratio of consumers who were late on their mortgages but current on their credit cards in Q4 2010 was 7.24 percent, 68.4 percent higher than the Q1 2008 level of 4.3 percent.

Conversely, the ratio of consumers who were late on their credit cards but current on their mortgages in Q4 2010 was 3.03 percent, the lowest level ever measured and 26.1 percent below the Q1 2008 figure of 4.1 percent.

Clearly, in the post-Lehman world Americans value the good standing of their credit card accounts much higher than the one of their mortgages.

The Takeaway

Home value depreciation has received most of the blame for the shift in debt repayment priorities. Consumers were (and apparently still are) growing increasingly unwilling to keep up with the payments on underwater properties that had in many cases become 30, 40, 50 percent or more cheaper than they were at the time of purchase with no prospects for recovery. Of course high unemployment has not helped the mortgage situation, even as it has not hurt credit card repayment patterns.

Unfortunately for Americans who have chosen to stay current on their credit cards, rather than on their mortgages, their credit score will take a big hit, which will take years to recover from. Even one missed payment on any of the accounts listed on your credit file will cause your FICO score to drop and the fall will continue with each successive missed payment. Soon you will find yourself cut off from all forms of lending and may not even be able to open up a cell phone account or rent an apartment. Whether you end up filing for bankruptcy or not, the derogatory account(s) will remain on your file for no less than seven years. It is not a pretty picture.

Image credit: Ekolay.net.